Based on a current report by knowledge intelligence agency Messari, Cardano and its native token, ADA, skilled a notable decline within the second quarter (Q2) of 2024, reflecting the broader downturn affecting the cryptocurrency market. Key efficiency indicators additionally confirmed vital decreases in numerous metrics.

Value Plunge, Market Cap Dips To $14 Billion

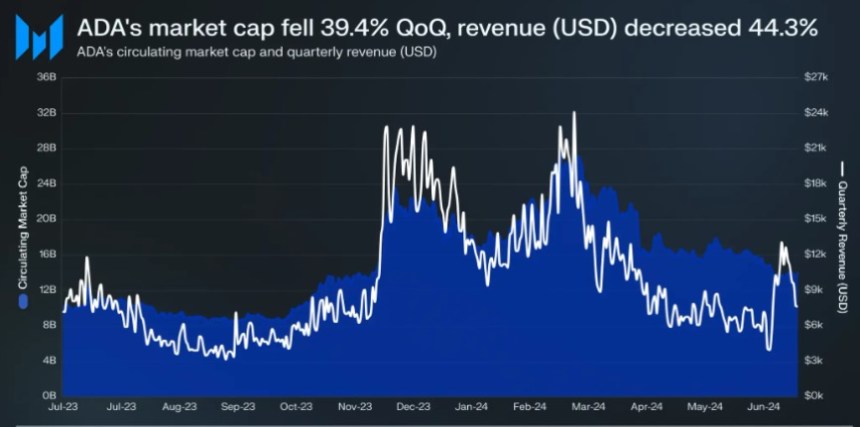

Based on the report, ADA’s worth plummeted 39.7% to $0.39, whereas its market capitalization fell by 39.4% quarter-over-quarter (QoQ) to $14 billion.

Messari famous that this decline was influenced by a slight improve in circulating provide, which accounted for the minor discrepancy in market cap figures. Consequently, ADA’s market cap rating dropped from ninth to tenth place.

Associated Studying

Transaction charges on the Cardano community, that are important for processing transactions and protecting storage prices, additionally suffered. Income in USD decreased by 44.3% QoQ to $0.74 million, whereas income measured in ADA fell by 28.0% to 1.60 million.

The platform’s common day by day transactions additionally decreased by 27.5% QoQ to roughly 51,400, and the variety of day by day lively addresses (DAAs) fell by 33.2% to 31,800.

Moreover, the common transaction charge in USD dropped 23.1%, from $0.21 to $0.16. Nevertheless, the common charge in ADA noticed solely a marginal decline of 0.6%, remaining at 0.34.

Treasury Stability Grows

Regardless of these setbacks, the ratio of transactions to lively addresses elevated by 8.4% QoQ to 1.62, suggesting an increase in “energy customers” partaking extra continuously with the platform.

When it comes to staking metrics, complete ADA staked and the staking charge elevated barely, though the entire worth of staked ADA in USD decreased considerably by 39.6% to $8.9 billion, primarily as a result of falling worth of ADA.

Cardano’s treasury steadiness, measured in ADA, rose 5.8% QoQ to 1.57 billion, though its greenback worth decreased by 36.7% to $604.7 million. At present, 20% of transaction charges are allotted to the treasury.

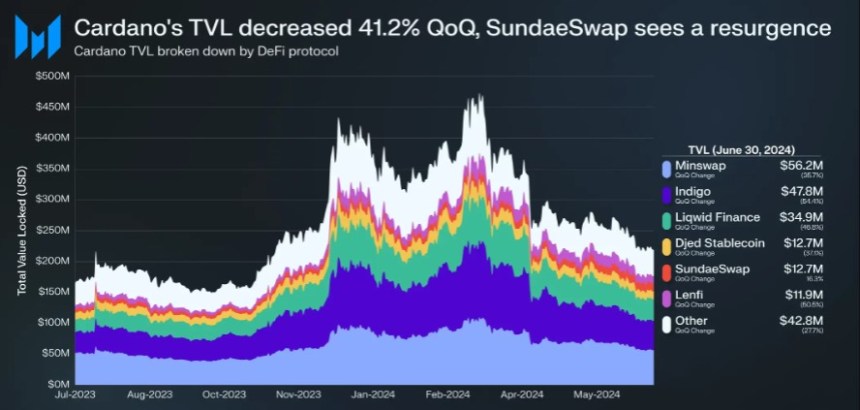

Decentralized software (DApp) exercise on Cardano additionally noticed declines, with common day by day DApp transactions falling 35.7% QoQ to 34,300 and common day by day decentralized alternate (DEX) quantity in USD reducing by 42.5% to $4.2 million.

Cardano TVL Drop Amid Market Downturn

Whole worth locked (TVL) on Cardano dropped 41.2% QoQ to $219 million, following a peak of $506 million in March 2024, pushed by a broader crypto market downturn moderately than Cardano-specific elements.

Furthermore, for the primary time for the reason that introduction of Cardano’s stablecoins in late 2022, the stablecoin market cap on the platform decreased by 12.4% QoQ to $19.6 million. Common day by day non-fungible token (NFT) gross sales additionally took successful, plummeting 57.4% QoQ to underneath 730 transactions.

Associated Studying

Regardless of these challenges, the report highlights ongoing developments inside Cardano’s ecosystem. The emergence of recent stablecoins like USDM and MyUSD noticed their market caps rise dramatically, indicating a shift within the panorama.

Moreover, upcoming upgrades, such because the Chang Onerous Fork, promise to extend Cardano’s governance capabilities, shifting the community nearer to reaching its long-term targets of self-sustainability and participatory decision-making.

On the time of writing, ADA was buying and selling at $0.34, down 0.7% for the 24-hour interval.

Featured picture from DALL-E, chart from TradingView.com