Macro strategist Jim Bianco is blowing up the narrative that establishments and high-net-worth traders are those closely accumulating shares in Bitcoin (BTC) exchange-traded funds (ETFs).

Bianco tells his 398,400 followers on the social media platform X that new obligatory 13F filings with the U.S. Securities and Trade Fee (SEC) reveal the breakdown of investor sorts within the spot BTC ETFs for the primary quarter of 2024.

“Anybody with over 5% helpful possession or at the very least $100 million in property should file a 13F inside 45 days of the top of the quarter. This was Might fifteenth. ~7,000 have been filed.

What did we study from the spot BTC ETF filings?

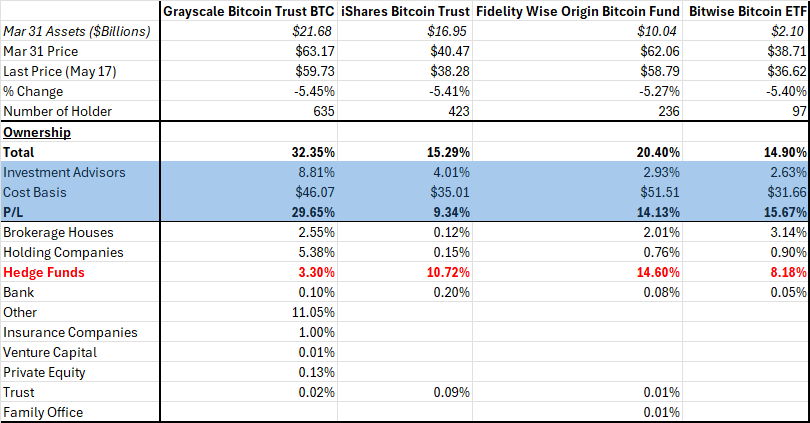

The desk under reveals some top-line outcomes.

The shaded blue space reveals the funding advisors’ holdings. They’re very small, between 2.5% and 4% (and eight.81% for GBTC). A current Citi report says the common ETF is about 35% owned by funding advisors. All through the quarter, we have been confidently informed boomers have been calling their wealth managers and telling them to get into BTC. This isn’t the case for 95+% of the spot BTC ETF holdings.“

He says the varieties reveal that about 85% of traders within the spot Bitcoin ETFs are retail traders as of the primary three months of the yr.

“I feared the spot BTC ETFs have been successfully ‘orange FOMO poker chips.’ The Q1 13F filings solely additional satisfied me this was the case.

Solely ~3% of the excellent ETF market cap was held by funding advisors, utterly blowing up the narrative that ‘the Boomers are coming.’ They could over time (as in years) however didn’t in Q1. ~10% is held by hedge funds, and ~85% by non-institutional traders (learn: retail).”

At time of writing, Bitcoin is buying and selling for $70,947, up over 7% up to now day.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3