Knowledge reveals a big imbalance within the Polymarket order guide for the 2024 US Election.

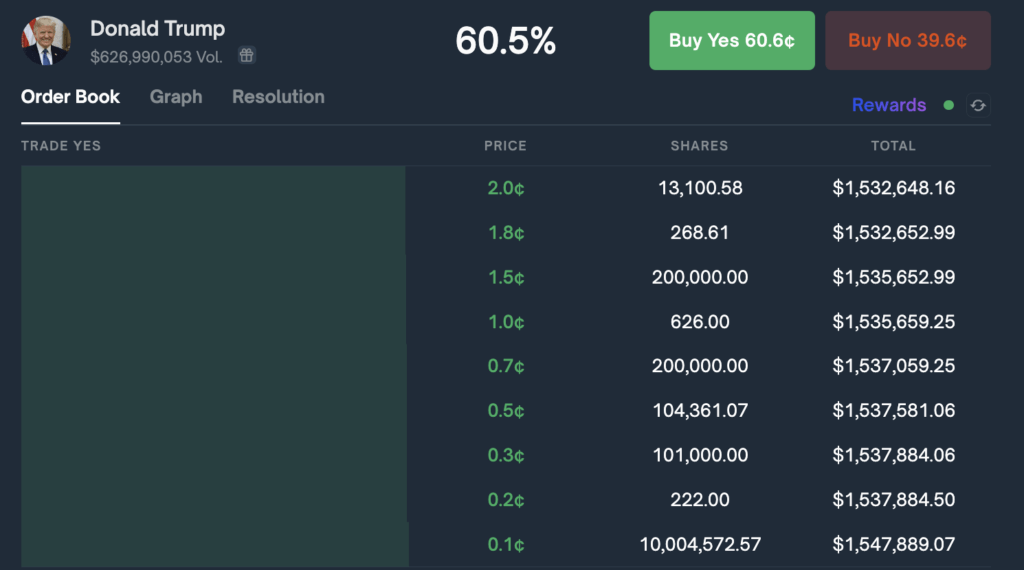

The market betting on a Donald Trump victory at present has asks totaling $32 million and bids at $1.5 million, leading to a market depth of $33.5 million. Given the character of prediction markets, that are timed occasions, it’s unsurprising that there can be higher sell-side strain.

For Trump, $28 million of the $32 million promote orders are positioned above $0.99, leaving simply $4 million in the remainder of the sell-side of the order guide.

The overall asks above the present value for Harris totals $17 million, with $13 million positioned above $0.99, leaving the same worth to Trump for the remainder of the sell-side of the order guide.

Surprisingly, there’s a lack of depth each round and beneath present costs. There may be solely round $2.5 million in seen market depth between $0.01 and $0.62, with the present value at $0.60.

In distinction, the marketplace for a Kamala Harris victory, at present at 39%, has $3.5 million in orders inside the identical vary. Trump has $1.5 million in complete bids, and Harris has $1.4 million as of press time.

With Trump and Harris having low ask values as much as $0.62, the liquidity required to theoretically transfer the market considerably is simply over 1.4% of the present reported open curiosity, round $4 million.

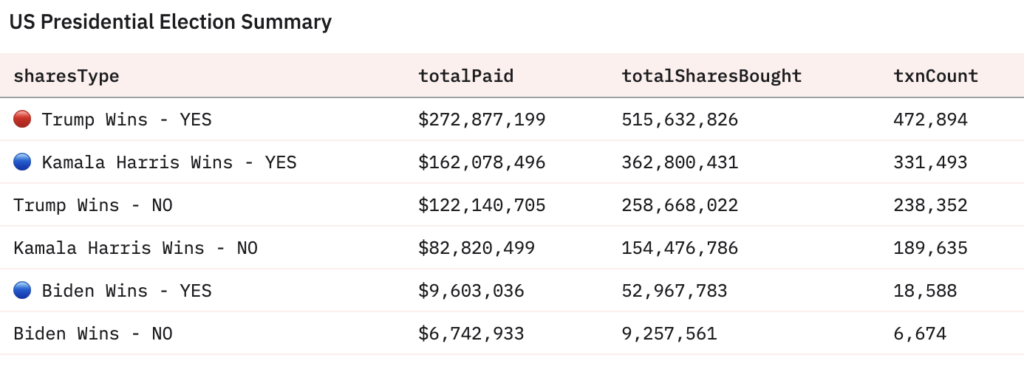

In accordance with Dune Analytics, the open curiosity for the Trump market alone stands at $276 million. Thus, at present seen market depth means that present buying and selling curiosity represents solely a fraction of the full excellent positions.

Moreover, discrepancies have emerged between reported open curiosity and precise betting volumes. Trump bets seem to surpass the platform’s complete reported open curiosity of $239 million, as listed by The Block.

Trade observers have famous challenges accessing open curiosity info on Polymarket’s web site. Hasu, technique lead at Flashbots, identified on social media the issue in finding these figures and questioned the emphasis on buying and selling quantity over open curiosity.

This information could partly clarify why the highest 4 Trump place holders have been inserting substantial bets, collectively shopping for up the order guide in latest weeks. $121 million in quantity has been traded from the highest 4 accounts, two of which had been created this month.

| Dealer | Positions Worth ($) | Revenue/Loss ($) | Quantity Traded ($) | Markets Traded | Joined |

|---|---|---|---|---|---|

| Michie | 3,980,981.12 | 341,179.18 | 8,450,962.77 | 0 | Oct 2024 |

| PrincessCaro | 6,978,910.68 | 813,711.08 | 23,473,481.78 | 14 | Sep 2024 |

| Theo4 | 7,280,451.39 | 137,384.50 | 15,206,599.73 | 8 | Oct 2024 |

| Fredi9999 | 16,723,955.99 | 1,556,542.18 | 74,097,607.44 | 45 | Jun 2024 |

| Complete | 34,964,299.18 | 2,848,816.94 | 121,228,651.72 | 67 |

These 4 merchants have been persistently betting on Donald Trump because the finish of September, inserting bets day by day and sometimes inside minutes of one another.

Due to this fact, a hypothetical calculation means that persistent purchase orders totaling round $4 million might considerably transfer the market, doubtlessly growing Trump’s odds considerably. This impression is as a result of shallow order guide above Trump’s present value.

With solely $4 million in promote orders between the present value ($0.60) and $0.99, a $4 million purchase order would doubtlessly exhaust this liquidity fully. This might push Trump’s value from $0.60 to almost $0.99, representing a 65% enhance in his odds.

For context, the same $4 million purchase order within the Harris market would have a comparable impact, because the construction of promote orders seems comparable.

This $4 million represents simply 1.4% of the reported open curiosity of $276 million for the Trump market, but as a result of present order guide construction, it might have a disproportionate impact available on the market value.

Nonetheless, real-world market forces would doubtless mood this impact. Massive orders usually appeal to new liquidity and set off responses from different market individuals. The precise motion is perhaps much less dramatic however nonetheless important.