Because the Consensys 2024 convention commences this week in Austin, Texas, the LINK neighborhood is abuzz with anticipation over a possible pivotal announcement from Chainlink in collaboration with SWIFT. Speculations are rife that this announcement, set for Could 30 throughout a session on tokenization, might considerably affect LINK’s market efficiency.

Chainlink And Swift Partnership Going To The Subsequent Degree?

The session titled “How Swift and Chainlink Are Working Collectively to Unlock Tokenized Belongings At Scale” will happen on the Mainstage on the Austin Conference Middle. It options Jonathan Ehrenfeld, Head of Securities and Digital Belongings Technique at SWIFT, and Sergey Nazarov, Co-Founding father of Chainlink.

The session goals to discover how the 2 entities are collaborating to attach conventional monetary infrastructure with the burgeoning multi-chain financial system. This partnership is essential for enabling a world system of on-chain finance for tokenized property, which might streamline and improve the safety of cross-chain transactions.

Associated Studying

This improvement follows a sequence of profitable experiments carried out in June 2023, the place SWIFT, alongside main monetary establishments like BNP Paribas and BNY Mellon, demonstrated SWIFT’s potential as a unified entry level for varied blockchain networks. These checks included token transfers inside and throughout completely different blockchain platforms, showcasing a stride towards integrating digital property globally.

Chainlink’s function as a number one supplier of on-chain knowledge and cross-chain interoperability options makes it a strategic associate for SWIFT, which has traditionally been the spine for international monetary communications throughout over 11,000 banks. The potential announcement is purported to revolve round additional developments on this collaborative effort, which can embrace launching new protocols or a mainnet launch.

Moreover, Sergey Nazarov’s participation in one other vital dialogue on the convention, scheduled for Could 29, titled “Constructing the Tokenized Asset Financial system | Chainlink and Securitize,” provides to the gravity of the week’s occasions. Right here, Nazarov, alongside Carlos Domingo, Co-Founder and CEO of Securitize, will delve into the multi-trillion-dollar tokenization alternative, discussing methods for blockchain initiatives and capital markets establishments to optimize their approaches to tokenization.

Associated Studying

The current $47 million strategic funding spherical led by BlackRock for Securitize, which coincided with the launch of BlackRock’s first tokenized fund (BUIDL) on Ethereum, underscores the accelerating curiosity and funding in blockchain and tokenization applied sciences. With Securitize, Chainlink might ink one other main participant within the discipline of tokenization.

LINK Value Is Prepared To Skyrocket

The outcomes of those classes and the anticipated announcement might considerably affect the LINK worth. Notably, the LINK worth is in a great place within the every day chart.

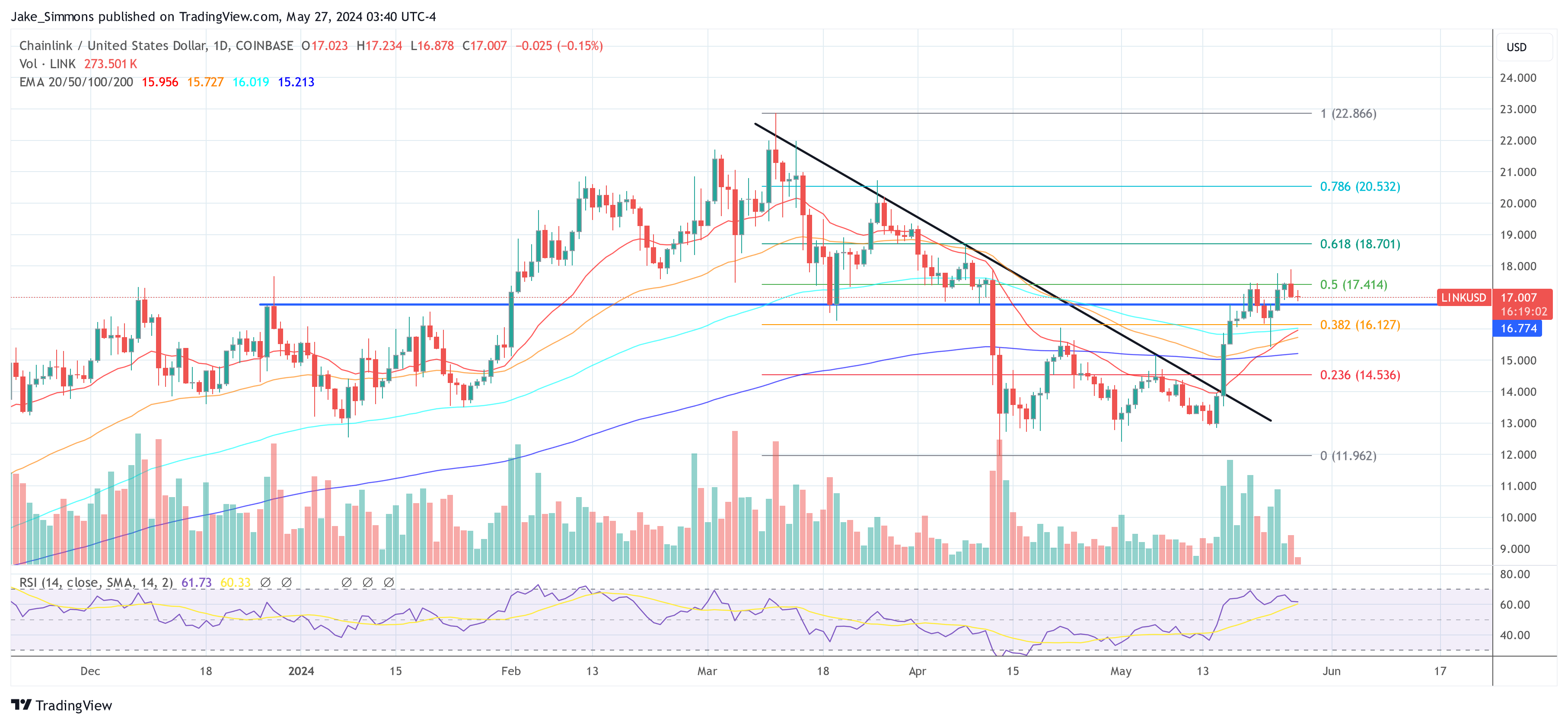

On Could 16, LINK’s worth efficiently broke above a descending pattern line that had beforehand capped its worth motion for roughly two months. This pattern line, originating from early mid-March, had been a barrier for any bullish momentum, with the value persistently rejecting this dynamic resistance till the talked about breakout.

Following this pivotal breakout, LINK’s worth trajectory shifted because it started a rally in direction of increased worth ranges. Notably, the value rallied to the 0.5 Fibonacci retracement stage, which is calculated from the native excessive in early March to the numerous low in mid-April. This stage, sitting at roughly $17.41, has develop into a vital point of interest for each merchants and analysts.

Since reaching the 0.5 Fibonacci stage, LINK’s worth has entered a section of consolidation, fluctuating inside a slim vary outlined by the 0.5 and 0.382 Fibonacci ranges—the latter at round $16.13. This worth habits signifies a tug-of-war between patrons and sellers, making an attempt to ascertain a extra outlined market course.

A convincing break above this stage might signify a continuation of the bullish momentum, probably resulting in additional beneficial properties. Technical merchants is perhaps carefully watching this stage, as a breakout might validate the bullish sentiment additional and will see the value aiming for the following Fibonacci ranges at $18.70 (0.618), $20.53 (0.786) and 22.86 (1.0).

Featured picture created with DALL·E, chart from TradingView.com