Fast Take

Bitcoin’s long-term holders (LTHs), those that have held for greater than 155 days, have historically been perceived because the ‘smarter cash’ attributable to their expertise weathering Bitcoin volatility. Key to their technique is shopping for Bitcoin throughout worth slumps and offloading throughout market euphoria.

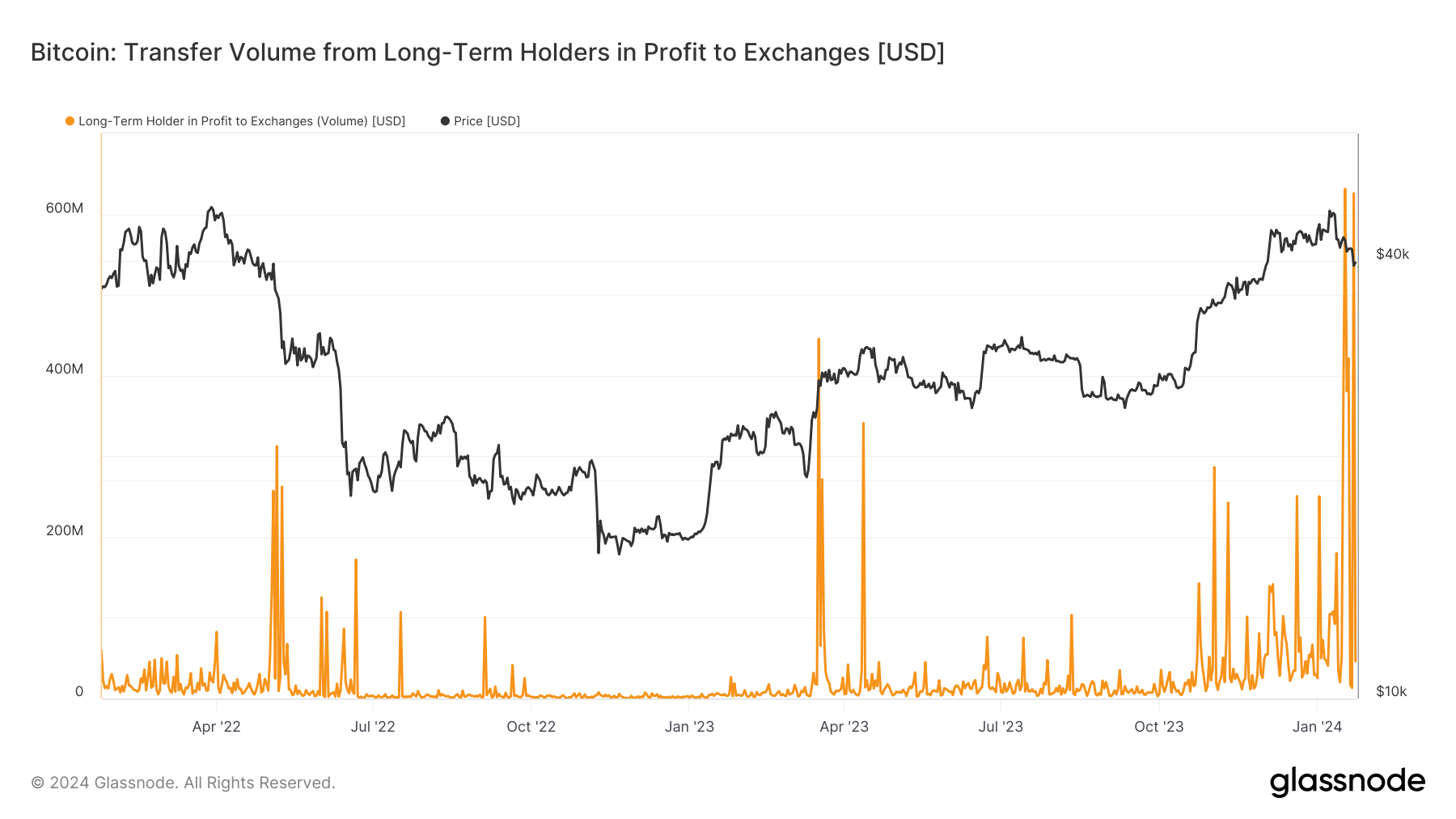

Nonetheless, noticed current developments trace at a shift. Knowledge evaluation signifies that LTHs initiated a sell-off, and this development has endured. Notably, on Jan. 22, roughly $625 million in revenue was transferred to exchanges, drawing parallels to the exercise on Jan. 17.

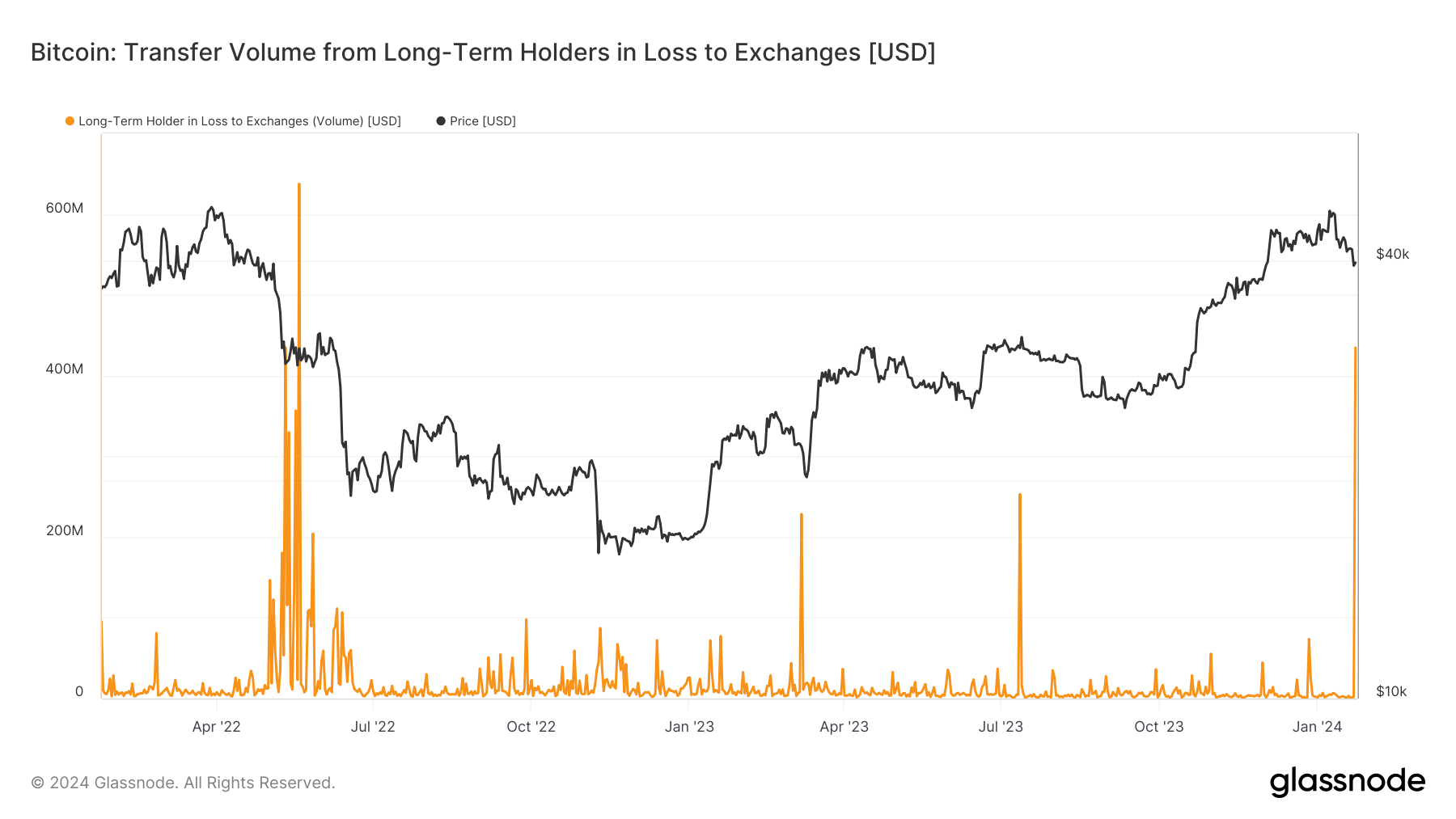

The info developments started to boost eyebrows on Jan. 23, when LTHs transferred cash to exchanges, incurring a considerable lack of roughly $430 million attributable to Bitcoin falling under $39,000. This case ominously mirrors the pre-Luna collapse capitulation witnessed in Could 2022. Again then, an almost an identical quantity was despatched to exchanges at a loss, adopted by a extra extreme lack of over $600 million only a week later, proper earlier than Bitcoin’s worth shockingly plummeted under $20,000.

The repetition of such losses might level in the direction of growing proof of capitulation amongst Bitcoin’s long-term stakeholders.

The put up Lengthy-term Bitcoin holders’ current sell-off raises ghosts of previous capitulations appeared first on CryptoSlate.