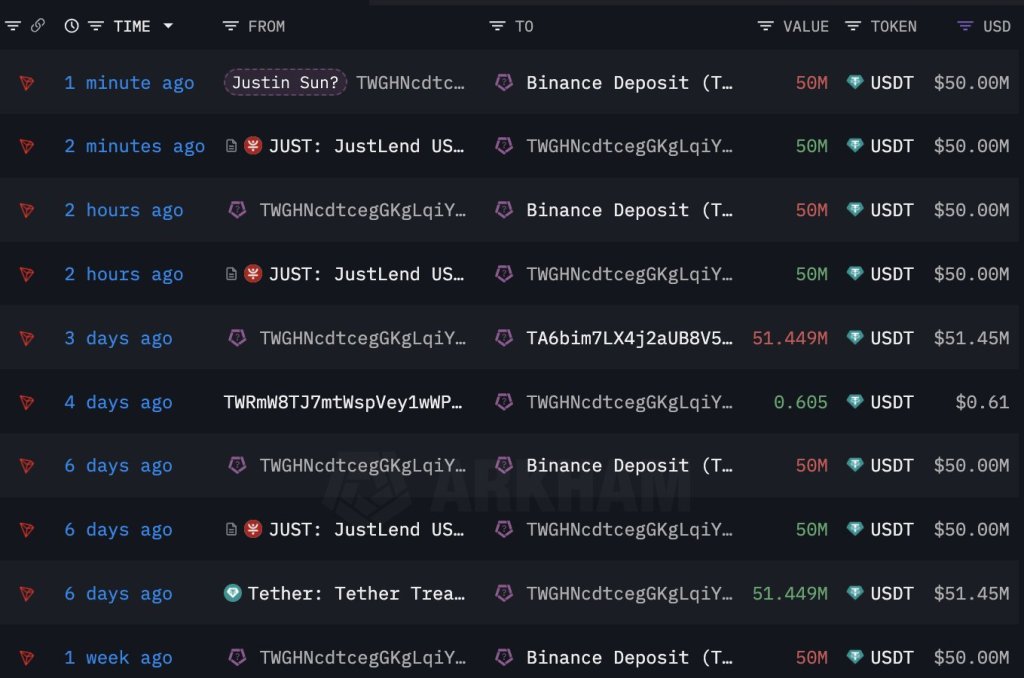

Justin Solar, the co-founder of Tron–a wise contracting platform for deploying decentralized purposes (dapps), is as soon as once more transferring and shuffling tens of millions of {dollars}. Based on Lookonchain knowledge on February 29, Solar reportedly transferred 100 million USDT to Binance, days after transferring large sums earlier this week.

Justin Solar Holds Thousands and thousands Of ETH: Will The Co-founder Purchase Extra?

From February 12 to 24, a pockets related to Solar acquired 168,369 ETH for a mean value of $2,894. This buy, valued at roughly $580.5 million, at present holds an unrealized revenue of round $95 million. Profitability might improve contemplating the sharp demand for crypto, particularly high cash like Bitcoin and Ethereum, in latest days.

The Ethereum value chart exhibits that ETH has been on a transparent uptrend, rising from round $2,200 in early February to over $3,450 when writing. At this tempo, and contemplating the institutional curiosity in potent crypto property, together with ETH, the percentages of the second most respected coin stretching features will probably be extremely probably.

As Bitcoin inches nearer to $70,000, the chance of Ethereum additionally monitoring larger towards its all-time excessive of round $5,000 will probably be elevated.

Since ETH already owns a giant stash of cash, there may be hypothesis that the co-founder will double down, shopping for much more cash. The crypto neighborhood will proceed watching the deal with till this occurs and there may be strong on-chain knowledge to help the acquisition.

Spot Ethereum ETFs And The Dencun Improve Are Key Updates

Up to now, optimism is excessive, particularly among the many broader altcoin neighborhood. As Bitcoin races to register new all-time highs pumped by institutional billions, eyes will probably be on america Securities and Change Fee (SEC). There are a number of purposes for a spot Ethereum exchange-traded fund (ETF).

The company has not supplied a definitive timeline for approving or rejecting the spinoff product. There may be regulatory uncertainty across the standing of ETH, a major headwind which may delay and even stop the well timed authorization of this product.

Nonetheless, the neighborhood is wanting ahead to the subsequent communication in Could. If the spot Ethereum ETF is a go, the coin will probably rally to new all-time highs, following Bitcoin.

Nonetheless, earlier than then, eyes are on the anticipated implementation of Dencun. The improve addresses challenges dealing with Ethereum, together with scalability. Via Dencun, Ethereum builders hope to put the bottom for additional throughput enhancements within the coming years.

With larger throughput, transaction charges drop, overly bettering consumer expertise. This improve may go a great distance in cementing Ethereum’s position in crypto, wading off stiff competitors from Solana and others, together with the BNB Chain.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site totally at your personal threat.