The US will extract more cash from American taxpayers and companies as the federal government’s liabilities develop into an excessive amount of to deal with, in line with a brand new forecast from JPMorgan Chase.

Michael Cembalest, Chairman of Market and Funding Technique for JPM’s Wealth and Asset Administration department, cites information from the Congressional Funds Workplace (CBO) that implies all Federal authorities revenues will probably be consumed by entitlement funds and curiosity on the Federal debt by the early 2030s.

Cembalest says earlier than that occurs, lawmakers will probably be pressured into discovering additional income sources to steadiness the price range, and a myriad of tax hikes could also be on the desk.

“Someday earlier than this occurs, I count on a mix of market stress and score company downgrades (which have already begun) to power the US to make substantial modifications to taxes and entitlements…

A wealth tax can be a risk; there’s an energetic Supreme Courtroom case which may impression its constitutional feasibility (Moore vs United States, which is said to the constitutionality of the Obligatory Repatriation Tax within the 2017 tax invoice).

[As well as] additional cuts to discretionary spending [are also possible], for the reason that US has run out of highway on that one.”

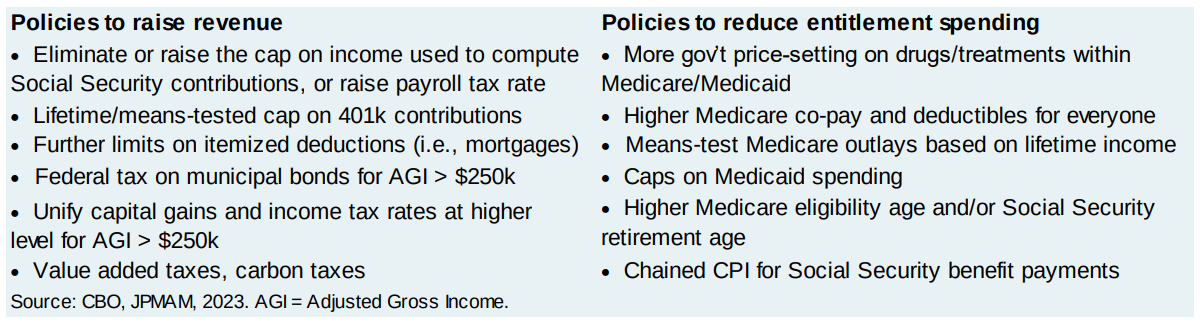

That’s not all – Cembalest particulars a listing of recent taxes, entitlement cuts and tweaks that might be taken to attempt to enhance the federal government’s fiscal outlook.

As of January eighth, 2024, the US authorities’s whole debt obligations reached $34,012,198,872,291.

In keeping with the CBO, the Federal authorities collected $4.9 trillion in income in 2022, most of which got here from earnings taxes.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney