Bitcoin outflows from the Mt. Gox alternate have occurred previously day, making some fear about potential bearish results. Right here’s what an analyst thinks.

Mt. Gox Has Made A number of Bitcoin Transactions In The Final 24 Hours

Throughout the previous day, a number of actions from wallets related to the bankrupt cryptocurrency alternate Mt. Gox have been noticed on the Bitcoin blockchain. The platform had introduced plans to repay its collectors, so the transactions are seemingly associated to them.

Mt. Gox has moved out 137,890 BTC in complete, price nearly $9.4 billion on the present cryptocurrency alternate price. With these transfers, the market has grow to be involved about whether or not these tokens will transfer in direction of buying and selling, including to the promoting stress available in the market.

Associated Studying

Because of this, the BTC worth has fallen about 4% previously 24 hours. Whereas the market has reacted negatively to the information to date, some have questioned whether or not these withdrawals are literally going to be bearish.

Analyst James Van Straten mentioned this in an X publish and supplied perspective on how a possible selloff arising out of those repayments would evaluate in opposition to one other that BTC witnessed not too long ago.

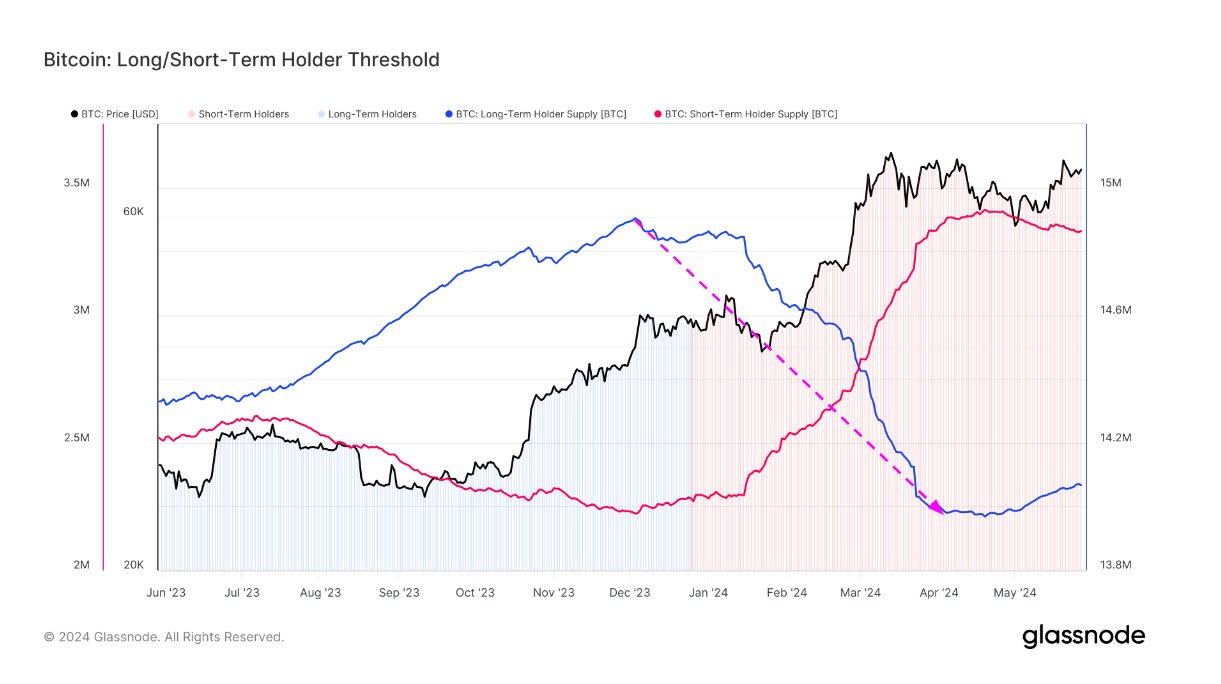

The distribution occasion in query is from the long-term holders (LTHs), which make up one of many two primary divisions of the BTC market based mostly on holding time.

All traders holding onto their cash since greater than 155 days in the past qualify for this cohort, whereas those that purchased throughout the previous 155 days are put within the short-term holder (STH) group.

The LTHs are thought of to be the resolute facet of the market, as they not often take part in selloffs, whereas the STHs are the fickle-minded traders who usually react to sector occasions by panic promoting.

The current rally within the asset, although, proved to be sufficient to maneuver even these HODLers into promoting, because the chart beneath exhibits their complete provide.

Because the graph exhibits, the LTH provide has been shifting sideways within the final couple of months, but it surely was in a state of decline for 5 months earlier than that.

On this selloff, the LTHs offered round 1 million tokens, of which round 340,000 BTC was linked to GBTC outflows. On the identical time, this distribution from the LTHs occurred, although the coin’s worth marched to a brand new all-time excessive, implying that the market might take in this huge promoting stress simply high-quality.

Straten notes that the Mt. Gox repayments are solely a few tenth of this selloff, and never everybody who will get these tokens will determine to promote. On the very least, everybody wouldn’t promote on the identical time.

Associated Studying

Thus, given this truth, it’s doable that Bitcoin will not be affected by this distribution if demand for the cryptocurrency stays as sturdy because it has been not too long ago.

BTC Value

Bitcoin had risen above the $70,000 degree earlier, however the Mt. Gox information has introduced the asset right down to $67,700.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com