Whereas Ethereum hasn’t been fairly in keeping with its bullish trajectory previously weeks, its circulating provide has completed the alternative. In accordance with knowledge from Ultrasoundmoney, ETH’s circulating provide has skyrocketed to over 120.72 million ETH as of at the moment.

Though this improve in provide will not be straightforwardly unfavorable for ETH, it nonetheless marks a notable shift within the community’s dynamics, fuelled largely by adopting Ethereum’s proof-of-stake (PoS) mannequin.

Provide Improve, How And Why?

The surge in Ethereum’s whole provide to 120.72 million ETH, as proven within the knowledge from Ultrasound.cash, displays the community’s growing exercise over the previous month.

On this interval alone, Ethereum noticed the issuance of 77,102 ETH, whereas 19,402 ETH had been faraway from circulation by means of a burning mechanism launched within the community’s current London Onerous Fork.

The web improve of roughly 57,653 ETH highlights a mild uptick within the annual provide progress charge from 0.58% to 0.69% during the last 7 days.

Notably, with Ethereum’s transition from the proof-of-work (PoW) to PoS mannequin, the community has not solely achieved a significant shift in safety however has additionally elevated the rewards for participation.

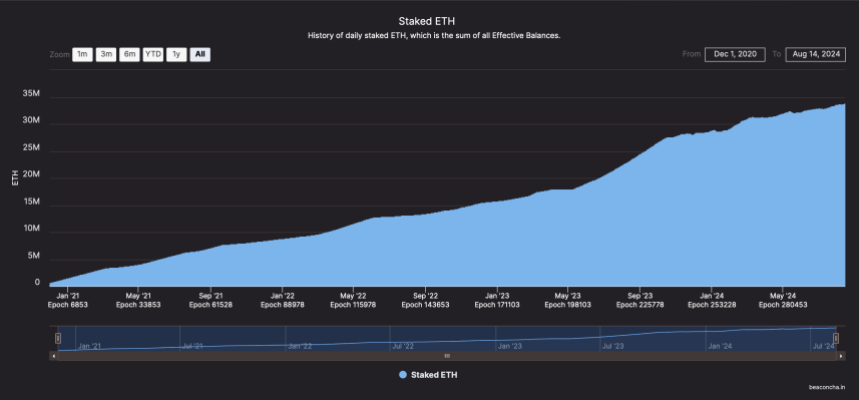

In regards to the probably causes behind the rise in provide, about 33.9 million ETH are at the moment staked within the community, producing substantial rewards in newly issued ETH.

This huge-scale staking seems to be contributing considerably to the rise in Ethereum’s whole provide. Moreover, the staking course of has been additional amplified by the pattern of restaking, the place contributors reinvest their staking rewards into the community.

This restaking cycle creates a compounding impact on the issuance of latest ETH, boosting the availability even because the community strikes to a “seemingly” inflationary trajectory after the preliminary deflationary expectations set by the ETH burn mechanism.

Ethereum Market Efficiency

To date, Ethereum seems to be seeing a gradual value improve, from $2,500 final Thursday to at the moment buying and selling at $2,652 on the time of writing, marking a 9.3% improve previously 7 days.

This surge in worth coincides with ETH’s market cap valuation, which noticed a spike of practically $20 billion over the identical interval. Regardless of this rise, ETH’s day by day buying and selling quantity has seen the alternative.

Significantly, over the previous week, this metric has plunged from over $21 billion to at the moment sitting at $12.8 billion. No matter this, many analysts within the crypto house stay bullish on Ethereum.

Earlier at the moment, a famend analyst often known as the titan of crypto on X has set a $3,000 goal for ETH. In accordance with the analyst, ETH appears prepared for a significant rally as a “CME futures GAP” in the direction of the upside stays unfilled.

#Altcoins #Ethereum $3,000 Goal

#ETH appears poised for a transfer, with a CME futures GAP above nonetheless ready to get crammed. pic.twitter.com/6lC2d6lgQ6

— Titan of Crypto (@Washigorira) August 15, 2024

Featured picture created with DALL-E, Chart from TradingView