On Saturday, Bitcoin skilled a strong rally, climbing above $58,250. Regardless of this upward motion, it was unable to maintain the momentum and shut above the 200-day Exponential Shifting Common (EMA). This led to the formation of a bearish engulfing candlestick sample on Sunday, signaling potential draw back momentum. At present, Bitcoin is buying and selling beneath $56,000, positioning it at a essential juncture by way of technical evaluation and market sentiment.

Sina G, the COO and co-founder of twenty first Capital, offered a breakdown of the components influencing Bitcoin’s worth trajectory right now, notably highlighting latest declines and evaluating its undervalued state by means of subtle metrics. Beginning with a historic overview, Sina identified that Bitcoin had seen a drastic 26% decline from a March peak of $73,000, settling round $56,000 in latest weeks.

Associated Studying

This sharp lower has been attributed to a number of macroeconomic and sector-specific components. In response to him, Bitcoin’s fall from the $73,000 peak in March to $56,000 aligns with historic bull market corrections, which regularly see vital but momentary retracements.

The affect of Bitcoin ETFs has been pivotal. Initially, these ETFs contributed considerably to the value surge from $16,000 to $73,000, as buyers engaged closely in a buy-the-rumor, buy-the-news technique. “As much as mid-march ETF flows have been very robust and the market moved up. Since then ETFs slowed down and chapter outflows took over, inflicting a weak worth motion all the way in which right down to $56K.

A notable latest affect on Bitcoin’s worth has been the promoting exercise of the German authorities, which disposed of Bitcoin seized in 2013 from the pirated content material platform Movie2k.to. “The federal government’s resolution to liquidate roughly 10,000 cash throughout three transactions coincided instantly with vital worth drops on particular dates in June and July,” he famous. This selloff contributed to a steep 24% crash in June and July, exacerbated by the big quantity of Bitcoin launched into the market.

Associated Studying

Is Bitcoin Undervalued?

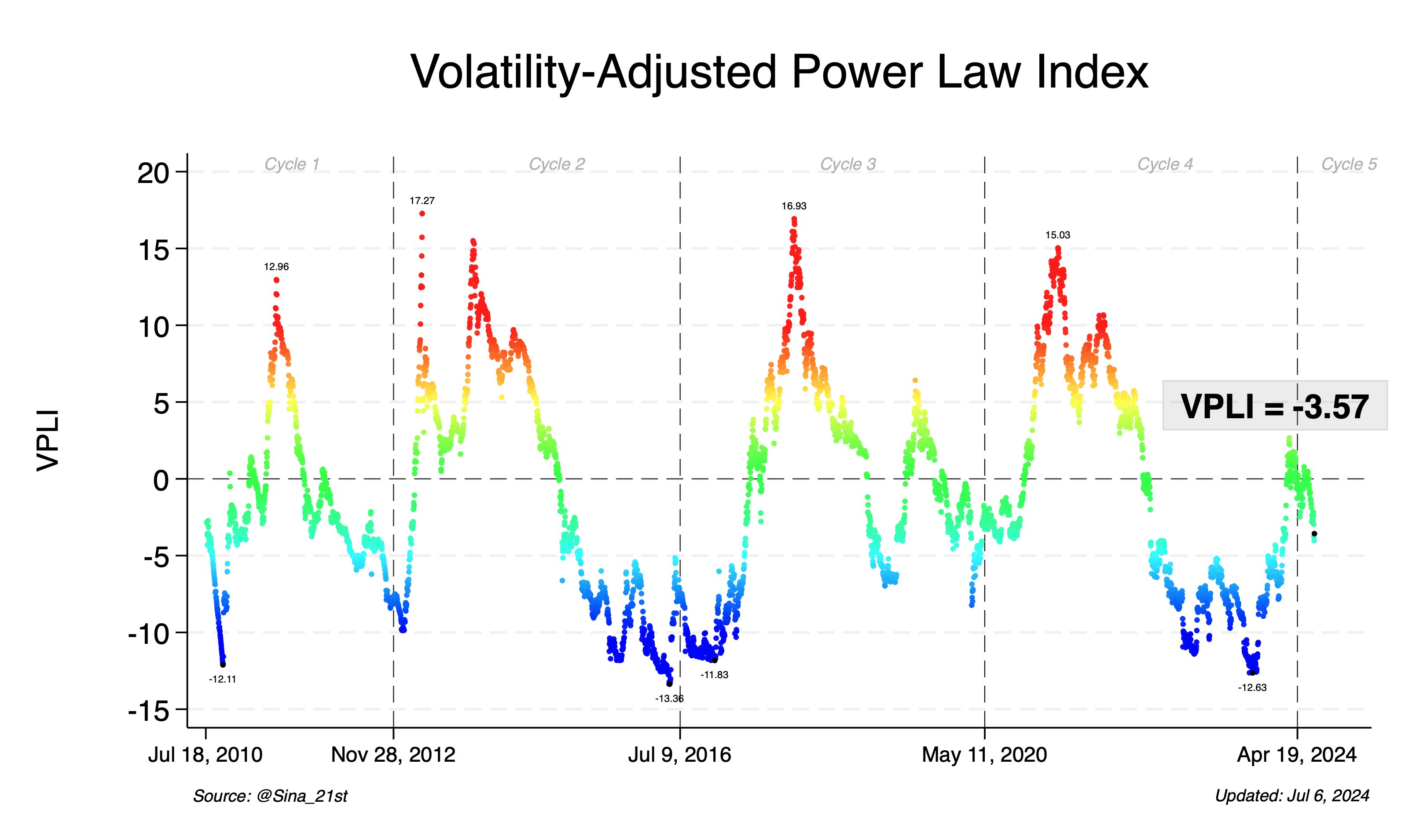

To deal with whether or not Bitcoin is presently undervalued, Sina turned to the Volatility-Adjusted Worth Degree Index (VPLI), a proprietary metric developed by twenty first Capital. “At present, our VPLI is at -3.57, which signifies that Bitcoin is considerably beneath its truthful worth,” Sina said. He additional clarified that traditionally, a VPLI rating of -10 corresponds with bear market bottoms, inserting the present studying in a context that implies Bitcoin is doubtlessly undervalued.

“This places us within the 41th percentile of values – i.e., Bitcoin has solely spent 41% of beneath this VPLI studying (most of which throughout the bear markets). So the risk-reward steadiness is favorable,” he added.

Wanting ahead, Sina highlighted two essential short-term indicators that might dictate Bitcoin’s rapid worth actions: the continuation of Bitcoin gross sales by the German authorities and the conduct of the perpetual swaps funding price. “Not too long ago, the funding price has been unfavorable, which is usually a bearish sign. This means that many merchants are taking brief positions, anticipating additional declines, which paradoxically may point out that the market is near reaching a backside,” he concluded.

At press time, BTC traded at $55,835.

Featured picture created with DALL·E, chart from TradingView.com