Information of an on-chain indicator might counsel Bitcoin is at the moment not at a stage the place its value could be at a big threat of dealing with correction.

Bitcoin 365-Day MA Progress Charge Is Sitting Beneath Historic Overheated Zone

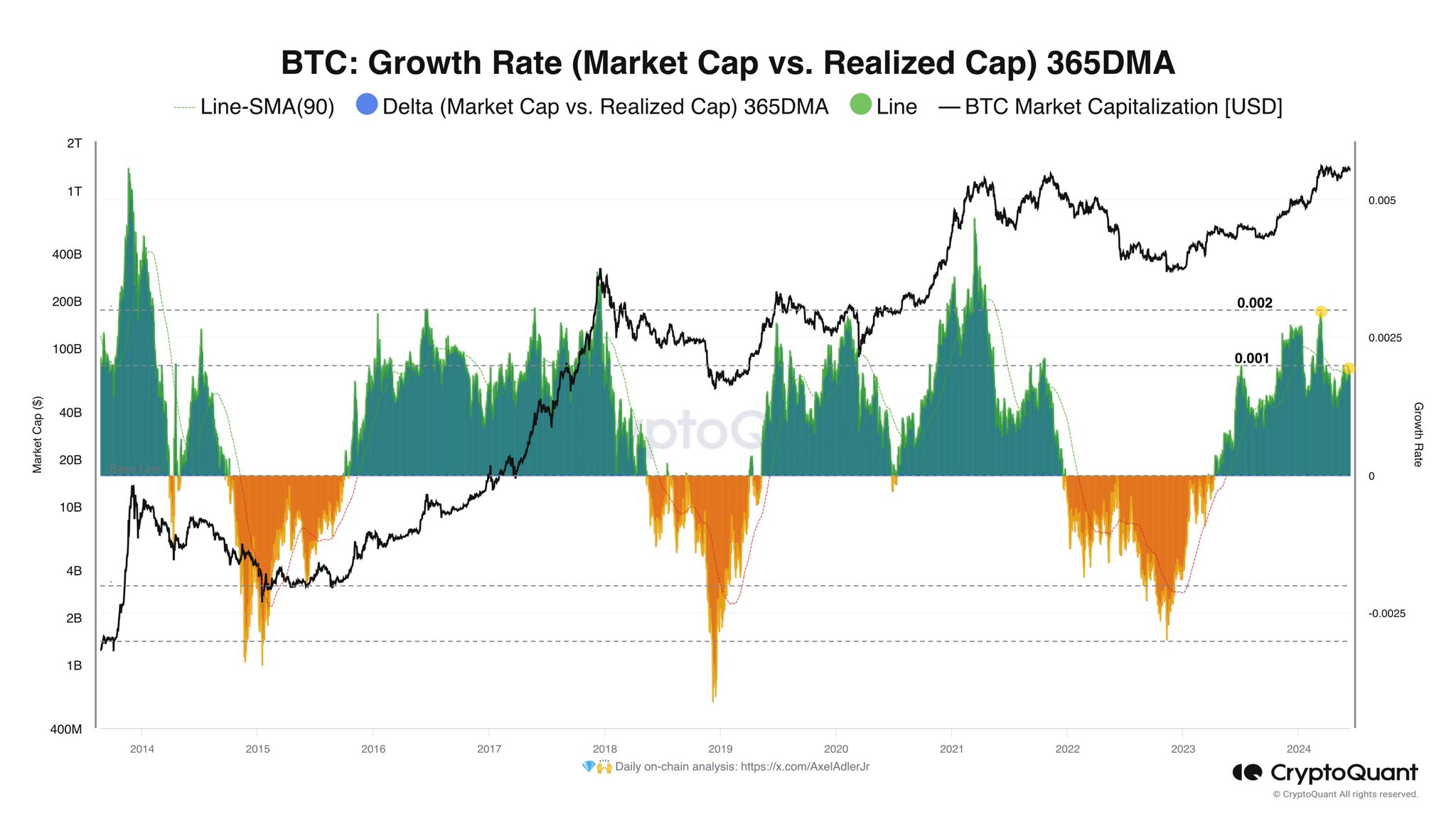

In a submit on X, CryptoQuant writer Axel Adler Jr has mentioned in regards to the current pattern within the “Progress Charge” metric for Bitcoin. The Progress Charge mainly retains observe of the distinction between the modifications occurring within the Bitcoin Market Cap and Realized Cap.

The Market Cap right here is of course simply the straightforward valuation of the cryptocurrency’s whole circulating provide on the present spot value. The Realized Cap, then again, is a little more advanced.

Associated Studying

The Realized Cap is an on-chain capitalization mannequin for the asset that takes the “actual” worth of any coin in circulation to be the identical as the worth at which it was final transferred on the blockchain.

Because the final transaction of any coin was probably the final occasion of it altering arms, the worth at its time would act as its present price foundation. For the reason that Realized Cap sums up this value for all tokens of the asset, it primarily calculates the sum of the fee foundation of every coin within the circulating provide.

In different phrases, the Realized Cap measures the full quantity of capital that the buyers have used to purchase their Bitcoin. The modifications within the Realized Cap would, due to this fact, signify the capital inflows or outflows occurring for the cryptocurrency.

Because the Progress Charge retains observe of how modifications within the Realized Cap are reflecting within the Market Cap, it mainly tells us about how reactive the market is being to capital flows.

Now, here’s a chart that reveals the pattern within the 365-day transferring common (MA) of the Bitcoin Progress Charge over the past decade or so:

As is seen within the above graph, the 365-day MA Bitcoin Progress Charge has been at optimistic ranges since early 2023. When the indicator has inexperienced values, it signifies that the Market Cap is rising at a fee sooner than the Realized Cap.

At current, the indicator is sitting on the 0.001 mark, which is a comparatively excessive stage. Thus, it might seem that capital inflows have been quickly driving up the worth lately.

Traditionally, during times of euphoria out there, the place Market Cap has exploded relative to the Realized Cap, tops have turn into extra possible to happen.

Associated Studying

From the chart, it’s obvious, although, that the current ranges of the metric, though excessive, have nonetheless been under the 0.002 mark past which corrections have turn into probably up to now.

The Bitcoin all-time excessive (ATH) again in March, which has continued to be the highest for the rally to this point, had additionally occurred when the Progress Charge had surged above this stage.

BTC Worth

Bitcoin had slipped beneath the $67,000 mark yesterday, however the asset has since seen a restoration push that has now taken its value again above $69,300.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com