Amid rising institutional engagement in Bitcoin, a pointy spike in exchange-traded fund (ETF) inflows over the previous few days has sparked curiosity from merchants and analysts alike.

Earlier as we speak, a noteworthy evaluation from the favored dealer Skew on social platform X highlighted a possible threat for Bitcoin amidst its present inflow of capital.

Skew identified the phenomenon he dubs the “headline curse,” noting that whereas the numerous influx of over $500 million into United States spot Bitcoin ETFs signifies rising institutional confidence, it might additionally foreshadow a looming value correction.

Associated Studying

Document Excessive Bitcoin ETF Inflows Sign Market Shifts

The latest resurgence in reputation for Bitcoin ETFs, significantly spotlighted by the BlackRock iShares Bitcoin Belief (IBIT), which alone noticed $526 million in inflows on June 22, brings with it a historical past of comparable occurrences that always led to cost sell-offs.

Bitcoin ETF Circulate (US$ million) – 2024-07-22

TOTAL NET FLOW: 533.6

(Provisional knowledge)IBIT: 526.7

FBTC: 23.7

BITB:

ARKB: 0

BTCO: 13.7

EZBC: 7.9

BRRR: 0

HODL: -38.4

BTCW: 0

GBTC: 0

DEFI: 0For all the info & disclaimers go to:https://t.co/4ISlrCgZdk

— Farside Traders (@FarsideUK) July 23, 2024

Skew emphasised that such excessive influx days normally correspond to market provide zones, the place sellers traditionally begin transferring again into the markets searching for value weak point.

This spike in inflows represents a essential juncture for the cryptocurrency, probably setting the stage for both a bullish continuation or a bearish retreat, relying on a number of market elements that Skew outlined.

Skew additional proposed within the evaluation that sustaining the present bullish momentum hinges on just a few key indicators.

These embody a constant passive spot bid, which includes limiting spot patrons capitalizing on value dips, and the power of spot takers to proceed bidding by means of current spot provide, which is critical to breach the five-month provide barrier.

Moreover, the absorption of sellers performs an important function; it’s a basic facet that must be addressed to achieve new all-time highs.

Though the inflow of funds into Bitcoin is an indication of positivity, Skew factors out that it’ll take a look at the market’s capability at these essential ranges to maintain demand robust and take in promoting strain.

One other giant influx day👇$BTC

As bullish as that is one another time IBIT reported mid – excessive 9 fig influx days it occurred round market provide zonesconsiderably a headline curse lol

So by way of truly buying and selling this, the apparent half is now does the market maintain this… https://t.co/qdGwMAvVjl pic.twitter.com/iZ921tpKHW

— Skew Δ (@52kskew) July 23, 2024

Impending Promote Strain

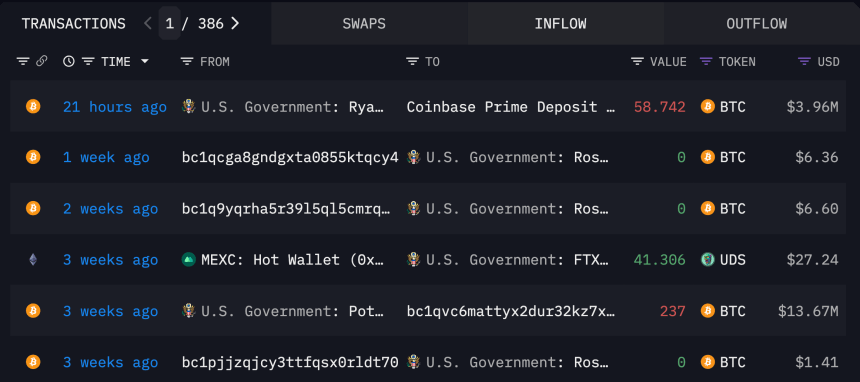

Talking of promote strain, blockchain analytics agency Arkham Intelligence not too long ago revealed that the US authorities has transferred $3.96 million from the seized Bitcoin to Coinbase.

Including to this doable promote strain, Arkham Intelligence, in one other report on X, additionally revealed that the defunct crypto trade, Mt. Gox, could also be transferring to proceed its Bitcoin sale. Yesterday, the trade made take a look at transactions depositing $1 to 4 separate Bitstamp deposit addresses.

Associated Studying

No matter these doable promote pressures, Bitcoin nonetheless maintains its value above $65,000, with the asset at present buying and selling at $66,981 on the time of writing.

Featured picture created with DALL-E, Chart from TradingView