Glassnode’s mannequin for monitoring the “value multiplier” impact for Bitcoin may present some hints about whether or not the asset is close to the highest or not up to now.

Bitcoin Is Observing A Multiplier Impact Of 4-5x Proper Now

In a brand new publish on X, the lead on-chain analyst at Glassnode, Checkmate, has mentioned the “value multiplier” impact of Bitcoin. This impact refers to the truth that the capital that flows into the cryptocurrency just isn’t all the time (in reality, more often than not) the identical because the change mirrored out there cap.

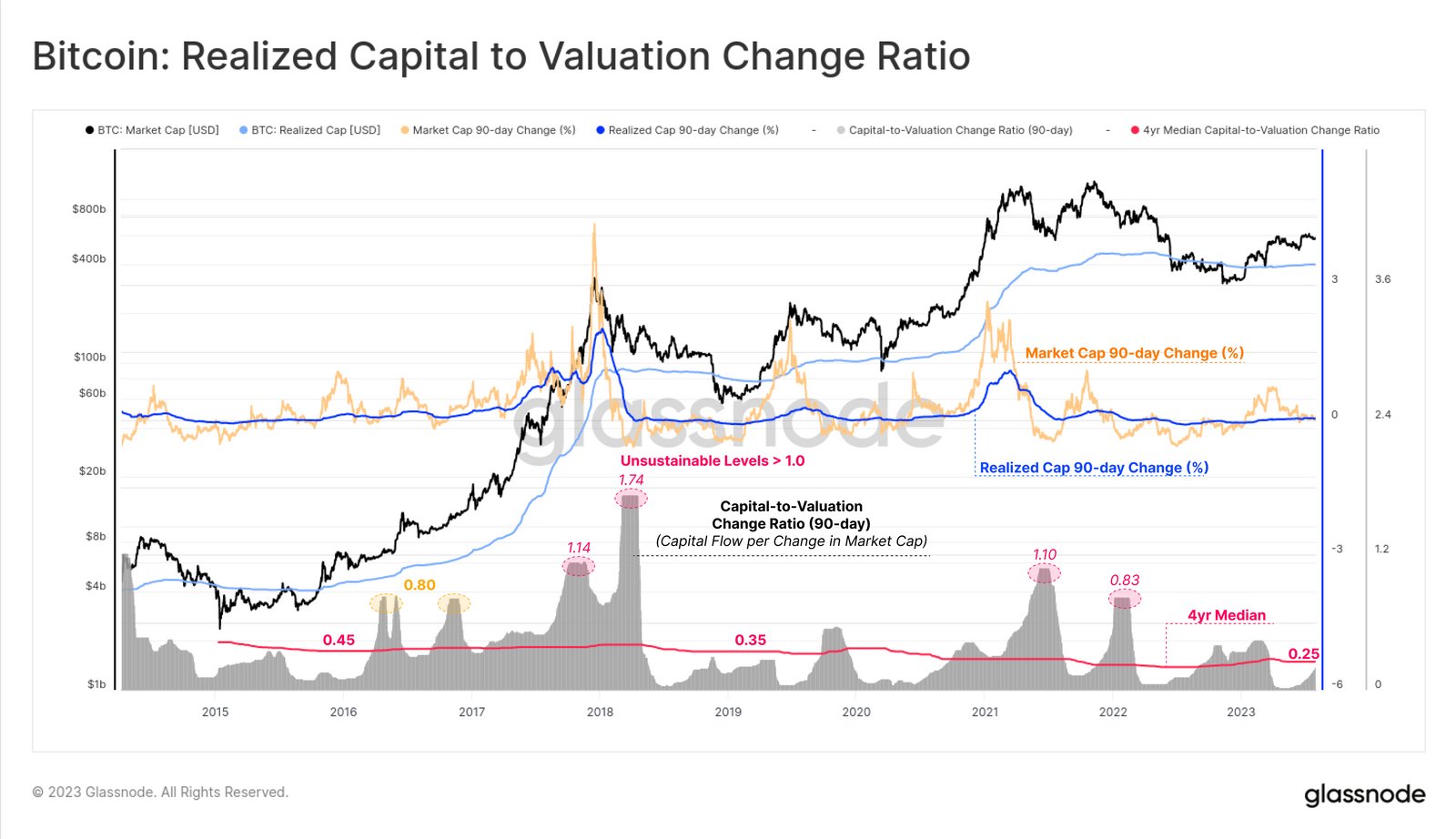

To trace the precise ratio between the 2, Glassnode has outlined the “Realized Capital to Valuation Change Ratio.” This indicator measures how a lot capital flows into the “Realized Cap” for each unit change out there cap.

The Realized Cap refers to a capitalization mannequin for Bitcoin that assumes that the true worth of every coin in circulation just isn’t the present spot value however the value on the time it was final transferred on the blockchain.

This final switch could possibly be thought of the earlier second the coin modified fingers, so the Realized Cap provides up the price foundation or acquisition worth of all cash in circulation. Put one other manner, the Realized Cap is a mannequin that measures the entire quantity of capital the traders have used to purchase Bitcoin.

Now, here’s a chart that reveals the development within the BTC Realized Capital to Valuation Change Ratio over the previous a number of years:

The information for the 90-day change within the metric | Supply: @_Checkmatey_ on X

The above graph reveals that the Bitcoin Realized Capital to Valuation Change Ratio (90-day) has just lately been beneath the 4-year median of 0.25. As Checkmate notes, this mannequin suggests the present multiplier impact of BTC is round 4 to five occasions.

Which means for each $0.20 to $0.25 going into the realized cap, the market cap is shifting by $1. From the chart, it’s obvious that the multiplier has usually shot up throughout bull markets.

“Bull market tops usually correspond with $0.80 to over $1.0 in capital inflows wanted to realize a $1 change out there cap (unsustainable < 1x Multipler),” explains the Glassnode lead.

However, bear markets “usually see heightened volatility with $0.2 in capital flows having a $1.0 influence on MCap (5x Multipler),” in keeping with the analyst.

Suppose this historic sample is something to go by. In that case, the present Bitcoin multiplier continues to be at comparatively low values, which might indicate the cryptocurrency nonetheless has loads of room to go earlier than a possible prime is encountered.

One other curious sample within the ratio can also be seen in the identical chart. It seems that the 4-year median has been happening because the years have handed. This may imply that BTC’s market cap has, on common, been changing into simpler to shift with time.

BTC Worth

Prior to now day, the Bitcoin spot ETFs had been lastly cleared by the US SEC, and it might seem that the market has reacted by shopping for this information, as the value has now breached the $48,000 stage.

Appears like the value of the coin has shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Dmytro Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual danger.