In response to analysts at Bitfinex, Bitcoin and its current exercise on exchanges displays a sample paying homage to December 2020, hinting at a attainable development section.

The alternate’s newest report highlights a big decline within the provide of Bitcoin held by long-term traders on centralized exchanges, reaching its lowest ranges in 18 months.

This development, coupled with the forthcoming halving occasion, suggests a situation conducive to additional worth appreciation, as acknowledged by the analysts.

Potential Development On The Horizon

The Bitfinex Alpha report underscores the diminishing inactive provide of Bitcoin, notably these property stagnant for over a 12 months. This discount implies that long-term holders both scale back their positions or switch their property off exchanges.

Such actions are basic to understanding Bitcoin’s worth dynamics, particularly because the halving occasion approaches.

With an rising variety of BTC leaving centralized exchanges and a lower in inactive provide, the market is primed for “potential development,” in response to Bitfinex analysts. They add that this mirrors the situations noticed earlier than the numerous market surge in December 2020.

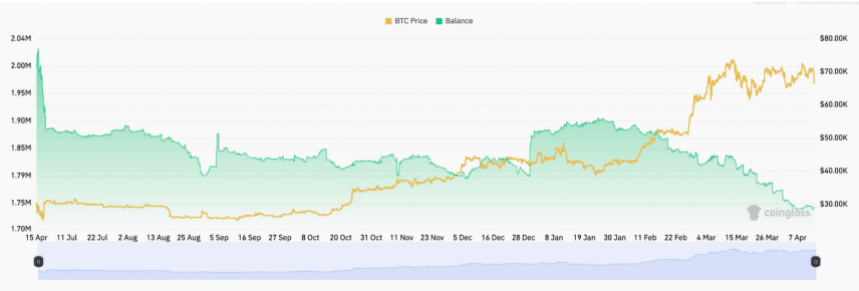

On a broader scale, information from CryptoQuant corroborates Bitfinex’s observations, indicating a steady decline in Bitcoin alternate reserves since July 2021. This decline, which has seen reserves plummet from 2.8 million to roughly 1.94 million, suggests a sustained development of Bitcoin leaving alternate wallets.

Bitcoin Newest Value Motion

In the meantime, Bitcoin’s worth efficiency has taken a downturn, notably starting late final week Friday and persevering with all through the weekend. The highest crypto witnessed a big decline, plummeting from above $70,000 to as little as $62,000.

Notably, this downward development has persevered over the previous 24 hours, with the asset experiencing a lower of 4.6% throughout this era and over 10% previously week, resulting in its present buying and selling worth of $62,034 on the time of writing.

Amidst these worth actions, indicators of panic have emerged inside the Bitcoin market. Current information from Whale Alert sheds mild on a big switch involving 7,690 BTC, valued at $483 million, to Coinbase, the most important cryptocurrency alternate in america.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 7,690 #BTC (483,425,557 USD) transferred from unknown pockets to Coinbase Institutionalhttps://t.co/olrmzaQdHx

— Whale Alert (@whale_alert) April 16, 2024

Whereas particulars concerning the origin of the tackle, “1Eob1,” stay undisclosed, it’s necessary to acknowledge that such transfers to exchanges usually sign potential intentions to liquidate holdings. This prevalence sometimes suggests a readiness to unload property inside the crypto sphere.

Moreover, ought to the entity accountable for this switch determine to unload the whole lot of the deposited BTC, it might doubtlessly exert a notable affect on the broader Bitcoin market.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.