Cardano (ADA), the tenth largest cryptocurrency by market capitalization, has been a rollercoaster trip for traders in latest months. After a steep value decline in March, ADA has seen a minor uptick, leaving analysts divided on its future trajectory. Might a repeat of a historic value sample propel ADA to new heights in 2024, or are there warning indicators lurking beneath the floor?

Cardano Mimics 2020: Bullish Echo Or False Hope?

Hopeful traders are clinging to a well-recognized chart sample. Based on common crypto analyst Milkybull, ADA’s value motion seems to be mirroring its motion in 2020. Again then, an “Adam and Eve” double backside sample preceded a major value surge. If historical past rhymes, a breakout from this sample might see ADA revisit its all-time excessive this 12 months.

It’s following the identical path of 2020 that initiated an explosive rally. pic.twitter.com/rI5FDzcn4P

— Mikybull 🐂Crypto (@MikybullCrypto) April 21, 2024

Nevertheless, historic comparisons are a double-edged sword. Whereas previous traits can supply some perception, blindly counting on them will be deceptive, particularly within the ever-evolving cryptocurrency market.

Technical Indicators Flash Inexperienced, However Community Exercise Sputters

Technical indicators usually used to gauge market sentiment appear to be portray a bullish image for Cardano. The Relative Power Index (RSI) and Chaikin Cash Circulation (CMF) are each trending upwards, suggesting a possible value improve.

Complete crypto market cap at the moment at $2.3 trillion. Chart: TradingView

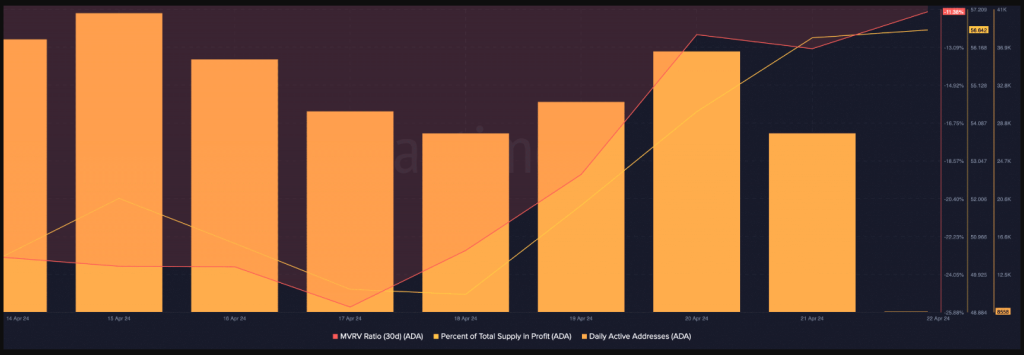

In the meantime, an important metric paints a contrasting image. Cardano’s each day energetic addresses, which replicate the variety of distinctive customers interacting with the community, have dipped barely previously few days. This decline in community exercise may very well be a trigger for concern, as it would point out dwindling person curiosity within the Cardano ecosystem.

Cardano’s Future: A Balancing Act

The outlook for Cardano stays unsure. Whereas the potential for a bull run based mostly on historic patterns and bullish technical indicators exists, the decline in community exercise raises questions on its long-term sustainability. Traders ought to rigorously contemplate these conflicting indicators earlier than making any funding selections.

Supply: Santiment

Additional developments inside the Cardano ecosystem, such because the profitable rollout of sensible contracts or elevated adoption of decentralized functions (dApps) constructed on the Cardano blockchain, might considerably impression its value.

Moreover, the general efficiency of the broader cryptocurrency market will even play a task in figuring out ADA’s future trajectory.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site completely at your individual danger.