Fast Take

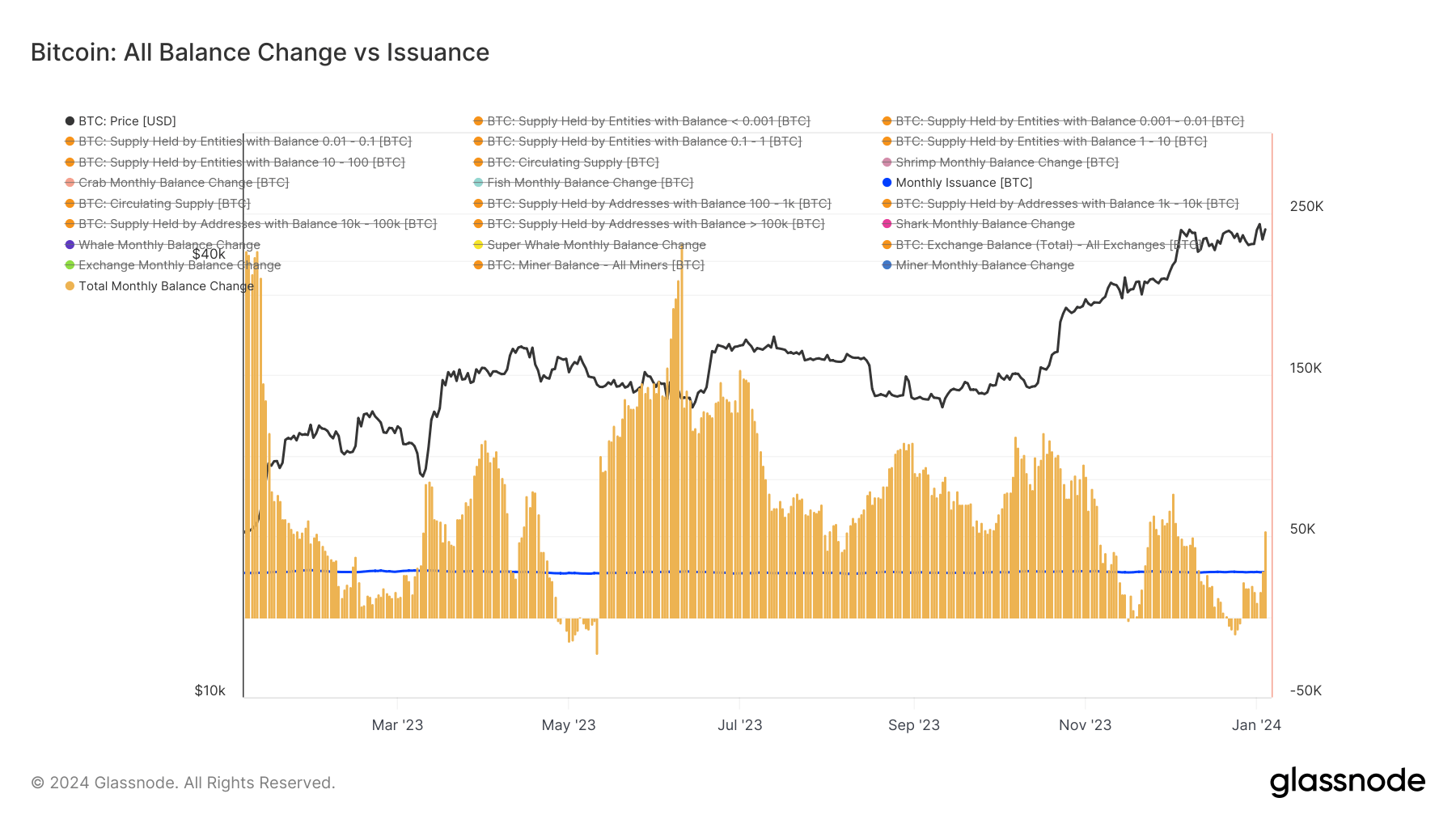

When juxtaposed with the quantity of newly mined BTC, the steadiness change of Bitcoin investor cohorts provides intriguing insights into the dynamics of the digital asset markets’ ecosystem. This evaluation reveals a relative measure of recent Bitcoin issuance absorbed by all completely different investor cohorts. Impressively, values above the blue line point out a cohort’s mixture steadiness rising past the overall cash mined in a given month, performing as a internet absorber.

Contrarily, values on the blue line recommend a comparatively flat steadiness for the cohort over a month in opposition to issuance, whereas adverse values point out a discount within the cohort’s mixture steadiness, indicating a distribution together with recent coin issuance. A every day mining price of roughly 900 BTC interprets right into a month-to-month quantity of round 27,000 BTC.

For the primary time since Dec. 4th, the mixture steadiness of all cohorts is surpassing this month-to-month issuance. As of Jan. 4th, the overall month-to-month steadiness change stood at 53,800, implying roughly 25,000 Bitcoins plus issuance had been absorbed from the market. This absorption marks a halt within the previous distribution part, a phenomenon solely beforehand seen in Might 2023.

The submit Investor cohorts outpace Bitcoin’s month-to-month mined provide for the primary time since early December appeared first on CryptoSlate.