In a latest thread on X (previously Twitter), famend on-chain analyst Checkmate supplied an evaluation relating to the longer term trajectory of Bitcoin. At present, the premier cryptocurrency hovers across the $60,000 mark, a pivotal second that echoes historic patterns inside the Bitcoin market cycle.

What Will The Subsequent 6 Months Deliver For Bitcoin?

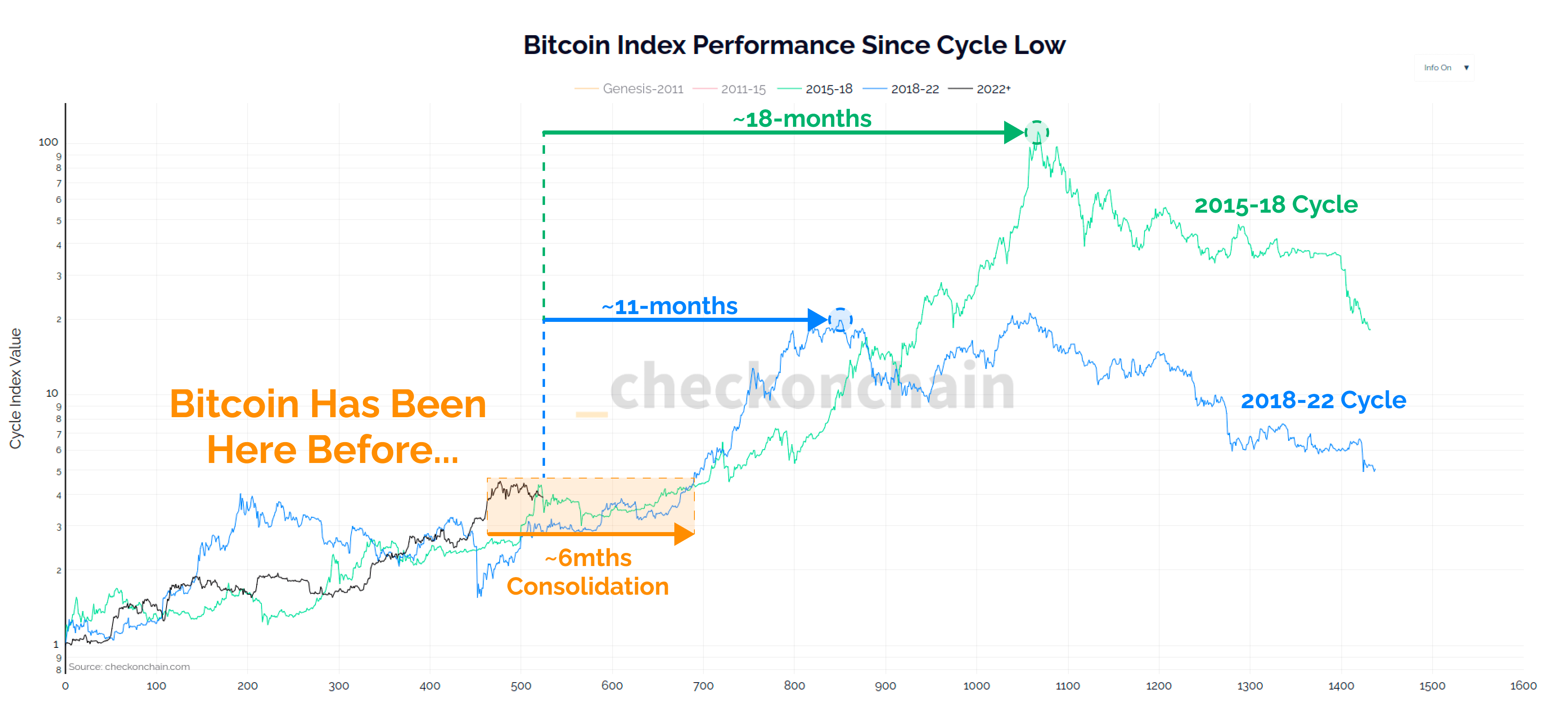

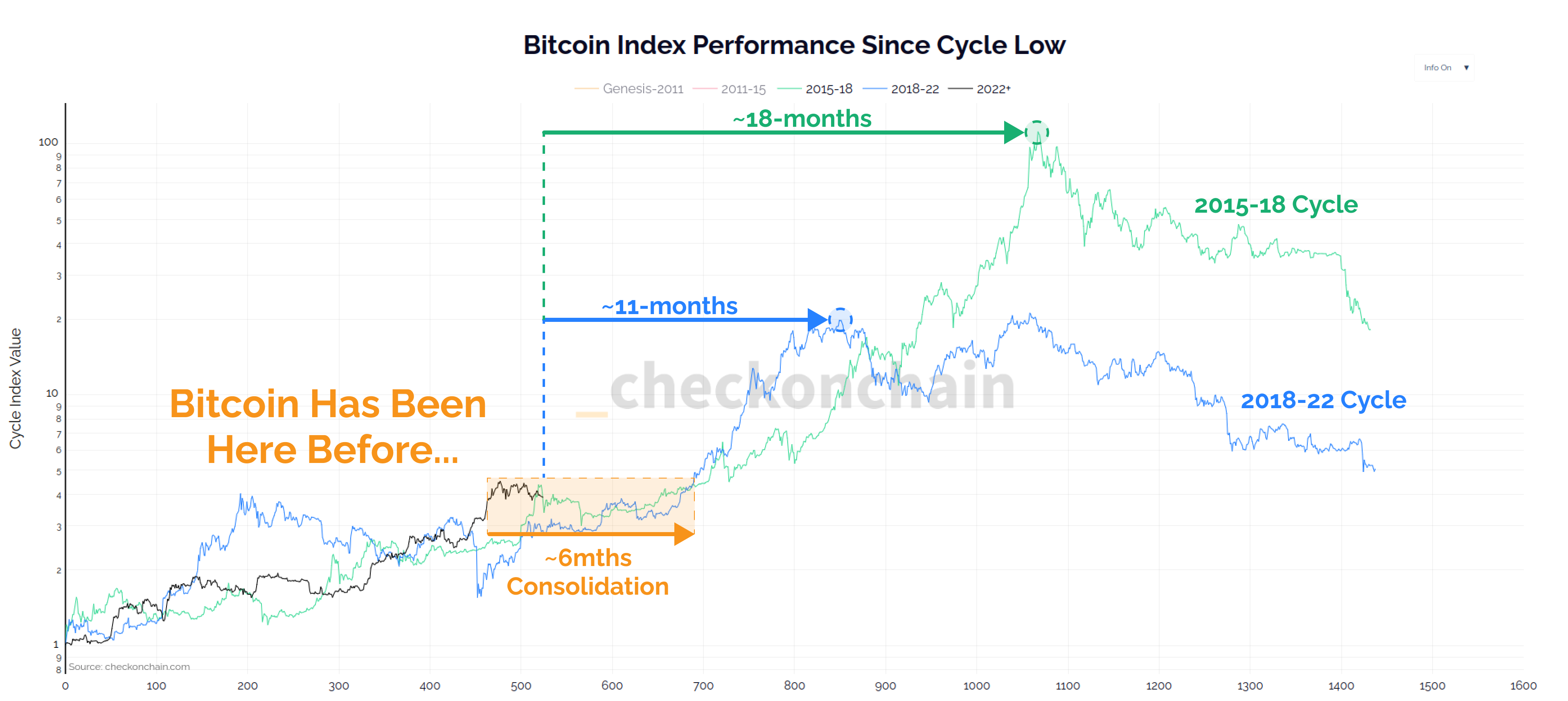

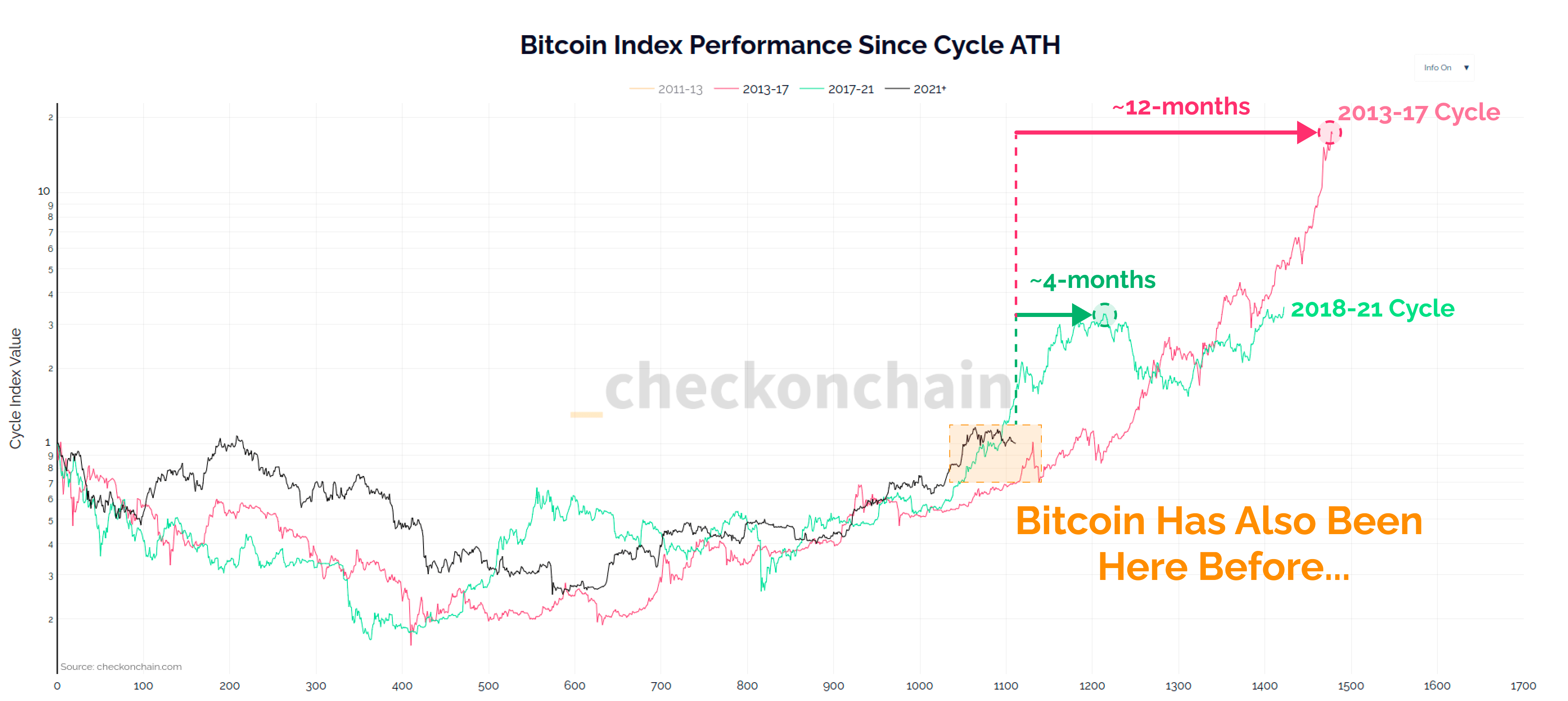

Checkmate argues that Bitcoin is positioned in a “chopsolidation” part—a time period coined to explain a stagnant but unstable interval. He means that this might final roughly six months, based mostly on earlier cycles, and probably usher in a interval of parabolic progress that would final between six to 12 months. “Bitcoin historical past tends to rhyme, and to date, this cycle isn’t any totally different,” Checkmate famous. “The track sung over the past two cycles paints round 6-months of chopsolidation forward of us, adopted by 6-12 months of parabolic advance.”

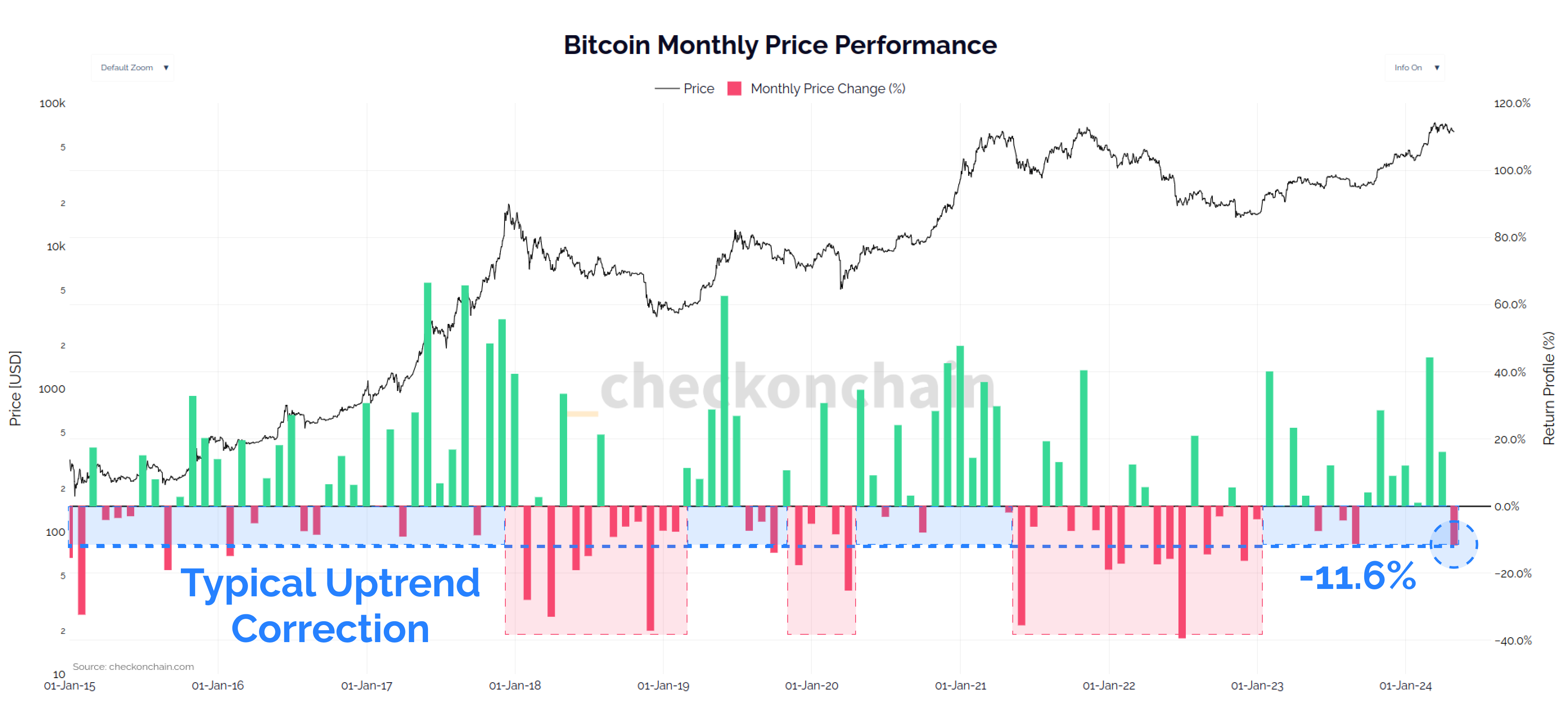

Supporting his evaluation, Checkmate refers to April 2021 as a big excessive level for Bitcoin for “many good causes,” noting that regardless of a substantial month-to-month drop of over $8,250 in April, such actions are typical and sometimes signify wholesome market corrections. “It’s an -11.2% month-to-month pullback, and is extraordinarily widespread throughout uptrends, and corrections are wholesome and crucial,” he acknowledged, reinforcing his confidence in Bitcoin’s resilience and potential for restoration.

Additional statistical backing comes from historic information centered solely on Bitcoin halving years (2012, 2016, 2020, and 2024), which Checkmate used for instance that such month-over-month corrections aren’t outliers however relatively widespread occurrences inside the digital asset’s cyclical developments. The tip of every 12 months post-halving has traditionally proven robust efficiency, supporting the notion that the present worth level may very well be a precursor to vital good points.

Promote In Might And Go Away?

Checkmate additionally retweeted a submit from Charles Edwards. The founding father of Capriole Investments commented in the marketplace’s unprecedented bullishness, implying {that a} deeper correction is to be anticipated.

“That is beginning to get ridiculous. Bitcoin has not had a run like this since inception. We at the moment are 1 day in need of the report set in 2011 for days with no significant dip [more than 25%]. If you’re not ready to just accept some draw back on this asset class, you shouldn’t be right here. Particularly now,” mentioned Edwards. His comment highlights the weird lack of extreme downturns available in the market, suggesting that buyers ought to be ready for potential volatility.

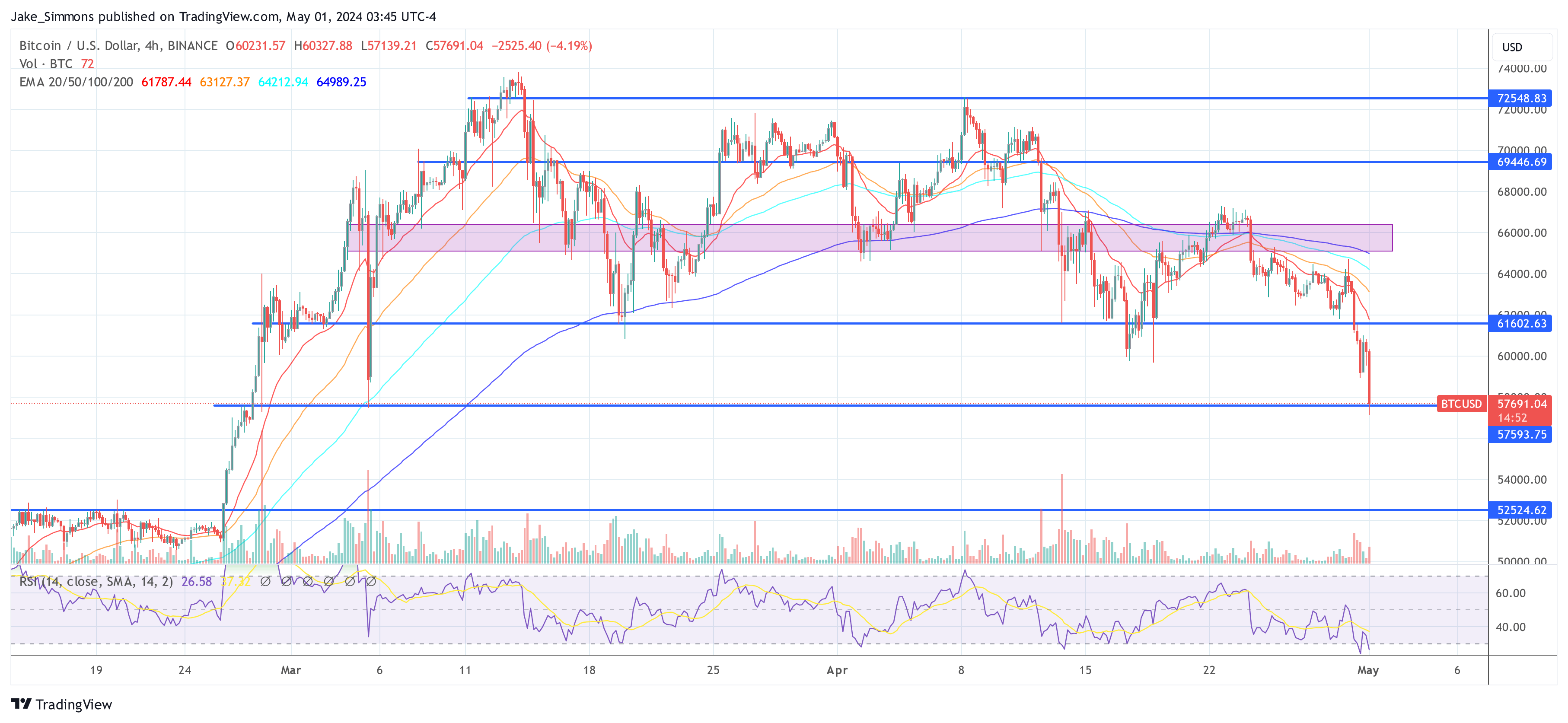

In one other submit on X, Edwards added a cautious notice to the in any other case optimistic outlook. He suggested, “Promote in Might and go away. This seems like distribution to me. So long as we commerce beneath $61.5K, state of affairs (1) is technically extra possible. A powerful reclaim of $61.5K would give some hopes to the bulls for state of affairs (2). A flush would even be good for the sustaining continuation of the bull market, the earlier we get one, the higher the lengthy alternatives are.”

This attitude suggests a strategic withdrawal could also be clever within the brief time period, implying that present market circumstances is perhaps extra bearish than they seem and {that a} vital correction might probably strengthen the market’s long-term prospects.

At press time, the BTC plunged to $57,691.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site totally at your individual danger.