Fast Take

Bitcoin left a major mark on the ETF trade in 2024, with Bitcoin ETFs drawing in additional than $12 billion in internet inflows mixed. Main this surge is BlackRock’s iShares Bitcoin ETF (IBIT), which has collected over $15 billion in internet inflows and stands on the forefront of this success narrative.

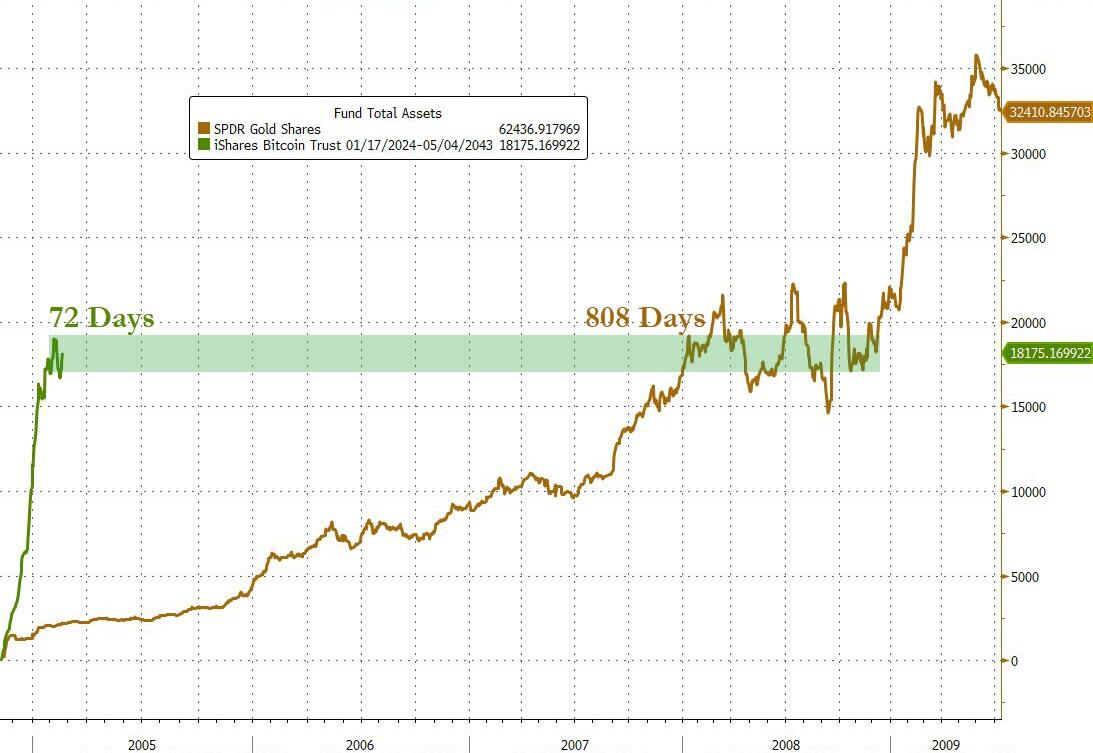

Not too long ago, IBIT accomplished a formidable streak of 71 consecutive days of inflows, firmly establishing itself among the many prime 10 US ETFs when it comes to successive inflows. Nonetheless, to totally grasp the importance of IBIT’s achievement, it’s essential to match it with the SPDR Gold ETF (GLD), given Bitcoin’s moniker as “digital gold.”

In keeping with Coinglass information, on April 24, IBIT’s buying and selling quantity reached $1.19 billion, whereas GLD’s quantity stood at $1.16 billion, regardless of GLD being greater than thrice the scale of IBIT when it comes to market cap.

A very notable comparability emerges from Nate Geraci, President of ETF Retailer, who shared a chart created by Zerohedge. It reveals that the SPDR Gold ETF (GLD) took 808 days since its inception to achieve the identical belongings beneath administration (AUM) that IBIT achieved in 72 days. This putting statistic emphasizes the swift growth and rising recognition of Bitcoin as an funding avenue.