Methods to commerce crypto – a query that resonates with many within the quickly evolving digital asset area. Whether or not you’re a novice desperate to discover ways to crypto commerce or an skilled crypto dealer trying to refine your methods, this information is your complete useful resource. From understanding one of the best time to commerce crypto to exploring one of the best cryptos to day commerce, we’ll delve into each facet it is advisable to know.

What Makes A Crypto Dealer?

A profitable crypto dealer isn’t just somebody who is aware of the best way to commerce crypto, however a person geared up with a novel set of abilities, particularly in technical evaluation. Technical evaluation is the cornerstone of crypto commerce selections. It entails deciphering market knowledge and value charts to forecast future value actions. This ability is especially essential for many who day commerce crypto or have interaction in short-term buying and selling methods like crypto scalping.

Technical evaluation in crypto buying and selling typically entails understanding and using numerous instruments and indicators. As an illustration, a proficient crypto dealer must be adept at studying candlestick charts, that are elementary in figuring out market tendencies and potential reversals. Information of development strains, chart patterns, indicators just like the Relative Energy Index (RSI) and the Transferring Common Convergence Divergence (MACD) in addition to shifting averages can also be very important in making knowledgeable selections about when to enter or exit a commerce.

Other than technical abilities, a crypto dealer should even have a powerful psychological make-up. The power to stay calm below stress and keep self-discipline, particularly in unstable market situations, is what separates seasoned merchants from novices. This psychological fortitude is very necessary in high-stakes buying and selling situations, reminiscent of when one is studying the best way to leverage commerce crypto or have interaction in crypto futures buying and selling.

Why Commerce Crypto?

Buying and selling cryptocurrency gives distinctive benefits that make it an interesting market for a lot of traders and merchants. Listed below are some key the explanation why folks select to commerce crypto:

- Market Volatility: Whereas volatility is commonly seen as a threat, for the savvy crypto dealer, it presents quite a few alternatives for revenue. The fast value fluctuations within the crypto market can lead to vital beneficial properties, particularly for these expert in crypto commerce methods like day buying and selling or swing buying and selling.

- Accessibility And Liquidity: The crypto market operates 24/7, providing unmatched accessibility in comparison with conventional monetary markets. This around-the-clock buying and selling functionality permits crypto merchants to react immediately to market information and occasions. Moreover, the rising adoption of cryptocurrencies has led to increased liquidity, making it simpler to execute trades rapidly and at desired costs.

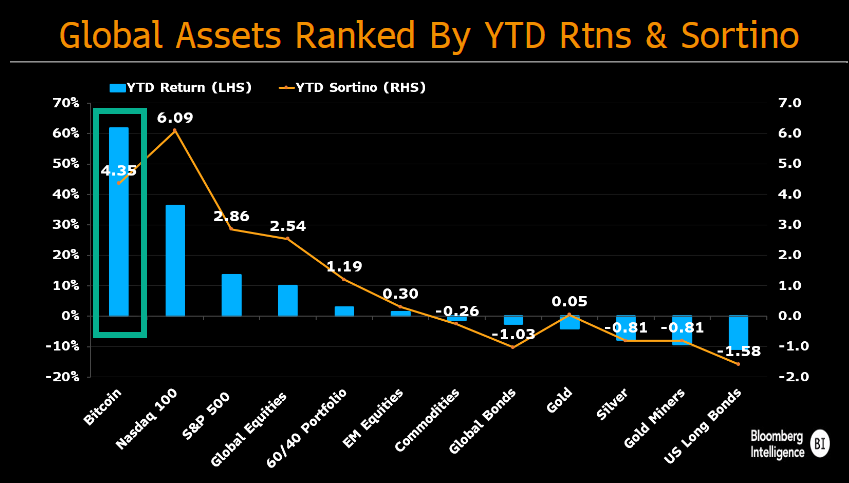

- Potential For Excessive Returns: Cryptocurrencies have been identified for his or her potential to yield excessive returns. Although excessive returns include excessive dangers, merchants who’ve discovered the best way to commerce crypto successfully, significantly those that have interaction in methods like day commerce crypto, can capitalize on these alternatives.

- Diversification: For traders trying to diversify their portfolio, cryptocurrencies supply an alternate asset class that’s not instantly correlated with conventional monetary markets. This diversification is usually a hedge in opposition to inflation or market downturns in different sectors.

- Democratization Of Finance: Crypto buying and selling supplies a stage of inclusivity and democratization not all the time current in conventional monetary markets.

Getting Began: How To Commerce Crypto

With regards to crypto buying and selling , the preliminary steps contain laying a powerful basis and buying the required instruments and mindset. Right here’s a elementary information to getting began:

- Understanding The Market Dynamics: Earlier than any precise buying and selling, it’s essential to know the distinctive dynamics of the crypto market. This contains understanding the elements that affect cryptocurrency costs, reminiscent of market demand, technological developments, regulatory information, and broader financial elements.

- Growing A Crypto Dealer’s Mindset: Buying and selling crypto requires a selected mindset. It entails endurance, self-discipline, and a willingness to study constantly. Growing a mindset that may deal with the ups and downs of the market is as necessary as any technical ability.

- Fundamental Danger Administration Ideas: Earlier than executing your first commerce, perceive the essential rules of threat administration. This contains solely investing what you may afford to lose, understanding the volatility of the market, and data concerning the totally different order varieties.

- Exploring Totally different Cryptocurrencies: Whereas many freshmen begin with well-known cryptocurrencies like Bitcoin or Ethereum, there’s a big selection of cryptocurrencies to discover. The smaller the market cap of an alternate cryptocurrency (“altcoin“), the extra unstable it tends to be. Mid and small caps typically have even better revenue potential, but in addition better dangers.

- Staying Knowledgeable And Up to date: The crypto market is fast-paced and always evolving. Conserving your self up to date with the most recent information and tendencies is essential. This entails following crypto information, becoming a member of on-line communities, and probably utilizing social media to trace real-time updates.

Crypto Commerce Methods (With Execs And Cons)

Selecting a crypto commerce is likely one of the first challenges for potential crypto merchants. You have to align your technique together with your targets, threat tolerance, and time dedication. Every technique comes with its personal set of benefits and challenges.

Day-Commerce Crypto

Day buying and selling in crypto entails shopping for and promoting cryptocurrencies inside the similar buying and selling day. Merchants capitalize on short-term market actions to make earnings.

Execs: The first benefit of day buying and selling is the potential for fast earnings because of the excessive volatility of the crypto market. It additionally limits publicity to in a single day market dangers since positions aren’t held past a day. Day buying and selling is extremely participating and will be very rewarding for many who have the time to observe the market always.

Cons: Nonetheless, day buying and selling is time-consuming and requires fixed market evaluation, which will be traumatic. It additionally calls for a great understanding of market tendencies and technical evaluation. The excessive frequency of trades can result in vital transaction charges, and the fast-paced nature of this technique can amplify losses simply as rapidly as beneficial properties.

Crypto Scalping

Scalping is a technique the place crypto merchants make earnings from small value adjustments, typically getting into and exiting positions inside minutes.

Execs: Scalping permits merchants to revenue from even the smallest market actions, making it a great technique in each unstable and steady market situations. It additionally reduces publicity to long-term market dangers.

Cons: Scalping requires immense self-discipline and a strict exit technique to forestall vital losses. It’s a high-intensity technique, demanding fixed consideration and fast decision-making. Scalping additionally usually entails a lot of trades, which can lead to excessive transaction prices.

Crypto Swing Buying and selling

Swing buying and selling entails holding onto cryptocurrencies for a number of days or even weeks to capitalize on anticipated upward or downward market shifts.

Execs: This technique is much less time-consuming than day buying and selling or scalping, permitting merchants extra time to investigate the market. Swing merchants can seize extra vital value shifts than day merchants, probably resulting in increased earnings.

Cons: Swing buying and selling entails the chance of holding positions in a single day or longer, exposing the dealer to unexpected market adjustments. It additionally requires a great understanding of market tendencies and the endurance to attend for the correct second to enter or exit a commerce.

Place Buying and selling

Place buying and selling is a long-term technique the place merchants maintain their positions for months and even years, based mostly on their evaluation of long-term market tendencies.

Execs: This technique requires much less time to observe each day market fluctuations and may yield substantial returns if the long-term market development predictions are correct. Place merchants are much less affected by short-term volatility.

Cons: The primary draw back is that capital is tied up for a very long time, making it unavailable for different funding alternatives. It additionally requires a deep understanding of the market and robust conviction in a single’s predictions, as holding positions by way of market ups and downs will be difficult.

How To Commerce Crypto: Step-By-Step Information

Buying and selling crypto can appear daunting at first, however by following a structured strategy, you may navigate the method with better ease. Right here’s a step-by-step information that will help you get began:

Preparation: How To Turn out to be A Good Crypto Dealer

- Select A Cryptocurrency Trade: Step one is deciding on a cryptocurrency change. Search for platforms identified for his or her safety, user-friendly interface, and the vary of cryptocurrencies they provide. Widespread exchanges like Binance, Coinbase, and Kraken are a great start line.

- Set Up Your Buying and selling Account: When you’ve chosen an change, arrange your buying and selling account. This course of will usually require you to supply private data and full a verification course of to adjust to regulatory necessities.

- Deposit Funds: After your account is ready up, you’ll must deposit funds. You are able to do this both by transferring fiat foreign money (like USD, EUR) into your account or by depositing cryptocurrencies from a digital pockets.

- Develop A Buying and selling Plan: Earlier than you begin buying and selling, it’s essential to have a plan. This could embody your funding targets, threat tolerance, and the buying and selling technique you plan to make use of (like day commerce crypto, swing buying and selling, and so forth.).

- Begin With A Demo Account (If Out there): Many platforms supply demo accounts the place you may apply buying and selling with digital cash. This can be a nice method to get a really feel for the market dynamics and check your buying and selling technique with out risking actual cash.

Begin Crypto Buying and selling

- Start Buying and selling: When you’re snug, begin buying and selling. This entails putting purchase or promote orders in your chosen change. Begin with smaller quantities to get a really feel for the market and regularly improve your buying and selling measurement as you acquire extra confidence and expertise.

- Monitor Your Trades And Regulate Your Technique: Repeatedly monitor your trades and the market. Be ready to regulate your technique if the market situations change. It’s necessary to remain versatile and conscious of market dynamics.

- Follow Danger Administration And Be taught: All the time keep watch over your threat publicity and use instruments like stop-loss orders to guard your investments. After every buying and selling session, replicate on what you’ve discovered, what labored, and what didn’t. Steady studying and adaptation are key to changing into a profitable crypto dealer.

Securing Your Cryptocurrencies

Securing your cryptocurrencies is an important facet of buying and selling and investing within the digital foreign money area. Right here’s how one can make sure the safety of your belongings:

- Use Trusted Wallets: There are two fundamental kinds of wallets: sizzling wallets (on-line wallets) and chilly wallets (offline or {hardware} wallets). Whereas sizzling wallets are handy for frequent merchants, chilly wallets present higher safety for long-term storage.

- Allow Two-Issue Authentication (2FA): All the time allow 2FA in your buying and selling accounts and wallets. This provides an additional layer of safety. In case your password is compromised, the attacker can’t entry your funds with out the second authentication issue.

- Be Cautious Of Phishing Makes an attempt: Be vigilant about phishing makes an attempt. These often come within the type of emails or messages that attempt to trick you into revealing your safety credentials.

- Use Sturdy And Distinctive Passwords: For every account and pockets, use sturdy, distinctive passwords. Keep away from reusing passwords throughout totally different platforms.

- Hold Your Software program Up to date: Be sure that your pockets software program, in addition to your laptop’s or smartphone’s working system, is repeatedly up to date.

- Backup Your Pockets: Recurrently backup your pockets, particularly in the event you’re utilizing a desktop or cell pockets. This ensures you could get better your cryptocurrencies in case your system is misplaced, stolen, or broken.

- Be Cautious With Public Wi-Fi: Keep away from accessing your crypto wallets or buying and selling accounts over public Wi-Fi networks. These networks are sometimes not safe!

Finest Cryptos To Day Commerce

Selecting the right cryptos to day commerce is a nuanced course of that hinges on a number of key elements. As a day dealer, your focus must be on discovering cryptocurrencies that not solely exhibit excessive volatility but in addition possess substantial liquidity and buying and selling quantity. This ensures you could enter and exit positions rapidly and at fascinating costs.

Elements To Take into account:

Liquidity is paramount in day buying and selling. Extremely liquid cryptocurrencies enable for smoother transactions with out inflicting vital value shifts upon entry or exit. Bigger, well-established cryptocurrencies like Bitcoin and Ethereum usually supply increased liquidity, making them dependable decisions for day buying and selling.

Buying and selling quantity is one other essential facet. Usually, cryptos with excessive each day buying and selling volumes are most popular as they point out energetic buying and selling exercise, which in flip suggests extra alternatives for value actions that day merchants can exploit. On the opposite, a technique can contain buying and selling altcoins with low liquidity, making it weak for bigger value swings.

Past liquidity and quantity, a crypto dealer must also take a look at the technical elements like chart patterns and indicators. Cryptocurrencies that present clear and predictable patterns will be extra manageable for crypto merchants who depend on technical evaluation. Indicators reminiscent of shifting averages, RSI, and MACD are instruments typically used to investigate and predict short-term value actions in these unstable markets.

Moreover, being cognizant of the present tendencies within the crypto market can present an edge. As an illustration, if there’s rising curiosity in particular sectors like GameFi or AI altcoins, these may current distinctive buying and selling alternatives. These sectors may exhibit elevated volatility and buying and selling quantity, creating favorable situations for day buying and selling.

Total, it’s essential to steadiness technical concerns with a way of market sentiment and information.

Finest Platform To Commerce Crypto

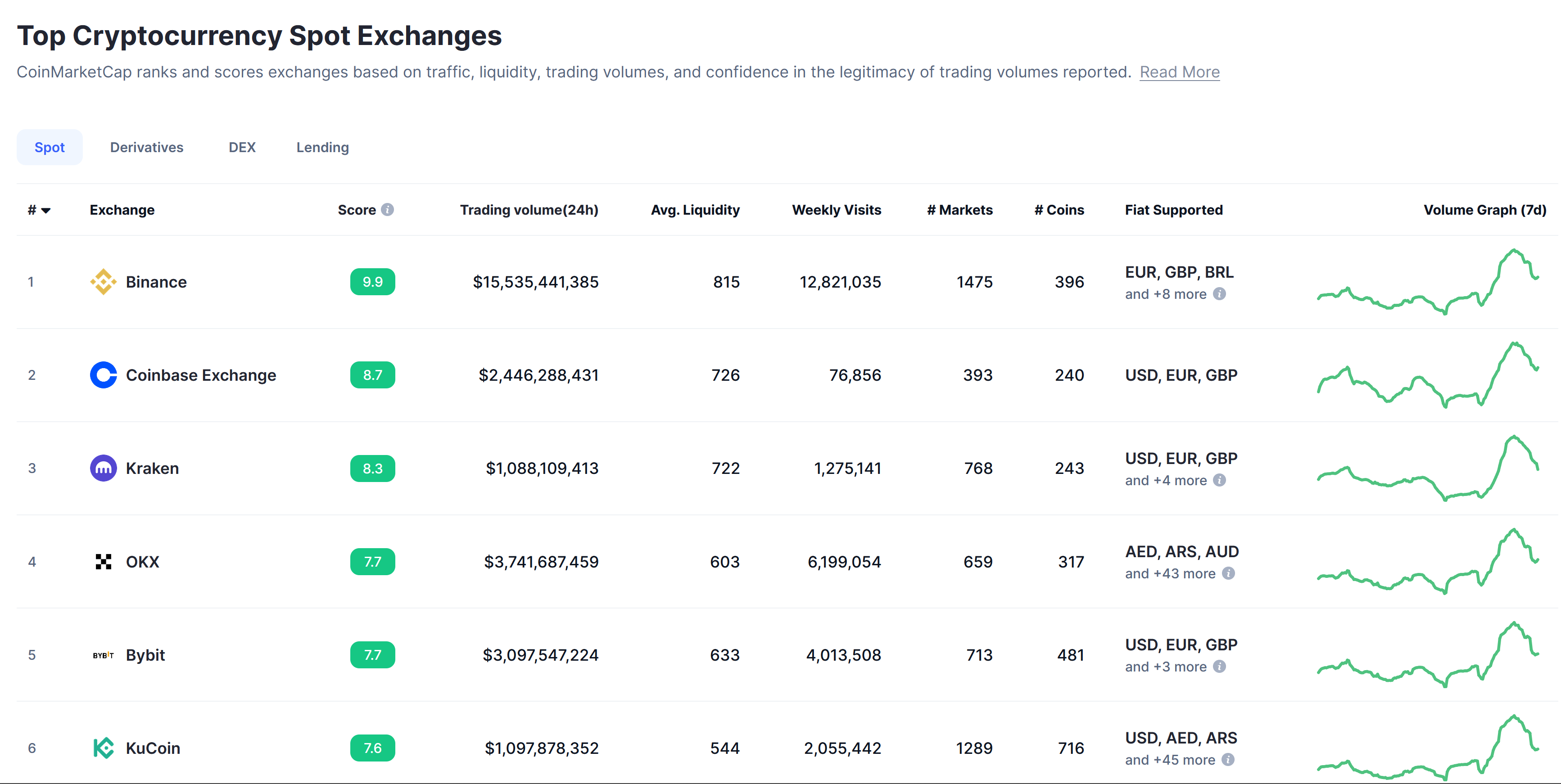

Selecting the right platform to commerce crypto is a essential choice for any dealer. Based mostly on spot buying and selling quantity, listed here are the highest platforms:

- Binance: Binance leads with a spot buying and selling quantity of roughly $15.48 billion within the final 24 hours. Recognized for its huge vary of cryptocurrencies (over 1,475 markets), it helps a number of fiat currencies like EUR, GBP, and BRL. Binance is favored for its complete instruments, options, and comparatively low charges.

- Coinbase Trade: With a buying and selling quantity of round $2.51 billion within the final 24 hours, Coinbase is famend for its user-friendly interface, making it supreme for freshmen. It helps main currencies like USD, EUR, and GBP and gives a steadiness between accessibility and complete buying and selling options.

- Kraken: with a buying and selling quantity of $1.08 billion, is praised for its safety and intensive vary of cryptocurrencies (over 768 markets). It helps numerous fiat currencies, together with USD, EUR, and GBP, and is thought for its sturdy safety measures.

- OKX: has a major buying and selling quantity of about $3.72 billion. It gives a variety of cryptocurrencies (over 659 markets) and helps various fiat choices together with AED, ARS, AUD, and 43 extra. OKX is acknowledged for its number of buying and selling choices and complete platform.

- Bybit: with a buying and selling quantity of $3.08 billion, stands out for its superior buying and selling options and help for USD, EUR, GBP, amongst others. It’s significantly in style amongst crypto merchants in search of derivatives buying and selling choices.

The place To Commerce Crypto?

Selecting the place to commerce crypto entails cautious consideration of varied elements. Right here’s a information that will help you make an knowledgeable choice:

- Safety: Prioritize platforms with sturdy safety measures. Search for options like two-factor authentication, chilly storage choices, and a observe report of dealing with safety breaches, if any.

- Charges: Evaluate the price constructions of various platforms. Decrease transaction charges could make a major distinction, particularly for frequent merchants.

- Person Interface And Expertise: For freshmen, a user-friendly interface is essential. For skilled crypto merchants, superior buying and selling instruments and options are necessary.

- Vary Of Cryptocurrencies: Take into account platforms that supply a variety of cryptocurrencies. This permits for diversification and the power to commerce in lesser-known, probably extra unstable cash.

- Liquidity: Excessive liquidity ensures you could purchase and promote cryptocurrencies rapidly and at costs near the market fee.

- Regulatory Compliance: Go for platforms that adhere to regulatory requirements. This may supply a stage of safety and legitimacy.

- Buyer Help: Good buyer help will be essential, particularly in resolving points swiftly.

- Neighborhood And Fame: A platform’s status inside the crypto neighborhood and its total observe report can present insights into its reliability and efficiency.

- Extra Options: Some platforms supply extra options like staking, margin buying and selling, or crypto financial savings accounts, which could align together with your buying and selling targets.

- Geographical Restrictions: Make sure the platform is obtainable and authorized in your area.

Crypto Commerce 101: Technical Evaluation

Candlestick Charts

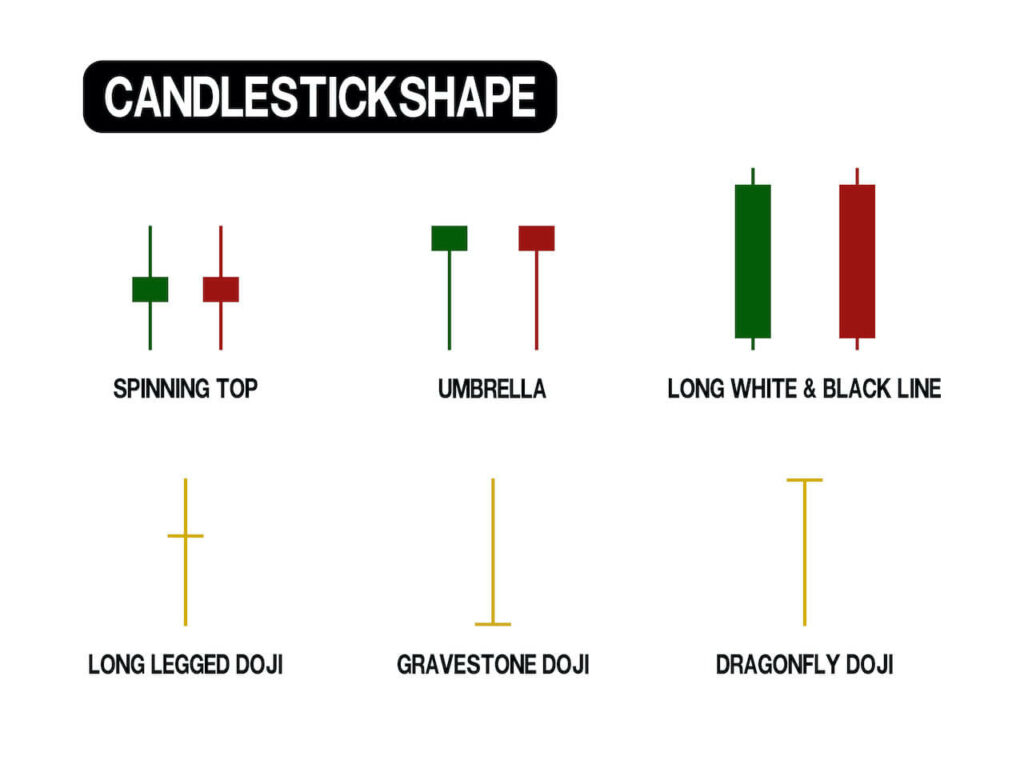

Candlestick charts are important for understanding market actions in crypto buying and selling. Every candlestick represents value actions inside a particular timeframe. The ‘physique’ exhibits the opening and shutting costs, whereas ‘wicks’ point out the excessive and low. Crypto merchants search for patterns like ‘Doji’ (indicating indecision) or ‘Bullish Engulfing’ (signaling a possible upward development) to foretell future value actions.

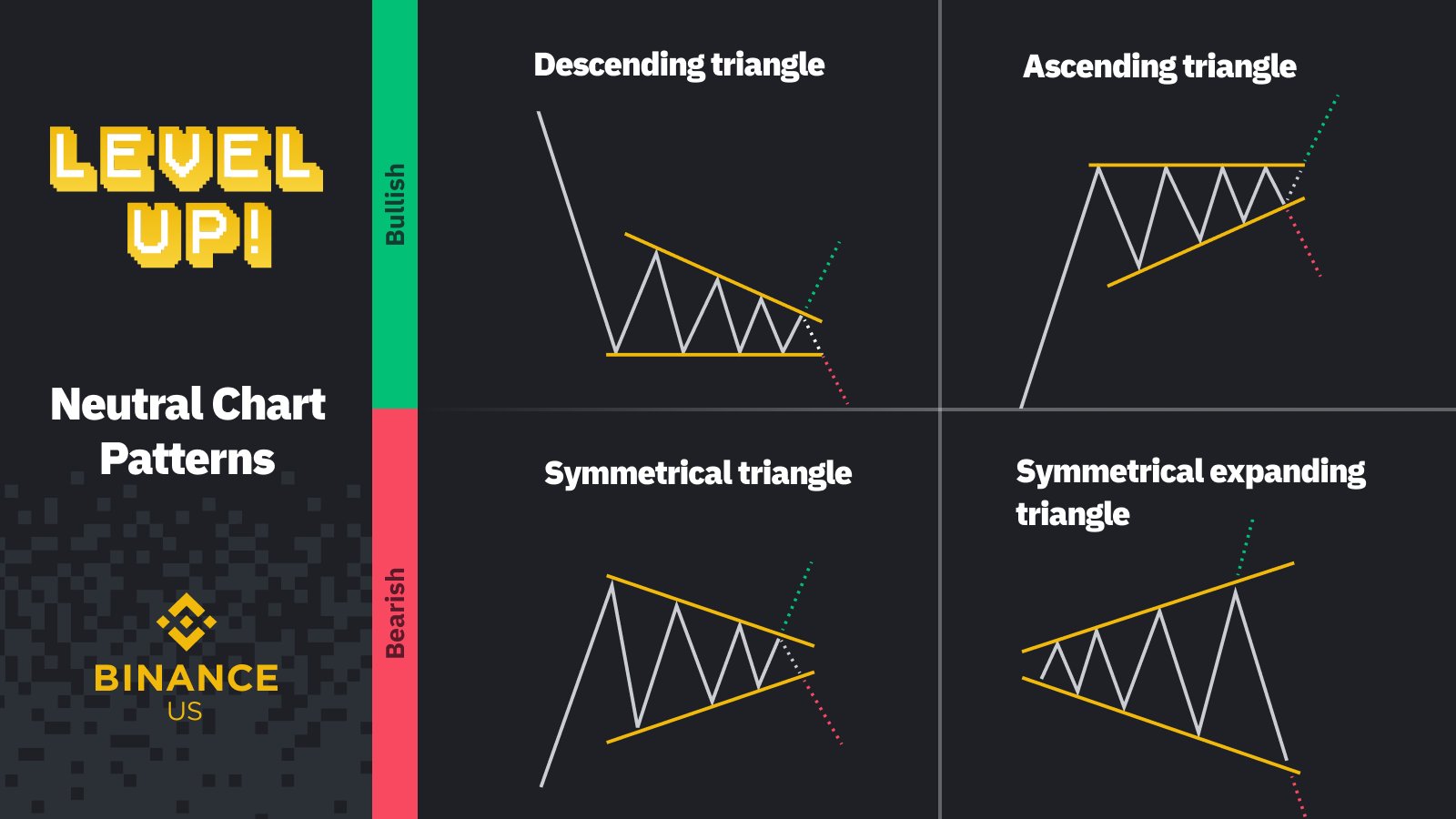

Pattern Strains And Triangle Patterns

Each patterns are very important instruments in technical evaluation for crypto merchants.

Pattern Strains:

You draw straight strains on value charts that join a sequence of highs or lows. In an uptrend, an upward development line connects the upper lows, indicating help ranges the place the worth beneficial properties power and bounces upwards. In distinction, a downward development line in a downtrend connects decrease highs, marking resistance ranges. Breaking by way of a development line typically indicators a possible change available in the market development.

Triangle Patterns:

These are fashioned by drawing two converging development strains as costs transfer in a narrowing vary. There are three varieties:

- Ascending Triangle: Shaped by a horizontal resistance line and an upward sloping development line. It typically signifies a continuation of an uptrend, particularly if the worth breaks above the resistance line.

- Descending Triangle: Characterised by a horizontal help line and a downward sloping development line. This sample usually indicators a continuation of a downtrend, significantly if the worth breaks beneath the help line.

- Symmetrical Triangle: Created when the slope of the worth’s highs and the slope of the worth’s lows converge to a degree. This sample signifies {that a} breakout is imminent, but it surely doesn’t predict the route. The breakout route of the worth out of the triangle can sign the continuation of the development or a reversal.

Crypto merchants use these patterns to make predictions about future value actions. A breakout above or beneath a triangle sample typically indicators a powerful transfer within the route of the breakout. Nonetheless, it’s essential to verify these indicators with different indicators and market elements.

Transferring Averages

Transferring Averages (MAs) are essential indicators in crypto buying and selling, used to clean out value fluctuations and determine tendencies. The 2 most typical varieties are:

- Easy Transferring Common (SMA): That is the typical value over a particular variety of time durations. It’s calculated by including up the closing costs over a set interval after which dividing by the variety of durations. SMA offers equal weight to all costs within the interval.

- Exponential Transferring Common (EMA): EMA offers extra weight to current costs, making it extra conscious of new data. It’s calculated equally to SMA however incorporates a weighting multiplier that exponentially decreases the load of older costs.

Crypto merchants use MAs to determine help and resistance ranges. For instance, a rising MA signifies help, suggesting an uptrend, whereas a falling MA signifies resistance, suggesting a downtrend. MAs additionally serve in crossover methods: A brief-term MA crossing above a long-term MA indicators a possible upward development (bullish crossover), whereas crossing beneath signifies a possible downward development (bearish crossover).

Relative Energy Index (RSI)

RSI is a momentum indicator, starting from 0 to 100, that assesses whether or not a crypto is overbought (above 70) or oversold (beneath 30). Crypto merchants use it to identify potential reversal factors. As an illustration, if RSI rises above 70, it indicators that the market is pink sizzling, whereas a worth above 90 is nearly a assure for a close to time period value pullback.

MACD (Transferring Common Convergence Divergence)

The MACD consists of two strains – the MACD line (the distinction between two EMAs) and a sign line. When the MACD crosses above the sign line, it suggests a bullish development, and a cross beneath signifies a bearish development. Divergences between MACD and value may also point out potential market reversals.

For Superior Crypto Merchants

Superior crypto buying and selling, reminiscent of day buying and selling and choices buying and selling, requires a classy understanding of the market and particular methods.

How To Day Commerce Crypto

Day buying and selling crypto is about exploiting short-term market fluctuations. It’s not nearly shopping for low and promoting excessive inside a day but in addition entails nuanced methods like enjoying on news-based volatility or utilizing particular technical indicators for fast entry and exit factors. An instance is a day dealer specializing in a selected cryptocurrency that has introduced a serious partnership. The crypto dealer makes use of instruments like RSI and MACD to find out the optimum entry and exit factors inside the day, capitalizing on the news-induced volatility.

How To Commerce Crypto Choices

Crypto choices buying and selling entails extra complicated methods in comparison with common buying and selling. As an illustration, a crypto dealer may purchase a ‘name possibility’ in the event that they anticipate the worth of a cryptocurrency to rise earlier than a particular date. Conversely, a ‘put possibility’ is likely to be bought in the event that they count on the worth to fall. This technique requires a deep understanding of market sentiment and potential triggers for value actions. A sensible instance can be a crypto dealer shopping for choices forward of a major occasion, like a blockchain improve, betting that this occasion will trigger substantial value motion.

Two main kinds of choices exist: European-style, which might solely be exercised on the expiration date, and American-style, which will be exercised any time earlier than expiration. For buying and selling crypto choices, a number of the most famed platforms embody Binance, Deribit (identified for being probably the most liquid crypto choices buying and selling platform), OKX, Bybit, Delta Trade, and CME (a regulated change in the USA).

Danger Administration in Crypto Buying and selling

Efficient threat administration is significant in crypto buying and selling to guard your investments and guarantee long-term success.

Setting Cease-Loss Orders: Cease-loss orders are a vital software. They routinely promote an asset when it reaches a sure value, limiting potential losses. In the event you purchase a cryptocurrency at $100 and set a stop-loss order at $90, the asset will routinely promote if its value drops to $90, thereby limiting your loss to 10%.

Diversifying Your Portfolio: Diversification entails spreading your investments throughout numerous belongings to cut back threat. As an alternative of placing all of your capital right into a single cryptocurrency, diversify throughout totally different cash, sectors, and even totally different asset lessons.

Avoiding Emotional Buying and selling: Emotional buying and selling typically results in impulsive selections, like chasing losses or making overconfident trades. To fight this, develop a buying and selling plan and persist with it, making selections based mostly on logic and evaluation reasonably than emotion. It’s additionally useful to set predetermined entry and exit factors for trades to keep away from emotional biases.

Implementing these threat administration methods can considerably enhance your buying and selling outcomes and assist in sustaining a extra steady and sustainable buying and selling profession within the unstable crypto market.

FAQ: How To Commerce Crypto

How To Commerce Crypto?

Start by selecting a dependable crypto buying and selling platform, arrange and fund your account, and educate your self on the fundamentals of cryptocurrencies and market tendencies. Develop a buying and selling technique based mostly in your threat tolerance and targets, and begin buying and selling by making knowledgeable purchase and promote selections.

How To Day Commerce Crypto?

Day buying and selling entails shopping for and promoting cryptocurrencies inside the similar day. Give attention to understanding market tendencies, use technical evaluation to make knowledgeable selections, and all the time handle dangers with stop-loss orders and disciplined buying and selling practices.

When Is The Finest Time To Commerce Crypto In US?

Cryptocurrency markets function 24/7, however one of the best time to commerce can rely upon market liquidity and volatility. Typically, overlapping hours between main monetary markets (just like the New York and London inventory exchanges) can see elevated exercise.

What Is The Finest Approach To Commerce Crypto?

One of the simplest ways to commerce crypto varies based mostly on particular person targets and threat tolerance. Choices embody day buying and selling, swing buying and selling, and long-term investing. Utilizing a mixture of technical and elementary evaluation is usually suggested.

How To Leverage Commerce Crypto?

Leverage buying and selling in crypto entails borrowing funds to extend potential returns. Begin by deciding on a platform that provides leverage, perceive the dangers concerned, use stop-loss orders to handle potential losses, and begin with decrease leverage to mitigate threat.

How To Commerce Crypto Cash?

Buying and selling crypto cash entails shopping for and promoting totally different cryptocurrencies. Use a crypto change, keep knowledgeable about market tendencies and information, analyze value charts, and execute trades based mostly in your evaluation and technique.

How Outdated Do You Have To Be To Commerce Crypto?

The minimal age requirement to commerce crypto varies by platform, however usually, you should be at the least 18 years previous.

How To Turn out to be A Crypto Dealer?

Acquire a radical understanding of the crypto market, buying and selling rules, and threat administration. Follow with a demo account, keep up to date with market information, and regularly construct your buying and selling expertise and portfolio.

How To Commerce Crypto And Make Cash?

Worthwhile crypto buying and selling requires in-depth market data, a well-thought-out technique, disciplined threat administration, and steady studying. Give attention to understanding market tendencies and technical evaluation to make knowledgeable buying and selling selections.

How To Be A Crypto Dealer?

Educate your self about cryptocurrencies, buying and selling methods, and market evaluation. Begin with a demo account (or small quantities) to apply, select a dependable buying and selling platform, develop a threat administration technique, and constantly replace your data and abilities.

How To Day Commerce Crypto For Novices?

Begin with understanding the fundamentals of the market and technical evaluation. Follow with a demo account, develop a disciplined buying and selling routine, use threat administration instruments like stop-loss orders, and keep knowledgeable about market information.

How To Margin Commerce Crypto?

Margin buying and selling entails borrowing funds to commerce. Select a platform that provides margin buying and selling, perceive the dangers of amplified losses, use stop-loss orders, and begin with small trades to achieve expertise.

How To Swing Commerce Crypto?

Swing buying and selling entails holding belongings for a number of days to capitalize on anticipated directional strikes. Research market tendencies (crypto bull runs vs. crypto bear markets). Additionally, use technical evaluation to determine entry and exit factors, and keep a disciplined strategy to buying and selling.

How To Commerce Crypto Futures In US?

Choose a platform that provides crypto futures buying and selling within the US. Perceive the fundamentals of futures contracts, the related dangers, and authorized necessities. Use threat administration methods and keep up to date with market and regulatory developments.

Can You Day Commerce Crypto?

Sure, you may day commerce crypto. It requires a deep understanding of the market, fast decision-making, and robust threat administration methods.

What Is The Finest Time To Commerce Crypto?

The very best time to commerce crypto can rely upon particular person buying and selling methods and market situations. Typically, durations of excessive market exercise, reminiscent of throughout overlapping buying and selling hours of main monetary markets, can supply elevated alternatives.

Featured photographs from iStock

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site totally at your personal threat.