In a brand new video titled “If I Had To 10X My Cash, I’d Solely Maintain These 4 Altcoins!” aimed toward shedding mild on potential bull market leaders, famend crypto analyst Miles Deutscher dissected the crypto panorama to pinpoint 4 altcoins that he believes may considerably outperform the market. His insights got here in response to a question from his Discord channel about potential 5x to 10x positive aspects through the present bull market.

Deutscher believes that success within the crypto markets doesn’t essentially come from holding an enormous array of cash however quite from rigorously deciding on just a few which have sturdy potential narratives. He articulated this throughout his presentation, stating, “You don’t must personal 30, 40, 50, 60 altcoins with a view to get your required returns. In truth, if you choose the proper cash and choose the proper narratives, you can probably succeed on this market with three, 4, or 5 altcoins.”

He additionally supplied strategic insights into the standard market behaviors through the summer season, a interval he describes as an everyday seasonal downturn throughout the crypto business. He used historic knowledge to assist his declare, emphasizing that even throughout bullish years, cryptocurrencies have suffered through the summer season months.

Deutscher reassured his viewers by saying, “Even in essentially the most bullish years for crypto, like 2021, majors have been wanting actually unhealthy throughout summer season months […] so why would you now begin to panic?”

Deutscher’s High 4 Altcoin Picks

Deutscher selected cash based mostly on their potential for vital returns and their strategic place throughout the market:

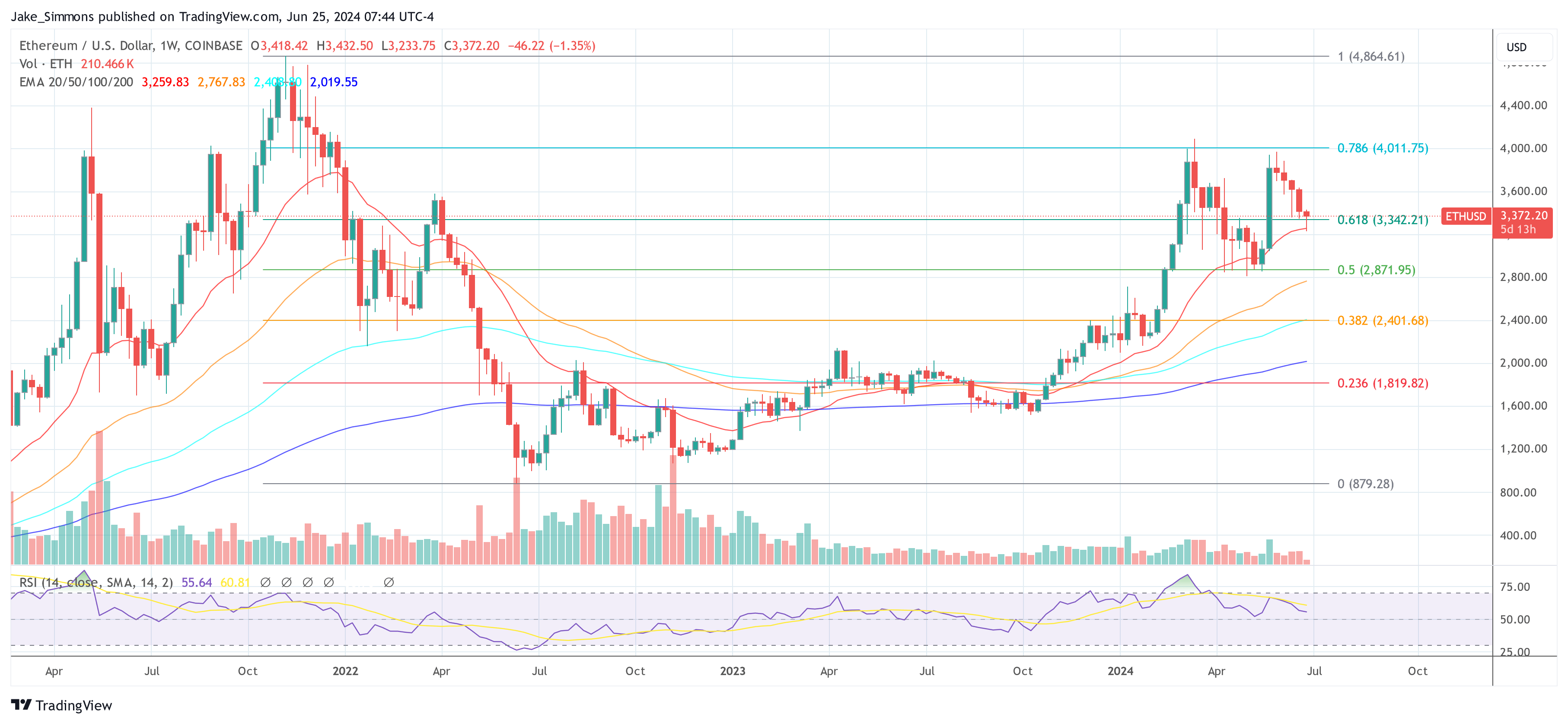

#1 Ethereum: ETH holds the premier place in Miles Deutscher’s choice as a consequence of its established position because the main good contract platform within the crypto sphere. Ethereum’s upcoming catalysts, notably the anticipated approval of US spot Ethereum ETFs, are seen as vital potential worth drivers.

Deutscher underscores its significance by stating, “Ethereum sits at a $428 billion totally diluted valuation versus Bitcoin which sits at $1.2 trillion. I feel Ethereum is at an inexpensive market cap now.”

Associated Studying

He doesn’t predict a 10x return from Ethereum on this cycle, however he values its potential for regular progress, making it a cornerstone in a well-diversified crypto portfolio. Deutscher additional helps his alternative by noting the technical elements: “Ethereum has been in a robust uptrend all the best way since $1,500,” indicating its resilience and bullish developments.

#2 Pepe: PEPE, a meme coin with a robust cultural footprint, is Deutscher’s second choose. He believes Pepe may carry out exceptionally properly in a positive market setting, pushed by its sturdy mindshare and place as a number one meme coin alongside giants like Dogecoin and Shiba Inu. Deutscher explains, “Pepe shouldn’t be solely the strongest proxy to commerce Ethereum’s risk-on proxy that’s, but it surely’s additionally one of many meme cash available in the market with the strongest thoughts share behind DOGE and SHIB.”

#3 Solana: SOL is chosen for its technological prowess and its vital adoption amongst builders and customers within the crypto group. Deutscher views Solana as a potent mixture of innovation and market potential, saying, “Solana has been the house of meme cash, it’s been the house of degeneracy. It’s made strides when it comes to its expertise adoption, numerous devs constructing on Solana.”

He acknowledges the excessive valuation of Solana however suggests it provides a favorable risk-reward steadiness, predicting that “SOL may probably go to $1,000 in a very loopy market.” Solana’s potential to scale and its sturdy group engagement positions it as a sturdy candidate for substantial mid-term positive aspects.

Associated Studying

#4 WIF: Dogwifhat enhances Solana in Deutscher’s portfolio, serving because the meme coin counterpart to Solana’s technological base. WIF, in accordance with Deutscher, balances the conservatism of extra established cash like Ethereum and Solana with a better threat and probably greater return profile.

He believes WIF is a key participant within the meme coin sector and a strategic choose for these trying to capitalize on risky market segments. He remarks on its efficiency and strategic positioning, “WIF has been a significant sell-off; it’s really buying and selling beneath a significant vary low […] However when you imagine in WIF like I do as a cycle lengthy meme coin wager and a Solana play, you can simply common within the decrease it goes.”

Crypto Funding Technique And Sensible Recommendation

Deutscher’s overarching technique blends conservative, foundational investments with higher-risk, probably high-reward alternatives. He advocates for a portfolio development that entails a strategic division between core holdings (80%-90%) and speculative bets (10%-20%). This method, he argues, permits buyers to capitalize on the upside whereas managing threat successfully.

Reflecting on the significance of market timing and portfolio positioning, Deutscher suggested his viewers, “It’s about accumulating on main dips […] and it doesn’t actually matter what occurs within the interim.” He emphasizes long-term positive aspects over short-term fluctuations, advising buyers to remain the course by means of market ups and downs.

At press time, ETH traded at $3,372.

Featured picture from iStock, chart from TradingView.com