Main on-chain analyst James Verify, popularly often known as Checkmatey, has just lately delved into the intricacies of Bitcoin’s market dynamics, providing an in depth on-chain information evaluation that sheds gentle on the forces driving Bitcoin costs. His newest insights spotlight a interval he describes as “Quiet and Trending,” suggesting a strong underpinning regardless of important sell-side pressures and shifts in volatility.

Bitcoin Follows The Stair-Stepping Rally-Consolidation-Rally Sample

Since December, Bitcoin has skilled substantial sell-side strain, with over 1.5 million BTC being bought. “Round 30% of this got here out of GBTC, however the remainder of it was good quaint revenue taking,” Verify explains.

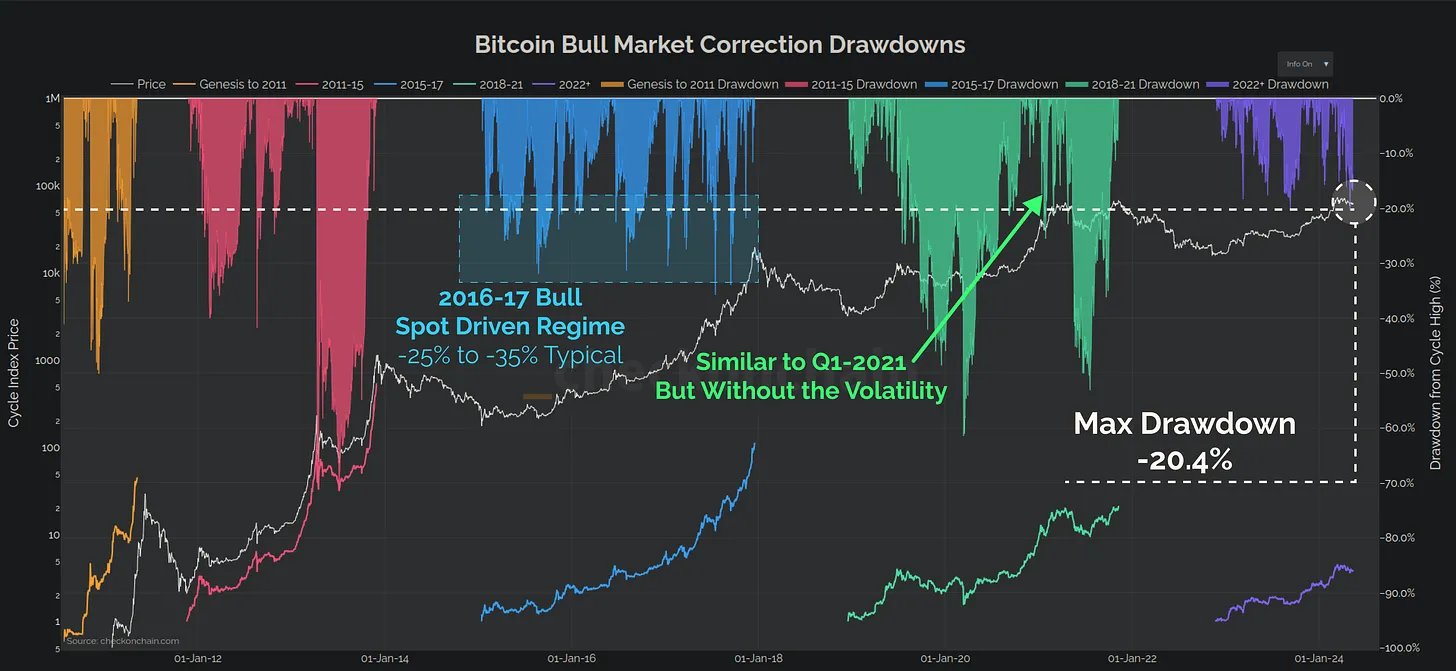

Regardless of such substantial market gross sales, Bitcoin has demonstrated resilience with a comparatively modest worth correction of simply -20%. This implies that the foundational help ranges for Bitcoin are stronger than what surface-level market actions may indicate.

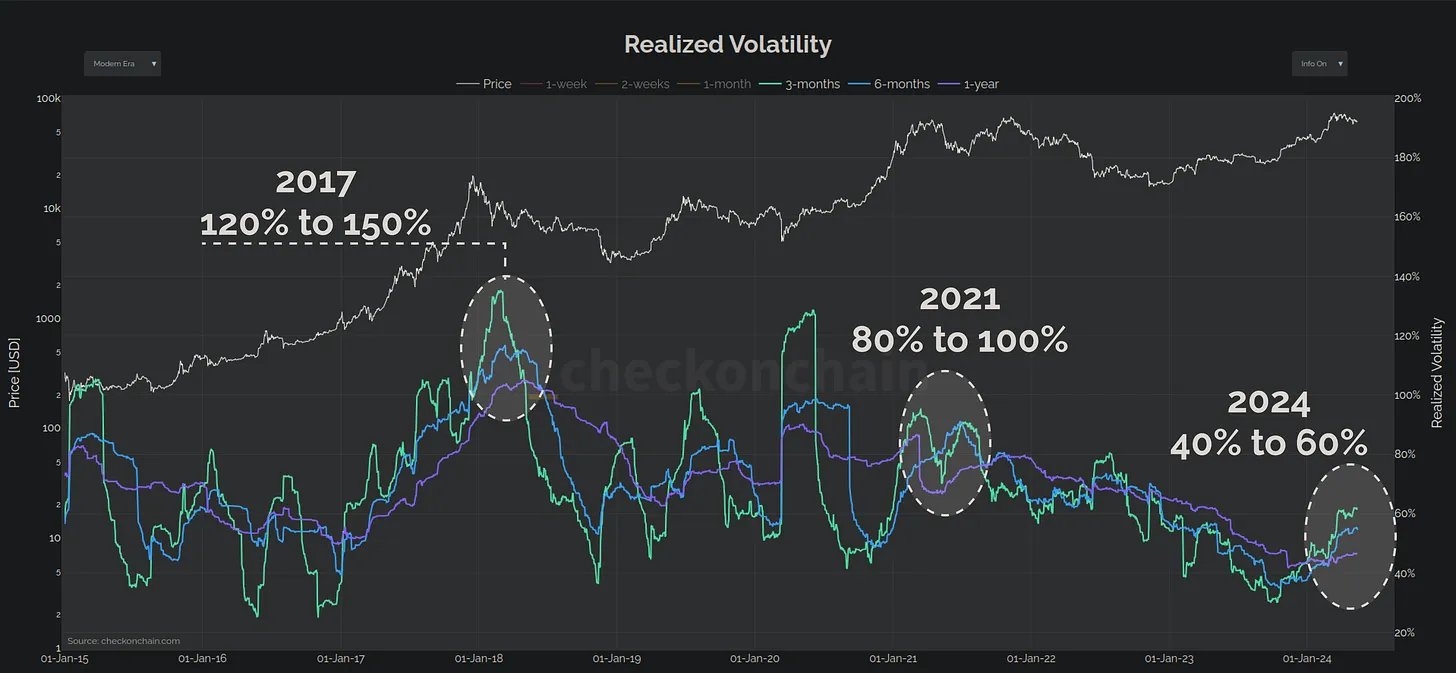

A hanging facet of Verify’s evaluation is the transformation in Bitcoin’s volatility profile. “The general realized volatility profile for Bitcoin is half what it was in 2021, and 3x smaller than 2017,” states Verify. This development signifies a rising maturity throughout the Bitcoin market, reflecting its evolution right into a extra secure asset over time in comparison with its early years.

Verify counters the standard narrative surrounding Bitcoin’s volatility: “What lots of people overlook nevertheless is that Bitcoin is unstable to the upside. Volatility to the upside is nice!” He posits that the present increment in volatility is average and means that the market remains to be within the early phases of a bull run, slightly than nearing its finish.

Associated Studying

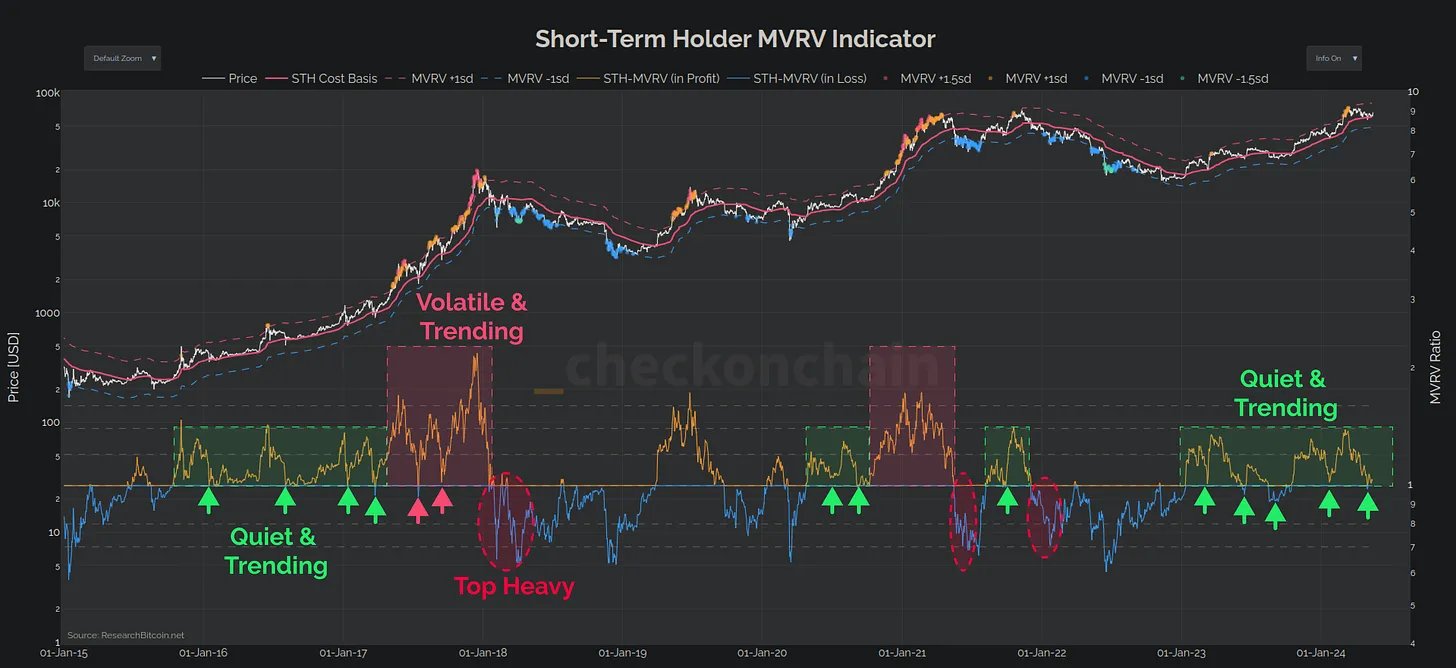

A vital software in Verify’s evaluation is the Quick-Time period Holder MVRV (STH-MVRV) Ratio, which he makes use of to gauge market sentiment and phases. Based on Verify, this ratio constantly finds help at 1.0 and resistance at 1.4 throughout secure uptrends. Stability is maintained so long as the ratio stays inside these bounds. “Solely when it breaks above this ceiling do issues change into unstable,” Verify notes, which might sign a transition to bearish situations.

Regardless of the sell-off that introduced Bitcoin right down to $57k, Verify observes that this has not considerably dented the profitability of short-term holders. “The magnitude of Unrealised Loss was very a lot consistent with bull market corrections, calming fears of a top-heavy market.”

Associated Studying

He additional highlights that a number of of the native prime consumers panic bought their Bitcoin on the lows, an motion he interprets as helpful for the correction part, serving to stabilize the market by shaking out weak palms.

Increasing his evaluation, Verify refutes the criticism that Bitcoin’s volatility makes it a much less viable asset. He factors to a chart comparability of Bitcoin’s 30-day volatility in opposition to top-performing US shares, displaying that Bitcoin’s volatility is effectively inside a manageable vary.

Moreover, he discusses the decrease realized volatility of the SPY index, attributing it to the “out sized efficiency of the Magnificent-7,” which is counterbalanced by the poorer efficiency of the opposite parts.

By highlighting the structural elements of the present “Quiet and Trending” market part, Verify gives a refined perspective on how Bitcoin is navigating its maturation pathway, balancing between its speculative origins and its potential as a mainstream monetary asset.

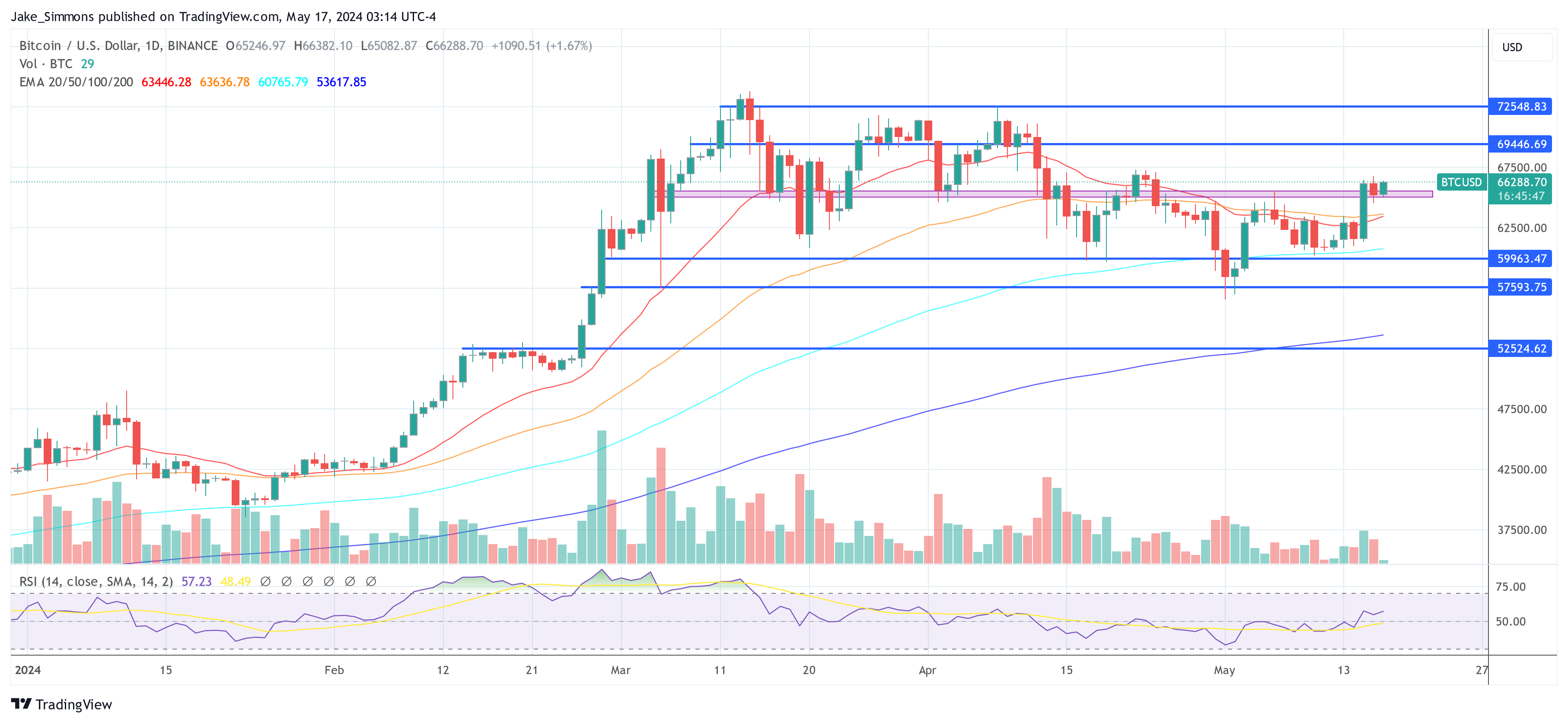

He concludes, “General, the Bitcoin uptrend in 2023-24 appears to be like pretty structured, following stair-stepping rally-consolidation-rally sample. Nevertheless, because the charts above present, volatility tends to select up throughout a consolidation, and that may result in instability.”

At press time, BTC traded at $66,288.

Featured picture created with DALL·E, chart from TradingView.com