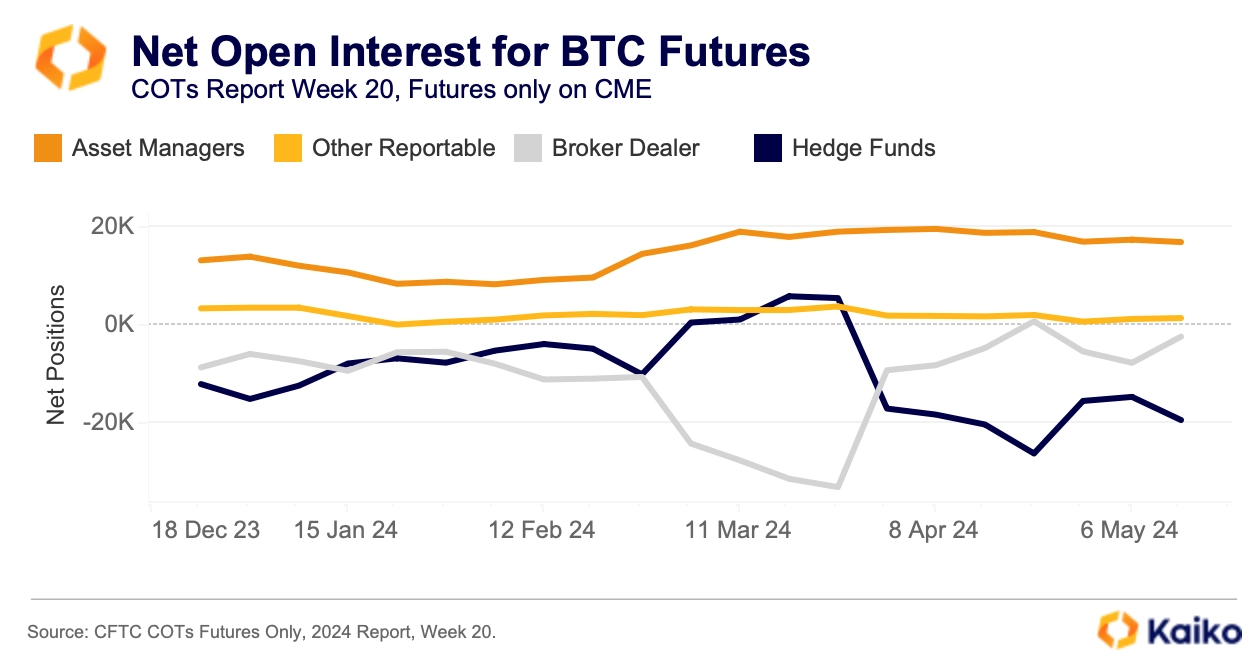

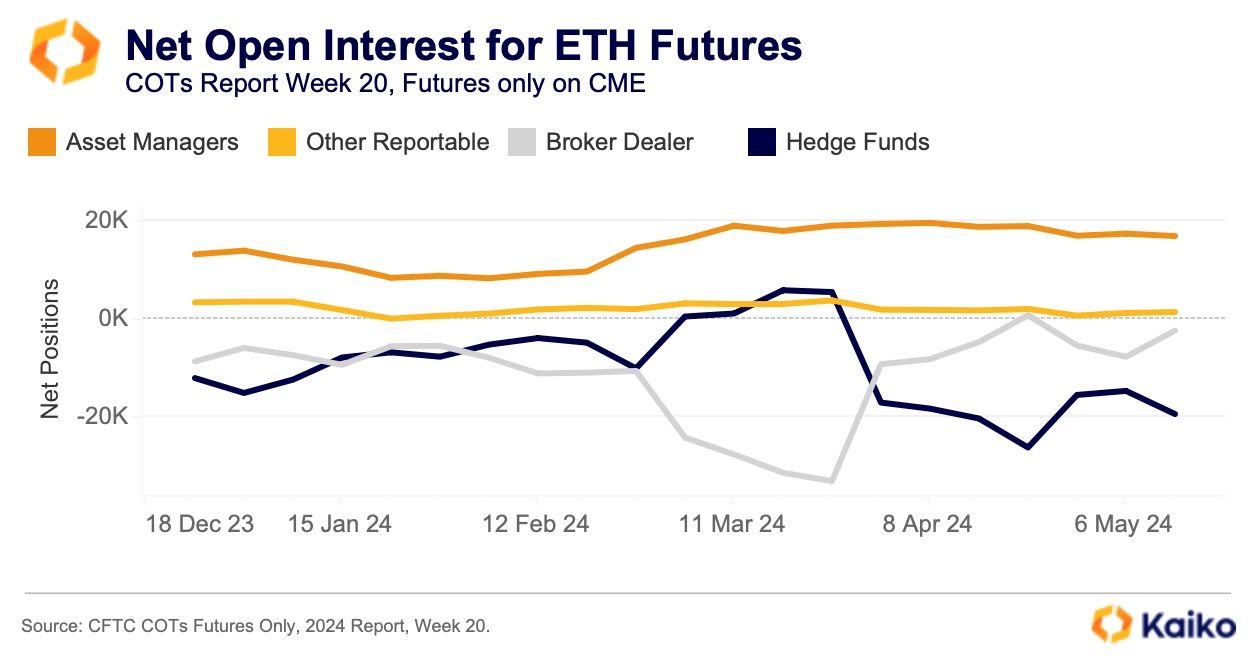

New knowledge from market intelligence agency Kaiko Analytics reveals that hedge funds are web brief on Bitcoin (BTC) and Ethereum (ETH) on the Chicago Mercantile Change (CME).

In a brand new analysis article, the crypto analytics platform says that whereas hedge funds are web brief on each BTC and ETH on the CME, it doesn’t imply the funds are bearish on crypto, however somewhat, that they’re partaking in foundation trades, a sort of arbitrage technique.

Internet brief signifies that the hedge funds have amassed extra brief positions than lengthy positions within the crypto derivatives markets.

Says Kaiko Analytics,

“This doesn’t essentially imply these funds are bearish on crypto, it’s extra possible they’re partaking in certainly one of crypto’s hottest trades, the premise commerce.

The premise commerce is a sort of arbitrage technique that exploits the worth distinction between two comparable property. On this case between an BTC or ETH spot and futures. Hedge funds are possible ‘lengthy foundation’ at current. This implies they’re promoting futures brief whereas holding spot BTC or ETH.

This protects in opposition to value strikes and ensures a particular sale value within the occasion of volatility within the underlying asset. The lengthy foundation commerce works finest when costs are in a state of contango, which suggests futures costs are above spot costs. The 2 costs will pattern in direction of each other as expiration nears.

Whereas we don’t have the info to say with certainty that this is the reason hedge funds are web brief, it’s the most definitely clarification for the huge brief positions held by these subtle merchants, who would not often brief with out hedging.”

Bitcoin is buying and selling for $69,251 at time of writing whereas ETH is price $3,750.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/nullplus