In 2023, the blockchain safety panorama witnessed a $50 billion drop in misplaced crypto belongings, depicting a shift in direction of enhanced safety protocols and the maturation of the DeFi ecosystem.

In line with crypto safety agency Hacken’s end-of-year report, final yr marked a notable discount within the scale of monetary damages from hacks and scams. Complete losses amounted to $1.9 billion, starkly contrasting the staggering figures recorded in earlier years. The lower in misplaced worth alerts a major development within the trade’s efforts to fortify safety measures and tackle vulnerabilities extra successfully.

Throughout the trade, BNB Chain was subjected to essentially the most assaults, at 214, with Ethereum in second place at 178. Notably, most BNB Chain and Ethereum hacks had been categorized as ‘rug pulls,’ at 148 and 97, respectively.

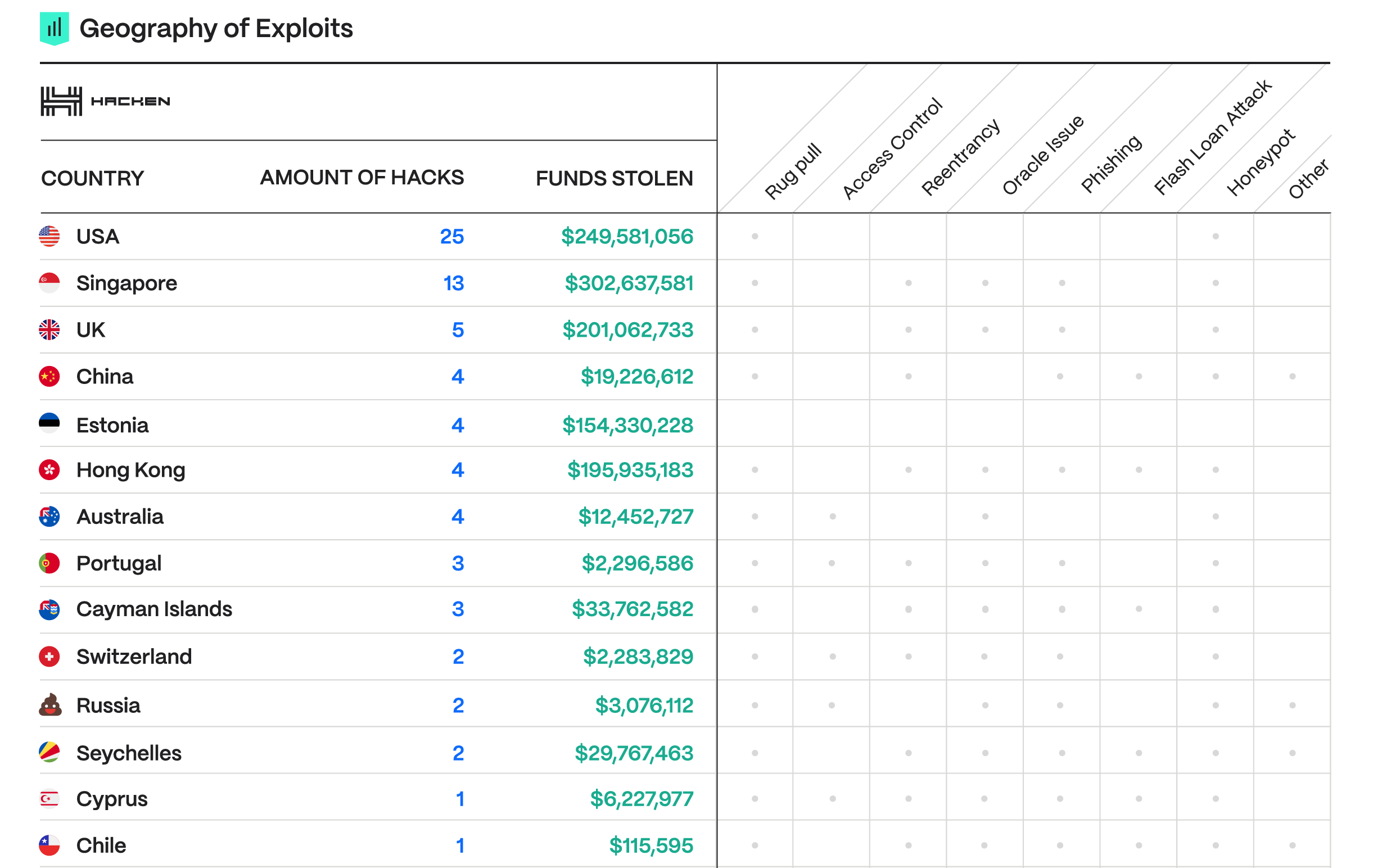

The report additionally highlights the geographical distribution of blockchain exploits, with vital hotspots rising in areas with excessive fintech exercise. This geographic evaluation gives useful insights into the worldwide nature of blockchain vulnerabilities and the necessity for a coordinated worldwide response to deal with these challenges.

The US noticed essentially the most at 15, with Singapore (13) and the UK (5) in second and third. China, in fourth place with 4, had one of many lowest worth stolen per hack at a median of $5 million in contrast with the USA at $10 million, Singapore at $23 million, and the UK at $40 million.

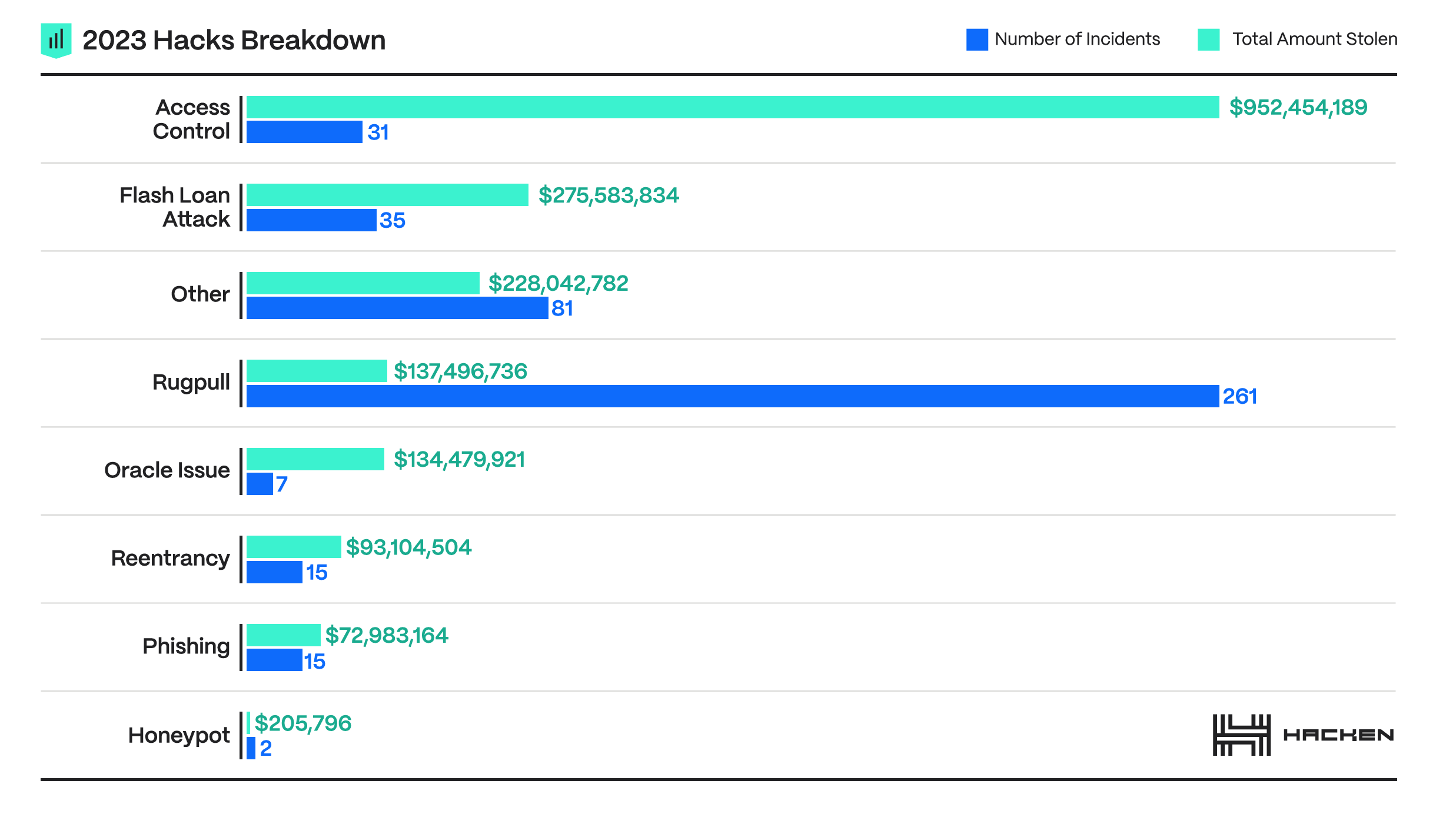

The year-on-year discount in losses doesn’t suggest a diminished risk panorama. Quite the opposite, the variety of assaults elevated by 14% in comparison with the earlier yr, highlighting an evolving and increasing assault floor. The range of those assaults, starting from refined entry management breaches to flash mortgage assaults, signifies that attackers constantly refine their methods to take advantage of the advanced internet of DeFi and blockchain applied sciences.

The yr’s most important theft concerned the Multichain bridge, with $231 million drained, demonstrating the excessive stakes in securing cross-chain operations. Regardless of the high-profile nature of some assaults, the trade noticed the primary yr during which exploited protocols managed to get well a considerable portion of the stolen belongings, round 20% or $400 million. This restoration was made potential by means of speedy response groups, the goodwill of particular hackers, and elevated legislation enforcement exercise.

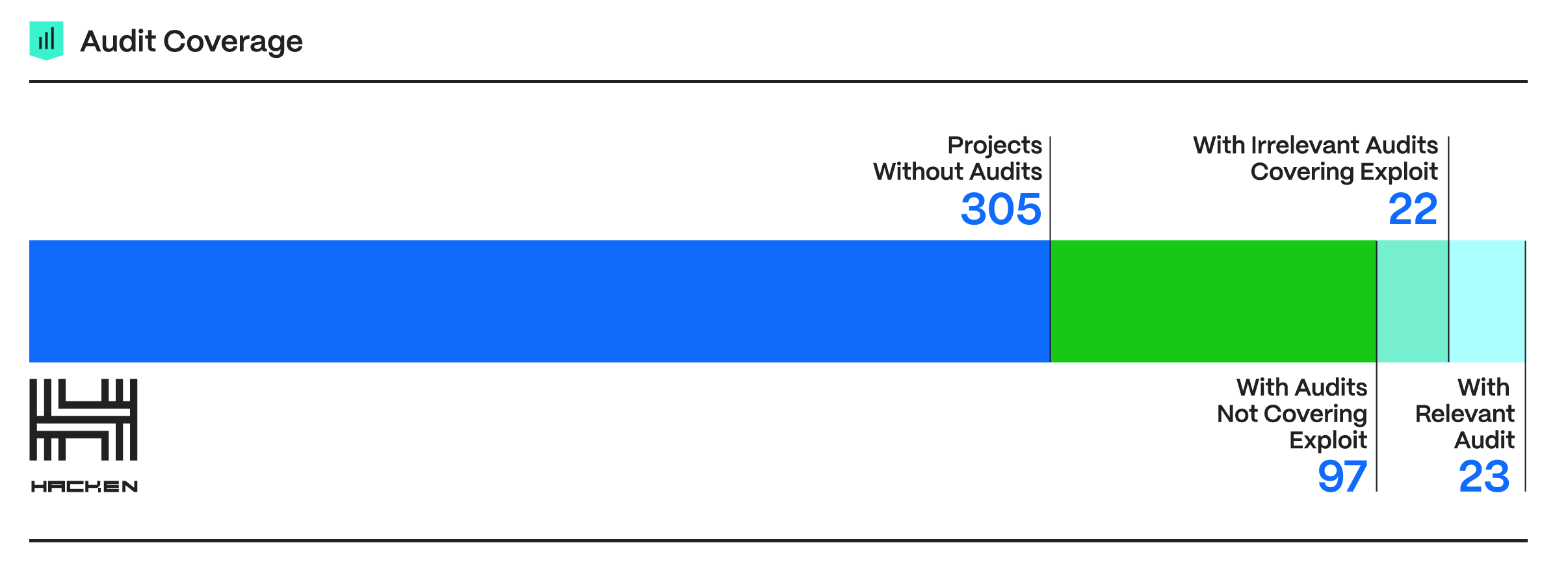

Hacken’s report additional stresses the vital significance of complete audit protection and the position of bug bounty packages in figuring out and mitigating vulnerabilities earlier than they are often exploited. Regardless of these safety measures, the information reveals that many tasks stay inadequately protected as a result of absence of audits or the irrelevance of performed audits to the deployed code. This hole in safety preparedness emphasizes the necessity for a extra proactive and thorough method to safety audits, making certain that they’re complete and related to the deployed blockchain code.

Furthermore, Hacken emphasizes the effectiveness of real-time monitoring instruments and growing safe pockets applied sciences as vital parts of a strong safety framework. These instruments play a significant position within the early detection and mitigation of potential threats, enhancing the general safety posture of blockchain platforms and defending customers’ belongings.

Waiting for 2024, the report affords predictions and suggestions for addressing future safety challenges. Amongst these is the anticipation of elevated vulnerabilities because the trade continues to innovate and broaden, significantly with adopting new Layer 1 and Layer 2 options. The report requires persevering with to emphasise entry management and flash mortgage assault prevention, the significance of fostering a proactive safety tradition, and the necessity for collaboration inside the trade to reinforce collective protection mechanisms.

It’s clear that whereas strides have been made in decreasing the monetary impression of assaults, the battle towards crypto-related crime is an ongoing problem to take care of the continued development and stability of the DeFi sector.