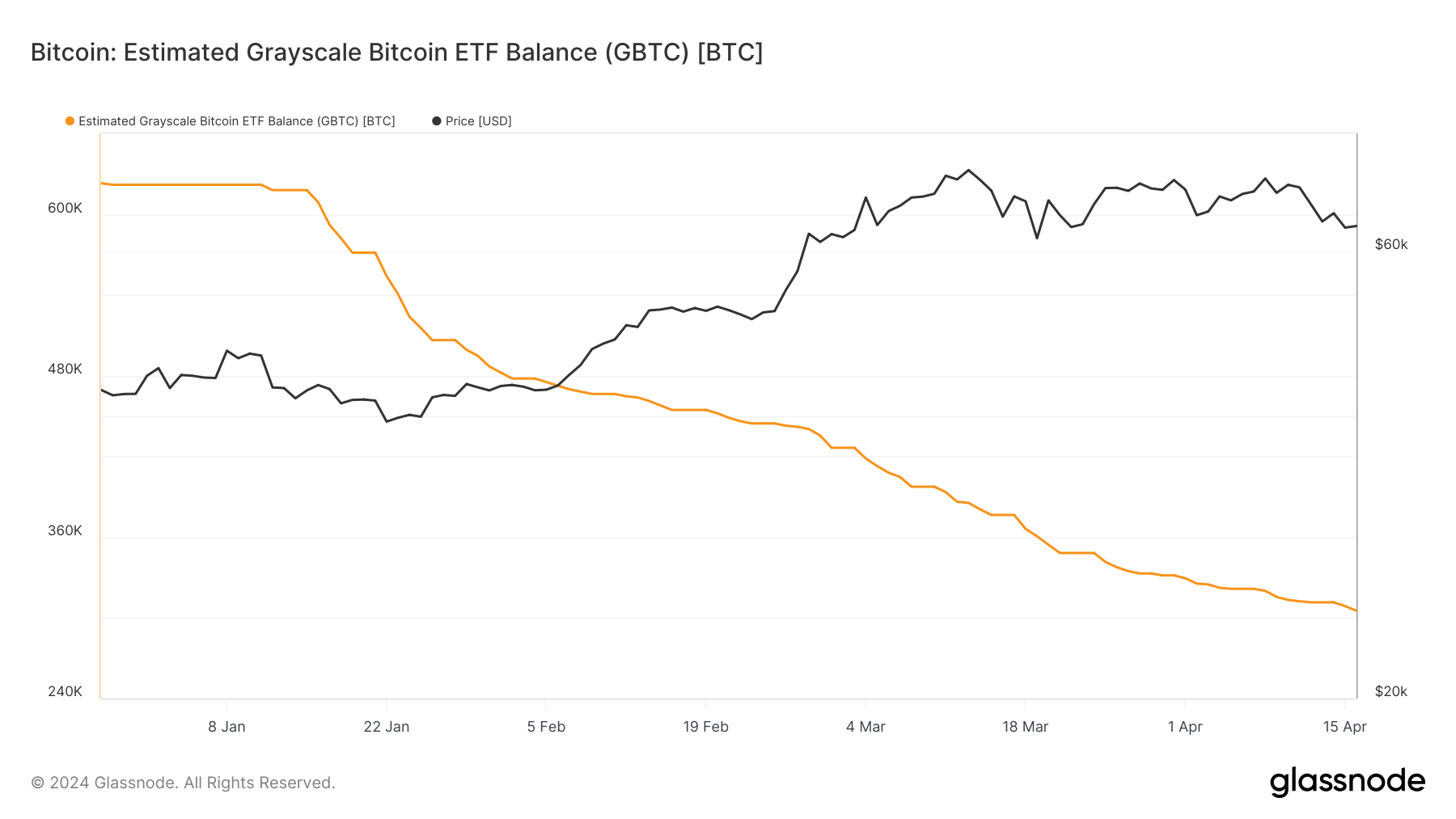

Grayscale’s Bitcoin ETF continues to document regular outflows and has now fallen to half of the Bitcoin it held on the level of the belief’s conversion to a spot Bitcoin ETF. Except Grayscale sees unprecedented inflows, it is going to see a halving of each its property and Bitcoin block rewards this week.

When the spot Bitcoin ETFs have been accredited in January, Grayscale held round 640,000 BTC underneath administration. It now has roughly 308,000 BTC valued at round $19.7 billion.

Whereas the quantity of Bitcoin held underneath administration has fallen by 51%, the worth of its property underneath administration has fallen simply 29% as a consequence of Bitcoin’s climb from $42,000 to $63,000.

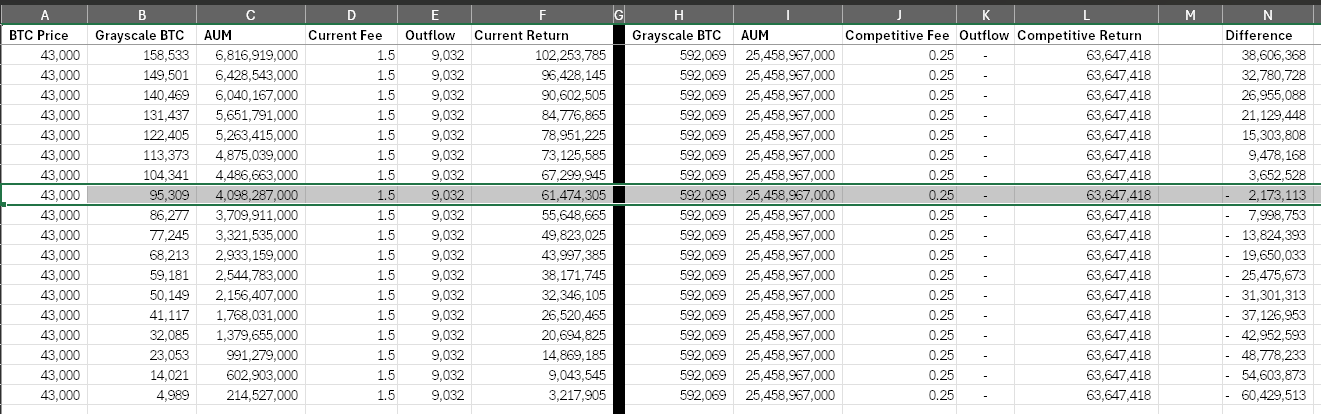

In contrast with the New child 9 ETFs, the outflow has been mainly attributed to the outsized charges charged by Grayscale. Whereas Grayscale has been in a position to proceed to garner considerably greater revenues by retaining its greater payment construction, it’s now approaching a tipping level whereby decreasing its charges could also be a viable possibility.

A research I performed on the finish of January confirmed that even at 95,000 BTC underneath administration, it could nonetheless generate over $60 million in revenues yearly from charges alone. These charges would nonetheless put it close to the highest of the income era leaderboard.

The put up Grayscale witnessing a double halving as Bitcoin holdings fall to 310k appeared first on CryptoSlate.