Fast Take

Based on James Butterfill, analyst at CoinShares, web outflows have reached a staggering $424 million this week as buyers more and more go for the extra cost-efficient US funds. Because the launch of spot-based ETFs, Grayscale Bitcoin Belief (GBTC) has witnessed a major pattern reversal, with outflows totaling $1.18 billion. In distinction, the newly launched US spot bitcoin ETFs have attracted a substantial inflow of capital, with inflows reaching $2 billion, in line with Butterfill.

An identical sample is mirrored in ProShares BITO’s monetary knowledge, with the fund recording $141 million in outflows throughout the identical interval, in line with Butterfill.

ETF analyst James Seyffart echoes this sentiment, predicting Jan. 16 as a web outflow day for Bitcoin ETFs because of the impression of GBTC and BITO. Seyffart estimates about $594 million will exit GBTC to $1.173 billion in whole outflows. On the identical time, most different funds have seen inflows.

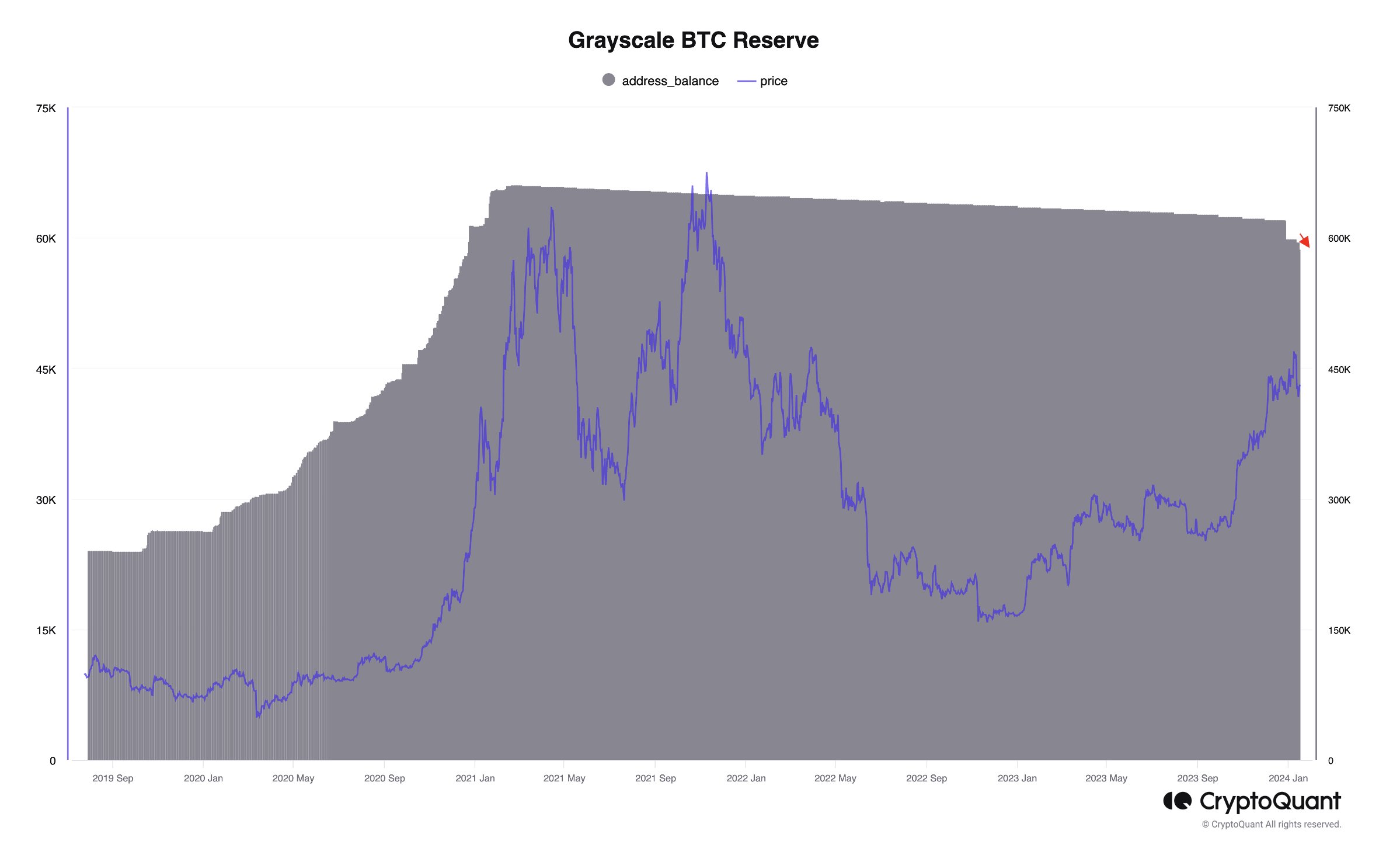

Based on varied sources, Grayscale now holds round 600,000 BTC within the reserve, with estimates ranging between 587,000 and 617,000 BTC.

The put up Grayscale Bitcoin Belief sees $1.18 billion exodus amid spot ETF recognition appeared first on CryptoSlate.