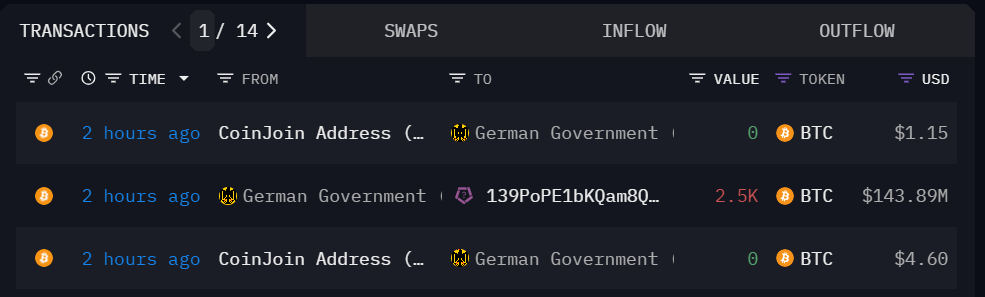

The German authorities’s Bitcoin pockets acquired a small quantity of Sats from a CoinJoin deal with amidst its vital promoting exercise.

On-chain information from the crypto analytical platform Arkham Intelligence revealed that the German authorities wallets acquired lower than $10 in three transactions from CoinJoin addresses right now.

CoinJoin transactions mix a number of Bitcoin trades to obscure the movement of funds and improve person privateness on-chain.

Not too long ago, these transactions have been closely scrutinized after the US authorities elevated its stress on privateness protocols. In keeping with the authorities, malicious gamers like North Korea-backed Lazarus Group have been utilizing these instruments for cash laundering and different nefarious actions.

Resulting from this, a number of Bitcoin pockets suppliers, together with Wasabi Pockets, discontinued the characteristic on their platforms.

Bitcoin promoting continues

The German authorities has continued its development of promoting the flagship digital asset throughout the previous day, in accordance with on-chain information.

Arkham reported that the federal government despatched 6306.9 BTC, estimated to be price $362.12 million, to Kraken, Cumberland, and two unlabeled addresses seemingly belonging to an institutional deposit or over-the-counter service supplier.

This current exercise has decreased the federal government’s Bitcoin holdings to 22,847 BTC, valued at $1.32 billion. Final month, Germany began its large-scale BTC sell-off, having initially held 50,000 BTC seized from a piracy web site in January.

In the meantime, the federal government’s uncommon on-chain transactions have sparked diverse reactions throughout the crypto neighborhood. On July 8, blockchain analytical agency SpotOnChain questioned the German authority’s determination to promote straight through centralized exchanges and the following withdrawal of a few of these BTC after the switch to those platforms.

Regardless of these gross sales, specialists observe that the Bitcoin market stays unaffected. Ki Younger Ju, CEO of CryptoQuant, acknowledged:

“Authorities BTC promoting is negligible in comparison with general liquidity, and most Mt. Gox BTC holdings haven’t moved to collectors.”

CryptoSlate’s information reveals that BTC’s worth has been trending downwards, falling about 10% within the final seven days to $57,270 as of press time.