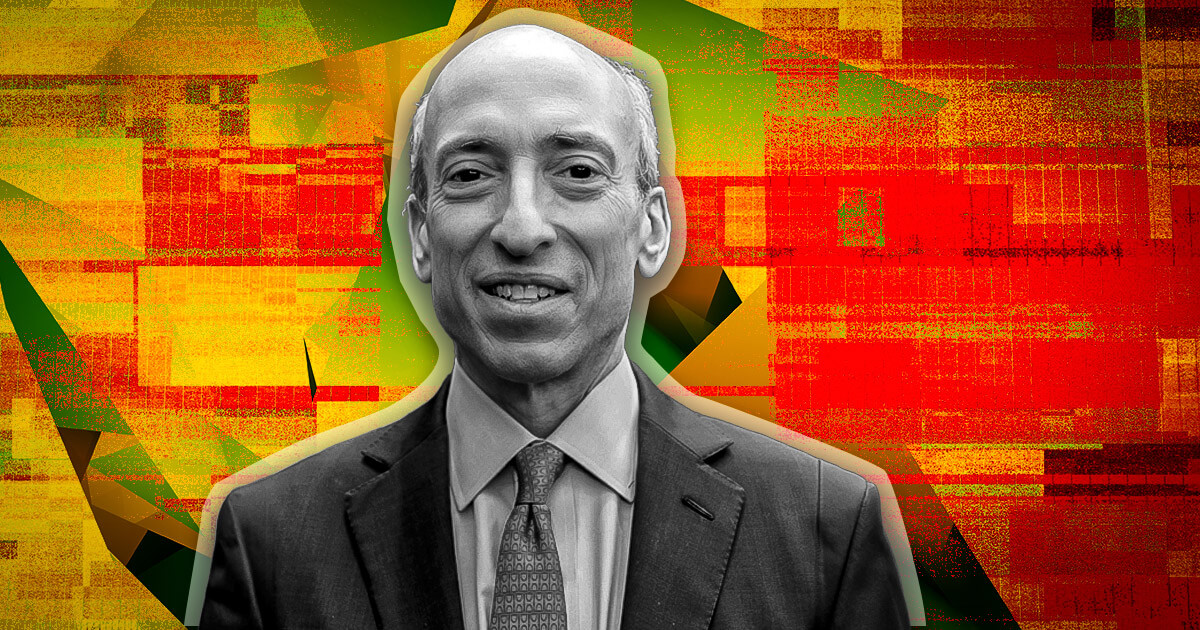

SEC chair Gary Gensler cautioned traders to fastidiously contemplate the deserves of every mission after the market skilled excessive volatility following Bitcoin’s ascent to a brand new all-time excessive.

Gensler made the statements throughout an interview with Bloomberg on March 6 and likened the crypto market’s volatility to a curler coaster experience.

In line with the SEC chair:

“[Cryptocurrency] is a extremely speculative asset class. One may simply have a look at the volatility of Bitcoin in the previous few days. And I grew up loving curler coasters … however you actually ought to be aware, because the investing public, that this can be a little bit of a curler coaster experience on risky belongings.”

Persevering with the metaphor, Gensler urged traders to think about the power of every asset’s basis because it reaches “the highest of [the] hill.” He added that important concerns embrace money flows, use instances, and every asset’s potential standing as a safety.

Gensler’s feedback come after Bitcoin briefly touched a brand new all-time excessive value of $69,324 on March 5 earlier than falling 11% to $60,861 inside hours, inflicting a bloody market rout.

Nonetheless, the flagship asset and the general market recovered many of the losses on March 6, with the flagship crypto buying and selling at $65,834 as of press time.

ETH ETFs

When pressed to touch upon the potential approval of spot Ethereum ETFs, Gensler mentioned that the SEC has the filings earlier than it and is reviewing them. He didn’t touch upon particular purposes.

The SEC has to resolve whether or not to approve or reject VanEck’s spot Ethereum ETF software by the Could 23 deadline, and lots of count on the regulator will concurrently problem a call concerning the opposite purposes.

One Polymarket prediction market locations Could approval odds at 43%, whereas varied consultants, together with executives at asset administration corporations, have positioned approval odds near 50%.

Gensler additionally declined to touch upon whether or not the Ethereum token (ETH) is taken into account a safety and if this is able to affect the approval of every pending ETF software. Nonetheless, he mentioned there are as much as 20,000 crypto tokens, and lots of of them could possibly be deemed securities as a result of traders depend on the efforts of a bunch of entrepreneurs behind every mission.

Gensler is thought for his inflexible stance towards crypto and his view that the majority tokens are securities that ought to be regulated by the SEC. Bitcoin stays the one asset he has confirmed as a commodity by the regulator and its chair.