Fred Krueger, an investor and crypto analyst, is predicting a “vicious” Bitcoin (BTC) rally shortly. He cites the latest unprecedented accumulation of the coin by Wall Road heavyweights.

This surge in institutional curiosity coincides with the latest approval of the primary spot Bitcoin ETFs by the USA Securities and Trade Fee (SEC).

Wall Road Ramping Up Bitcoin Buy

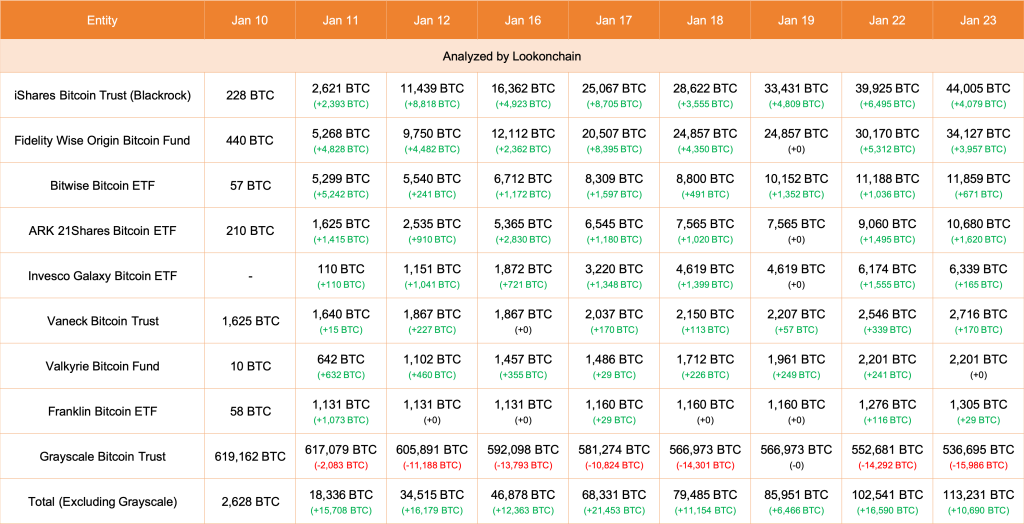

In a submit on X, Krueger pointed to the substantial Bitcoin purchases by main monetary establishments, together with Constancy Investments, BlackRock, and Ark Make investments. As an instance, the analyst famous that Constancy was shopping for roughly 4,000 BTC on daily basis.

Associated Studying: Bitcoin Goes To The Physician: 5 Key Metrics For BTC In 2024

Alternatively, Ark, Krueger continues, has been gobbling upwards of 1,500 BTC every day. BlackRock, the world’s largest asset supervisor, has but to launch its Bitcoin holdings. Nevertheless, primarily based on the tempo of Ark Make investments and Constancy Funding’s accumulation charge, BlackRock is probably going shopping for cash at a quicker tempo. Thus far, Lookonchain information locations BlackRock’s IBIT holdings of BTC at over 44,000.

If something, the speed at which these Wall Road establishments are doubling down on Bitcoin is a web bullish for value. Notably, BTC calls for stay excessive greater than every week after the USA SEC licensed the primary spot of Bitcoin ETFs. That they’re steadily shopping for means that establishments are bullish about Bitcoin’s potential.

The heightened tempo of BTC accumulation is lower than three months earlier than the community halves its miner rewards. The Bitcoin halving occasion in early April will scale back miner rewards from 6.25 BTC to three.125 BTC. If previous value efficiency guides, the ensuing provide shock would possibly set off one other wave of upper highs, even lifting costs above 2021’s peaks of $69,000.

BTC Falls, FTX Unloads Hundreds of thousands Of GBTC Shares

Even amid the general optimism, BTC continues to be struggling. Days after the approval of spot Bitcoin ETFs, BTC has been trending decrease, shedding double digits. It even quickly fell under $40,000 on January 23 earlier than recovering to identify charges.

Analysts pin the sell-off to FTX, the defunct crypto trade, off-loading an estimated $1 billion of Grayscale Bitcoin Belief (GBTC). With the FTX property promoting their stake in GBTC, costs are anticipated to stabilize because the distinctive promoting occasion is alleviated and establishments double down, shopping for extra BTC at spot charges.

Observers additionally notice that GBTC outflows had been matched or surpassed by the spike in influx to different funds, largely BlackRock’s ETF product.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal threat.