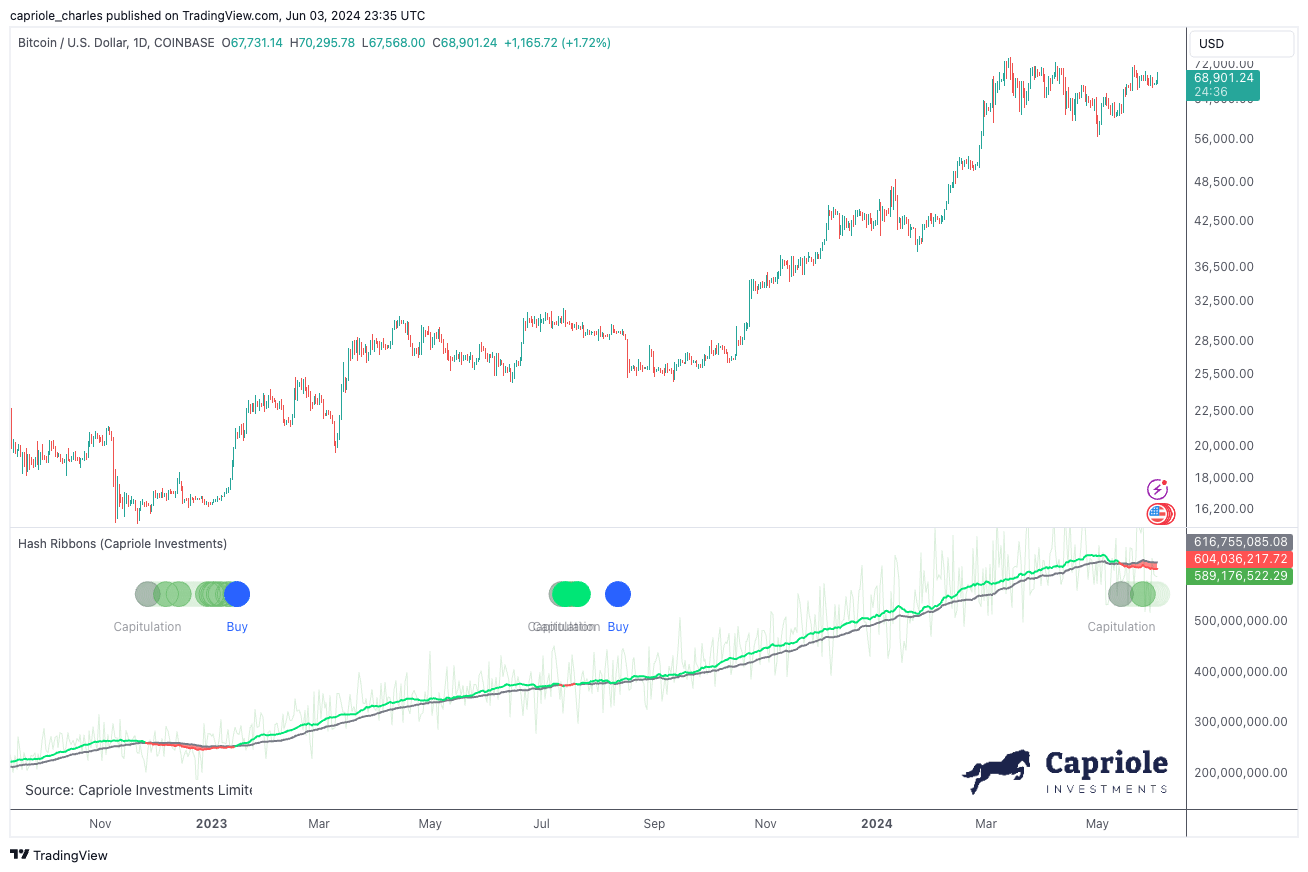

In his newest dispatch, Charles Edwards, CEO of the Bitcoin and digital asset hedge fund Capriole, has flagged a major market indicator within the newest version of the agency’s publication, Replace #51. Edwards factors to the activation of the “Hash Ribbons” purchase sign, a notable occasion that has traditionally indicated prime shopping for alternatives for Bitcoin.

Bitcoin Hash Ribbons Flash Purchase Sign

The Hash Ribbons indicator, first launched in 2019, makes use of mining information to foretell long-term shopping for alternatives based mostly on miners’ financial pressures. The sign arises from the convergence of short-term and long-term transferring averages of Bitcoin’s hash price, particularly when the 30-day transferring common falls beneath the 60-day. In keeping with Edwards, this occasion has “within the overwhelming majority of instances synced with broader Bitcoin market weak spot, value volatility and considerably long-term worth alternatives.”

The present Miner Capitulation, as highlighted by Edwards, started two weeks in the past and coincides with post-halving changes within the mining sector. This era usually results in the shuttering of operations and even bankruptcies amongst much less environment friendly miners. Edwards notes, “Simply as we’re seeing as we speak, these mining rigs will sometimes then be phased out over a number of weeks following the Halving leading to falling hash charges.”

Regardless of the historic profitability of miners, particularly with elevated block charges from new purposes similar to Ordinals and Runes, Edwards means that the market mustn’t overlook the present alternative signaled by the most recent Miner Capitulation. “Whereas this capitulation is happening when miners have broadly been worthwhile, we’d be remiss to not word this uncommon alternative,” said Edwards.

Associated Studying

The Hash Ribbons haven’t been with out their critics, with every prevalence stirring debate concerning the present relevance and accuracy of the sign. Edwards addressed these criticisms by referencing the earlier 12 months’s sign, which correlated with Bitcoin buying and selling within the $20,000 vary, reinforcing the indicator’s predictive energy. “Each prevalence brings some debate about their relevance as we speak, or why the present sign maybe doesn’t depend,” Edwards defined.

Edwards recommends that the most secure strategy to leveraging the Hash Ribbons is by ready for affirmation by renewed hash price development and a optimistic value development. He concludes, “The most secure (lowest volatility alternative) to allocate to the Hash Ribbons technique is on affirmation of the Hash Ribbon Purchase which is triggered by renewed Hash Fee development (30DMA>60DMA) and a optimistic value development (as outlined by the 10DMA>20DMA of value).”

Broader Market Context

Transitioning from the technical to the contextual, Edwards discusses the altering regulatory panorama that has lately turn into extra favorable to cryptocurrencies. The SEC’s approval of an Ethereum ETF, categorizing ETH as a commodity, marks a major shift within the regulatory strategy in direction of cryptocurrencies and displays rising institutional acceptance.

Associated Studying

“The reclassification of Ethereum and the approval of its ETF signify a pivotal shift in governmental stance on cryptocurrencies,” Edwards notes. “This might result in elevated institutional involvement and probably extra stability within the crypto markets.”

Moreover, Edwards factors to macroeconomic components that might affect Bitcoin’s worth. The enlargement of the M2 cash provide and the Federal Reserve’s stance on rates of interest are designed to stimulate financial exercise. Nonetheless, Edwards warns of the potential long-term penalties of those insurance policies, similar to inflation, which may improve Bitcoin’s enchantment as a hedge in opposition to financial devaluation.

“Bitcoin was conceptualized as an alternative choice to conventional monetary programs in instances of financial stress,” Edwards remarks. “The present financial insurance policies reinforce the basic causes for Bitcoin’s existence and will result in elevated adoption.”

On the technical entrance, Edwards offers an evaluation of Bitcoin’s value actions, highlighting the latest breakout and consolidation above vital resistance ranges. He units a conditional mid-term value goal of $100,000, contingent upon the market sustaining its present momentum and the month-to-month shut remaining above a vital threshold of $58,000.

At press time, BTC traded at $69,008.

Featured picture created with DALL·E, chart from TradingView.com