The adoption of digital expertise within the finance area has given rise to the idea of fintech. Finance corporations have been leveraging new digital applied sciences to supply their monetary companies and merchandise to their clients. The arrival of fintech has been one of the vital revolutionary issues within the twenty first century. Fintech has made it doable to supply a big selection of economic companies to clients in a seamless method. That’s not all! A broad class of fintech careers has come into existence. Undoubtedly, in case you are focused on a profession in fintech, now could be the perfect time.

Do you’ve gotten the query in thoughts – Is FinTech an excellent profession path? In that case, right here is the reply. Fintech is among the most in-demand profession pathways you can select to have a brilliant future. Furthermore, you may select from all kinds of high-paying jobs to achieve your aspirations. If you’re keen about fintech you could certainly discover the various fintech specialists profession alternatives that exist. It might certainly function the proper platform that can allow you to achieve new heights in your profession.

Beginning a profession in Fintech

The exponential price at which the fintech business is rising highlights its potential. Sooner or later, the fintech area is more likely to develop additional. Now could be the correct time for people to think about their careers in fintech. When you have not but given a considered your journey as a licensed fintech knowledgeable, you do not need to fret. You can begin fascinated by your profession in fintech proper now. To begin your profession in fintech, there are some things you could have in mind.

-

Creating a stable basis on fintech

One of many elementary necessities for a licensed fintech knowledgeable is to have a stable background within the topic. In case you do not need a robust data, you do not need to fret. You’ll be able to select skilled fintech programs to widen your data and understanding of the area.

-

Cultivating applicable fintech abilities

If you wish to have a flourishing profession within the dynamic fintech business, you must equip your self with the mandatory abilities. A number of the abilities that you could work on are programming abilities and knowledge evaluation. Moreover, you may work in your abilities in Synthetic Intelligence (AI) to achieve an edge over others.

Develop in-depth data of fintech ideas and turn out to be part of the developments in finance with elementary Fintech Flashcards.

In extremely unpredictable and unsure instances, it’s a should to develop abilities regarding cybersecurity. Particularly within the fintech realm, the talent can act as a significant power for you. By capitalizing in your cybersecurity abilities, you may scale back the dangers and threats that come up resulting from malicious actors. Furthermore, particular abilities can broaden your profession alternatives since you may interact in actions like danger administration, compliance, and governance.

Adaptability is a crucial talent that has excessive relevance in various organizational contexts. Within the fintech setting, adaptability might help you to adapt to the evolving technological setting. Because the fintech business is present process fixed change, the talent might help you stay related and worthwhile.

It’s true that technical abilities are indispensable to profit from profession alternatives in fintech. Nevertheless, it’s equally necessary to have communication and interpersonal abilities. These abilities might help you collaborate along with your crew and resolve crucial points. Communication abilities might help you search suggestions and establish the areas you must enhance to excel in your profession.

-

Remaining abreast of the newest fintech traits

Because the fintech business is rising quickly, you could replace your self in regards to the newest happenings and occasions. You have to hold tabs on the newest applied sciences which are making a mark within the fintech world. Equally, you additionally must know in regards to the newest rules that affect the practices of fintech corporations. If you wish to broaden your data, you may discuss with credible articles, journal papers, and different sources.

Wish to be taught in regards to the fundamentals of AI and Fintech? Enroll now in AI And Fintech Masterclass

-

Constructing a stable skilled community

Within the trendy enterprise world, networking is indispensable. Identical to another business in fintech, networking is of excessive significance. By constructing a large skilled community, you may come throughout various profession alternatives in fintech. You’ll be able to construct a community by attending business occasions or partaking in on-line skilled networking web sites. It might undoubtedly give rise to new avenues that can provide your profession in fintech a significant push.

-

Selecting the best certification course

If you wish to have a profession within the fintech house, you may select an acceptable on-line course. The excellent news is that presently, there are quite a few on-line programs and certification packages you can select from. Nevertheless, it could get overwhelming to decide on the correct in fact. You are able to do your individual analysis and search recommendation to pursue a course. The choice to affix a course can certainly open up alternatives so that you can search a task within the fintech area. By having the correct credentials, your capabilities, in addition to confidence, can enhance considerably. Moreover, it may possibly act as a supply of aggressive benefit for you.

You do not need to hasten to dive into the fintech area. You must undertake a gradual and systematic method so that you could establish your predominant goal as a licensed fintech knowledgeable. Now that you understand how to take the preliminary steps to have a profession in fintech, you must familiarize your self with the highest profession alternatives. By gaining perception into it, you may select the profession choices which are aligned along with your skilled aspirations.

Be taught the fundamental and superior ideas of Fintech. Enroll now within the Fintech Fundamentals Course

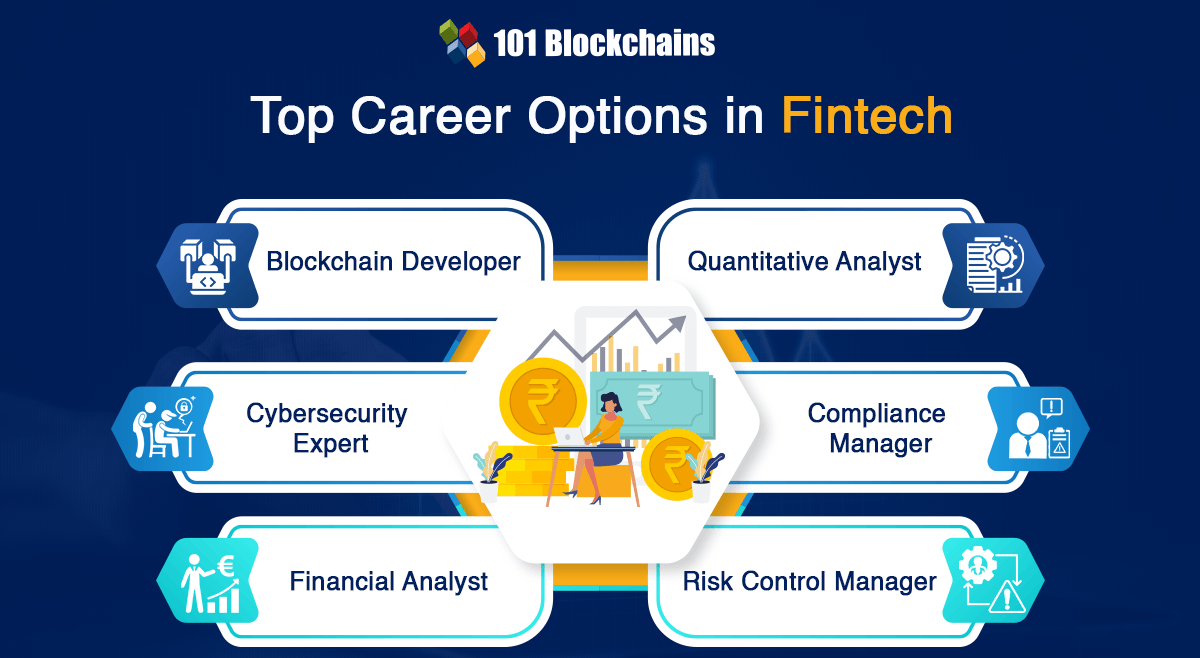

Prime profession choices in Fintech

For licensed fintech specialists, profession alternatives are immense within the fintech business. Your focus needs to be to profit from the alternatives that come your approach. Nevertheless, to take action, you could have a transparent understanding of a few of the profitable fintech specialists’ profession alternatives. Beneath is the listing of the in-demand roles that employers are in search of proper now within the fintech setting.

The Blockchain developer position is among the most promising profession alternatives for fintech specialists. A number of the predominant duties and tasks embrace producing, growing, and adopting blockchain options. When you have a eager curiosity in blockchain expertise, it is a perfect profession selection for you.

Your job will let you continually be taught and develop as an expert. Your employer could ask you to develop decentralized purposes and sensible contracts. You will have to work in a collaborative method and handle points regarding bug fixing, programming, and plenty of extra. The perfect factor is you can continually be taught whereas working as a blockchain developer. Therefore, it is possible for you to to develop in your profession within the fintech area.

Create new, high-level, modern blockchain options for various industries as a highly-skilled blockchain developer with Blockchain Developer Profession Path.

Within the fintech business, one of the vital in-demand roles is that of a cybersecurity knowledgeable. Profession alternatives: On this position, you’ll have to safeguard the info, monetary programs, and total infrastructure towards malicious actors. Because the menace from on-line hackers and cybercriminals stays always, there’s a excessive demand for cybersecurity specialists.

By working within the cybersecurity space in fintech, you’ll play a key position. A number of the tasks that you must fulfill embrace growing security protocols, conducting danger evaluation, and managing safety occurrences.

In fintech, one of the vital promising profession alternatives in fintech is that of a monetary analyst. A monetary analyst is an expert who analyzes monetary knowledge, examines market traits, and develops monetary fashions. Undoubtedly, your position as a monetary analyst might be instrumental within the fintech business. In case you want to excel in a particular position, you could have a stable basis of economic ideas and ideas.

The emergence of digital applied sciences resembling large knowledge and machine studying has led to a surge in demand for quantitative analysts within the fintech area. To not point out, to work as a quantitative analyst, you must have sturdy technical know-how. By conducting quantitative evaluation, you will have to develop data-driven methods or construct modern algorithms. Importantly, abilities in areas resembling Synthetic Intelligence and machine studying are a should for a quantitative analyst.

Wish to find out how AI and Fintech disrupting finance careers? Be a part of Premium Plan and watch our on-demand webinar on How AI And Fintech Are Disrupting Finance Careers

The fusion of expertise and finance has given rise to the necessity to adhere to applicable regulatory and authorized necessities. Consequently, the position of compliance managers has turn out to be more and more necessary. As a compliance supervisor, you could be certain that the fintech agency that you just work for adheres to authorized obligations. Furthermore, a compliance supervisor has to make sure that all the mandatory skilled norms and values are upheld. Moreover, your position as a compliance supervisor might be crucial to establish any suspicious actions and take applicable measures.

Within the finance area, danger management managers play an important position. The first accountability of a danger management supervisor is to evaluate monetary dangers and take actions to mitigate such dangers. Clearly, in case you are looking for the position of a danger management supervisor, your contribution might be of excessive worth. Clearly, by performing your tasks in a diligent method, you may assist your group obtain its final objectives. Nevertheless, a few of the abilities that you could possess embrace portfolio administration, danger administration, and qualitative and quantitative evaluation.

Enroll now within the Licensed Web3 Blockchain Developer Certification to find out about the perfect practices for writing, testing, and deploying Solidity sensible contracts for web3 apps.

Fintech – A pretty profession path

Within the aggressive instances, fintech is a particularly enticing profession path. In the present day, expertise has made its mark in several areas. Clearly, within the finance area, the state of affairs isn’t any totally different. The mix of finance and expertise has given rise to a number of recent profession decisions that people can select from. Therefore, fintech is an efficient profession path, and there’s no doubt about that.

The truth that individuals have accepted fintech has led to its immense recognition. Because of the rise of fintech, the standard fee and lending mechanism has undergone a change. The idea of digital cash has come into existence. Licensed fintech specialists have been taking part in a key position in increasing the recognition of fintech.

As a fintech knowledgeable, you may make optimum use of your technical abilities and finance-related data. Moreover, by selecting the profession path, you may equip your self for the way forward for finance within the digital world. The icing on the cake is that a fintech profession wage is very profitable. Unquestionably, by becoming a member of the fintech setting, you may develop as an expert and earn a good-looking wage.

Enter into the brand new technology of economic companies powered by modern expertise with the interactive Fintech Talent Path.

Conclusion

The fintech area is flourishing at current as it’s rising from power to power with every passing day. The expansion and growth of fintech has led to the creation of a number of profession choices for people. Undoubtedly, by leveraging one’s technical proficiency and finance-related data, it’s doable to have a promising profession in fintech. The information has make clear a few of the key issues that you could think about whereas beginning your journey as a fintech skilled.

You must develop a stable basis in fintech and domesticate applicable fintech abilities. Furthermore, you could work in your cybersecurity abilities, adaptability abilities, and communication abilities. Clearly, it’s equally necessary to replace your data of the newest fintech traits and occasions. Furthermore, you must select the correct certification course and construct a stable skilled community to profit from your profession alternatives in fintech.

A various vary of profession alternatives for licensed fintech specialists have been recognized that may aid you select your job position. A number of the key roles are blockchain developer, cybersecurity knowledgeable, monetary analyst, quantitative analyst, compliance supervisor, and danger management supervisor. Importantly, you must select the position in line with your pursuits and abilities. By taking over an expert position within the fintech area, you may have a tremendous profession. The skilled journey will aid you obtain your desires whereas providing a profitable wage.