This week might mark a pivotal second within the first quarter of 2024 for the whole crypto market and the 2 largest cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), as main central banks, led by the Financial institution of Japan and the US Federal Reserve (Fed), put together to announce their rate of interest choices.

In accordance with crypto futures trade Blofin, these bulletins will set the tone for financial coverage within the coming months. The affect of safe-haven sentiment has led to a pullback in each BTC and ETH costs, with merchants expressing better optimism for BTC.

Bitcoin Worth Motion Vary Projected At 9.78%

As per a current on-chain evaluation report launched by the trade, crypto merchants expect BTC’s worth motion vary to succeed in 9.78% over the following seven days, with a projected 30-day vary of 20.33%.

Nonetheless, regardless of the anticipated volatility, the report signifies that merchants stay bullish on BTC within the medium to long run.

Skewness evaluation means that worth declines and pullbacks are anticipated to induce volatility, however the length of this spherical of pullback is anticipated to be comparatively quick. Danger aversion to macro uncertainty is seen as the first set off.

The most recent sellers’ gamma distribution helps the anticipated wide selection of BTC worth fluctuations, with gamma peaks round $65,000 and $75,000. With the quarterly settlement approaching, market makers’ affect on BTC worth motion is progressively recovering, offering assist throughout worth drops however making it difficult to surpass the $75,000 degree.

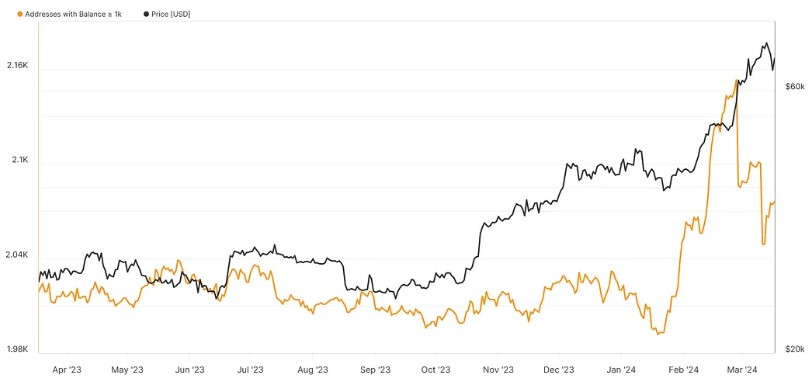

As well as, on-chain information reveals a decline in spot buyers’ enthusiasm for purchasing BTC, though the variety of addresses holding greater than 100 BTC continues to extend, as seen within the chart above. The lowered variety of addresses holding over 1,000 BTC means that vital holders have determined to promote at BTC’s new highs.

Regardless of warning over potential worth fluctuations, the hedging impact contributes to the rising risk of BTC worth stabilization, making holding BTC a good alternative.

Bearish Sentiment Dominates Entrance-Month Choices For Ethereum

In accordance with the report, much like BTC, merchants anticipate comparatively excessive volatility ranges for ETH within the quick time period, with projected worth motion ranges of 10% over seven days and 20.32% over 30 days. Nonetheless, the report means that merchants are much less optimistic about ETH’s future efficiency in comparison with Bitcoin.

Moreover, Blofin finds that bearish sentiment dominates the front-month choices, whereas bullish sentiment stays favorable within the back-months. Blofin emphasizes that expectations of fee cuts could assist the ETH worth, however the pricing of Ethereum tail danger signifies “elevated pessimism” relating to vital occasions impacting the ETH worth, with spot Ethereum ETFs seen as a possible set off.

Lastly, Blofin explains that the excessive leverage of altcoins has lengthy been a “supply of danger” within the cryptocurrency market. The current worth decline has led to the liquidation of many extremely leveraged altcoin positions, leading to decrease annualized funding charges for perpetual contracts.

This deleveraging of altcoins, coupled with their comparatively small market share of lower than 20%, has helped to mitigate danger and contribute to market stability, in response to the report. Nonetheless, regardless of the general decline in altcoin leverage, hypothesis in meme cash continues.

At current, the value of Bitcoin stands at $62,500, reflecting a major decline of seven.5% inside the final 24 hours. Equally, Ethereum is buying and selling at $3,276, experiencing a 6.8% drop throughout the identical interval.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal danger.