Knowledge exhibits excessive greed sentiment has made a return among the many Bitcoin buyers after the cryptocurrency’s value has damaged above $50,000.

Bitcoin Concern & Greed Index Now Factors In direction of “Excessive Greed”

The “Concern & Greed Index” refers to an indicator that tells us concerning the normal sentiment amongst Bitcoin merchants and broader cryptocurrency sectors.

The metric represents this sentiment utilizing a numerical scale from zero to hundred. In accordance with Various, its creator, the index calculates this rating utilizing 5 components: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Tendencies.

When the Concern & Greed Index has a price of 54 or better, the buyers now share a sentiment of greed. However, values of 46 or much less suggest the presence of worry among the many merchants.

The area between these two ranges (values 47 to 53) corresponds to the territory of “impartial” sentiment. Along with these three core sentiments, “excessive worry” and “excessive greed” happen on the deep ends of the worry and greed ranges.

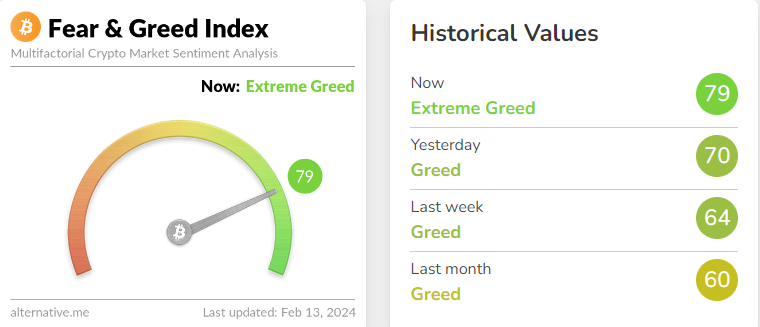

Here’s what the Bitcoin Concern & Greed index appears like proper now to see which of those areas the market is in:

Seems like the worth of the metric is 79 in the intervening time | Supply: Various

As displayed above, the Bitcoin Concern & Greed Index has surpassed the 75 threshold for excessive greed in the course of the previous day and has attained a price of 79. The metric was at 70 yesterday, so it has seen a little bit of a soar in simply the final 24 hours.

This surge in sentiment from greed to excessive greed has occurred as cryptocurrency broke previous the $50,000 barrier for the primary time since December 2021.

Traditionally, the intense sentiments have been fairly important for the asset, as main bottoms and tops for the worth have occurred in these areas. This relationship between the 2, nonetheless, has been inverse.

Excessive worry has been when bottoms have taken form, whereas excessive greed has been the place tops have shaped. Previously, Bitcoin has normally tended to maneuver towards the bulk’s expectations. This expectation is the strongest in these ranges, so it is sensible {that a} reversal is the primarily seemingly right here.

Followers of a buying and selling philosophy known as “contrarian investing” exploit this reality to time their shopping for and promoting strikes. “Be fearful when others are grasping, and grasping when others are fearful” is a well-known quote from Warren Buffet that sums up the thought.

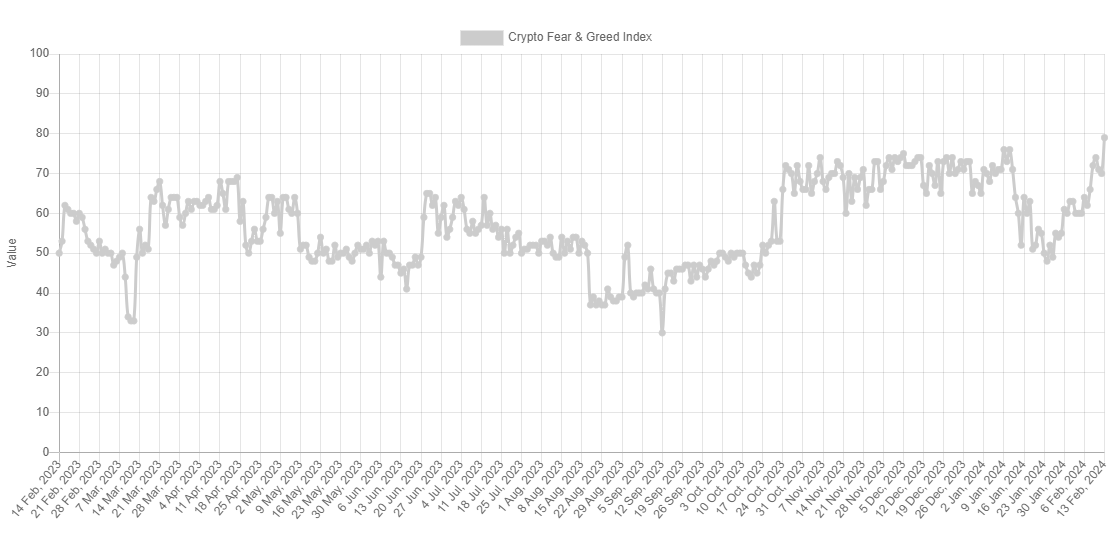

Because the chart under exhibits, the final time the Concern & Greed Index attained excessive greed ranges was across the time of the spot ETF approval.

The pattern within the Concern & Greed Index over the previous 12 months | Supply: Various

As BTC buyers are very effectively conscious, the coin hit a prime coinciding with the occasion because the market took to promoting the information. Because the sentiment is now again inside excessive greed with its newest surge, one other related reversal level could also be shut for its value.

Maybe it’s at a time like this when a contrarian investor would take into account shifting in direction of promoting, going towards the hype and euphoria floating across the market.

BTC Value

Bitcoin has loved a surge of over 4% prior to now day, which has taken its value in direction of the $50,000 mark.

The worth of the coin seems to have shot up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Various.me, charts from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site totally at your personal danger.