Onchain Highlights

DEFINITION:The typical funding price (in %) set by exchanges for perpetual futures contracts. When the speed is optimistic, lengthy positions periodically pay quick positions. Conversely, when the speed is damaging, quick positions periodically pay lengthy positions.

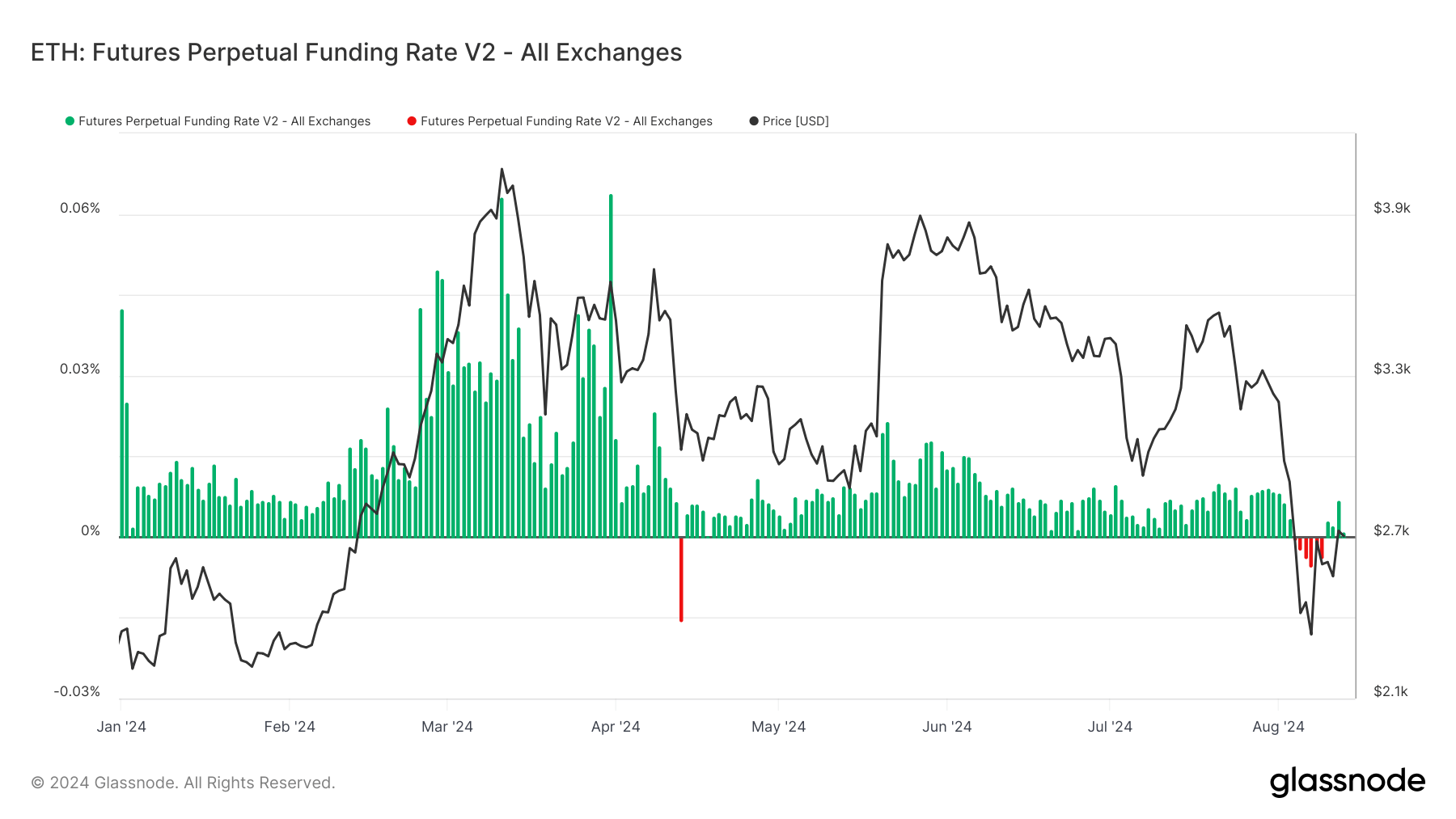

Ethereum’s perpetual futures funding price has not too long ago dipped off its bullish premium. This development is clear in each short-term and long-term views, reflecting growing bearish sentiment amongst merchants.

Traditionally, damaging funding charges point out that quick positions are paying lengthy positions, suggesting a prevalence of bearish bets. The charts spotlight that regardless of Ethereum’s value volatility because the begin of 2024, funding charges have typically been optimistic, signaling bullish expectations. Nevertheless, the current decline in each funding charges and costs beneath the $2,700 degree highlights a shift in market sentiment.

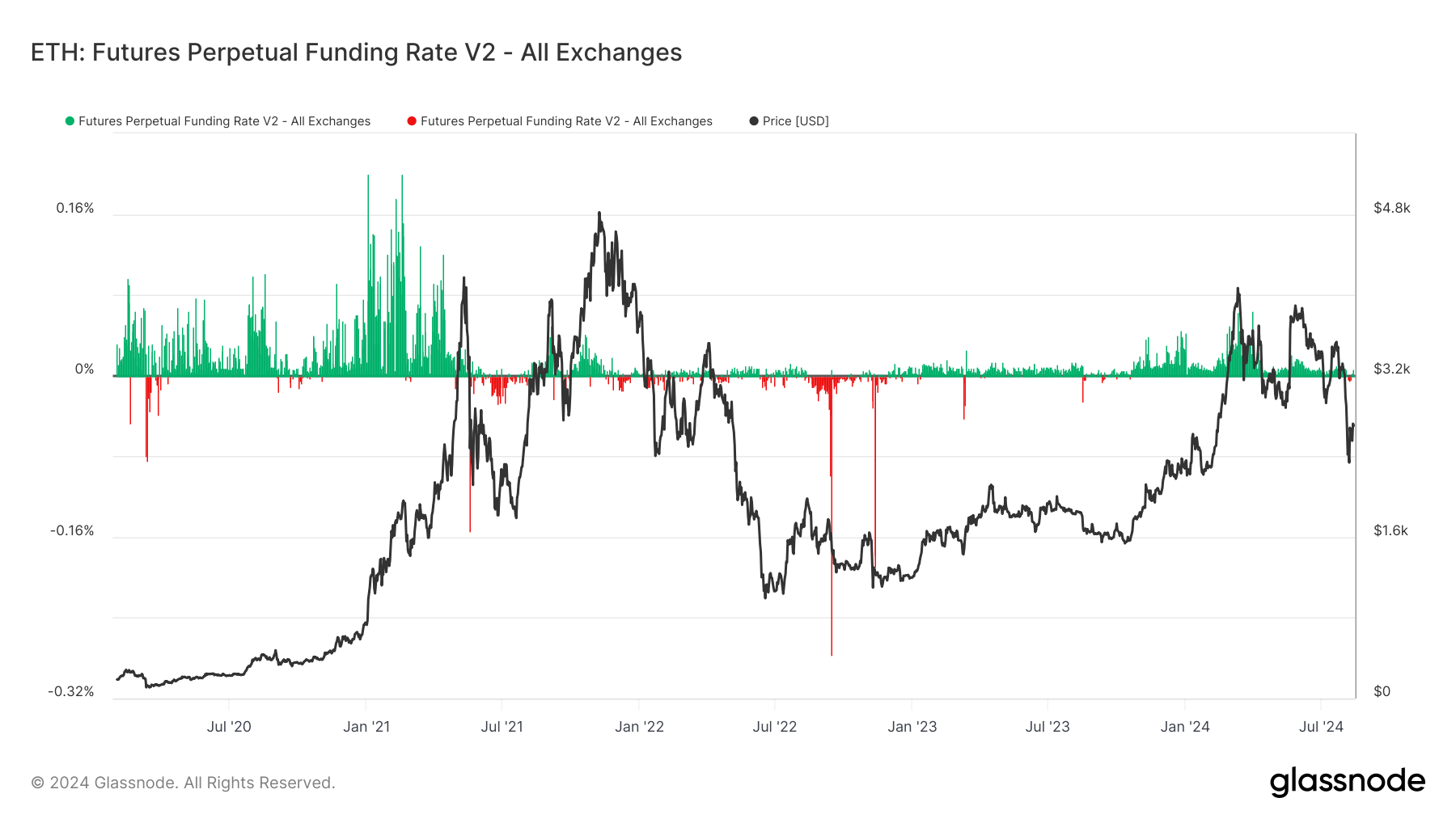

Over the previous few years, Ethereum’s perpetual futures funding price has exhibited vital fluctuations, carefully mirroring broader market tendencies. In intervals of robust market optimism, similar to throughout the 2021 bull run, funding charges surged into optimistic territory, indicating a dominance of lengthy positions as merchants guess on continued value will increase.

Nevertheless, throughout market downturns, notably in mid-2022 and at a number of factors in 2023, funding charges turned damaging, reflecting a shift towards bearish sentiment. These oscillations spotlight how funding charges have traditionally served as a barometer for dealer sentiment, typically foreshadowing main value actions within the underlying asset.

The submit Ethereum’s funding charges and value decline level to bearish shift appeared first on CryptoSlate.