Ethereum costs are secure at spot charges, shifting horizontally even after the US Securities and Change Fee (SEC) authorised the listing and buying and selling of spot Ethereum ETFs on July 23.

Ethereum is trending beneath the essential resistances at $3,500 and $3,700 at press time. Nevertheless, patrons have stored costs above $3,300 as value motion strikes horizontally.

Although there are expectations of volatility, studying from choices information, now that spot Ethereum ETFs can be found for buying and selling, one analyst picked out a crucial improvement which may have an effect on the BTC-ETH dynamic.

Ethereum Whales Taking, ETH Outperforms BTC

In a submit on X, Santiment information reveals an uptick in whale exercise forward of the spot Ethereum ETF in the US. The analytics platform mentioned a number of high-value ETH transfers have outpaced these ordinarily seen on Bitcoin and USDT since July 17.

The bizarre improve in this type of switch might present rising confidence in Ethereum and ETH’s long-term prospects. This has even been accelerated with one other crypto spinoff product, offering an alternative choice to Bitcoin.

Trying on the ETHBTC value chart, it’s evident that ETH bulls have the higher hand. After the drop in late June, the coin continues outperforming Bitcoin, sharply rising on July 23. Evident within the day by day chart, there’s a double-bar bullish formation signaling the presence of ETH patrons eager on funneling capital and increasing beneficial properties.

ETH is discovering assist on the 50% Fibonacci retracement stage of the Could 2024 commerce vary, confirming the uptrend. Even so, for Could patrons to take cost, bulls should clear 0.057 BTC, setting the bottom for additional beneficial properties towards 0.08 BTC recorded in 2022.

Over $1 Billion Price Of Spot ETF Shares Traded

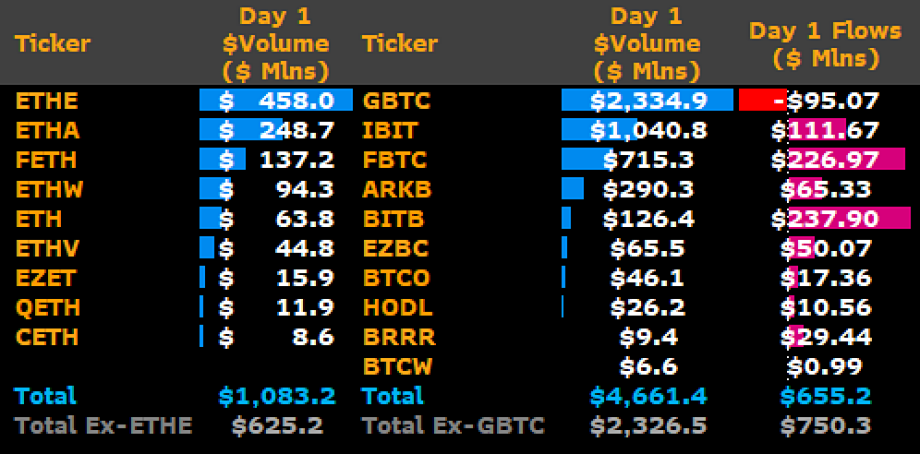

Inflows into spot ETFs will gas the bull run. As seen in Bitcoin, value efficiency will largely rely on curiosity from institutional gamers. Barely 24 hours after the product launched in the US, numerous issuers purchased $1.1 billion of ETH.

Inflows will probably rise when ETH costs break above the fast resistance stage, ideally final week’s excessive and $3,700. As costs stall for now, the launch of this product, a Bitwise analyst mentioned, cements Ethereum’s function as a foundational know-how in web3.

As seen from the speedy development of the digital financial system, Ethereum, the Bitwise analyst added, will see the good contracts platform catalyze improvement.