Ethereum (ETH) value is hovering forward of the Securities and Trade Fee (SEC) resolution concerning the Spot ETH ETF (exchange-traded fund). Buyers’ and market watchers’ optimism has elevated because the ‘King of altcoins’ surpasses the $3,900 mark.

Some analysts consider this bullish momentum might quickly propel ETH’s value above all established value targets.

Associated Studying

Ethereum Soars Amid ETF Approval Expectation

Ethereum, the second-largest cryptocurrency by market capitalization, has seen a big uptick this week. As rumors of ETH spot ETFs being authorized this Wednesday surged, the neighborhood’s sentiment in direction of the asset turned extraordinarily bullish.

Beforehand, Bloomberg consultants had asserted that possibilities of an ETF approval had been slim because of the US authorities’s crackdown on the business. Nevertheless, this week’s U-turn from the Biden administration sparked a constructive sentiment that elevated the possibilities to 65-75%.

Because of this, Ethereum surged a powerful 30.4% from its value seven days in the past. The King of altcoins went from buying and selling slightly below the $3,000 mark to surpassing the $3,900 resistance degree on the time of writing.

The neighborhood’s optimistic expectations proceed as a number of US lawmakers urge SEC chair Gary Gensler to approve Ethereum ETFs.

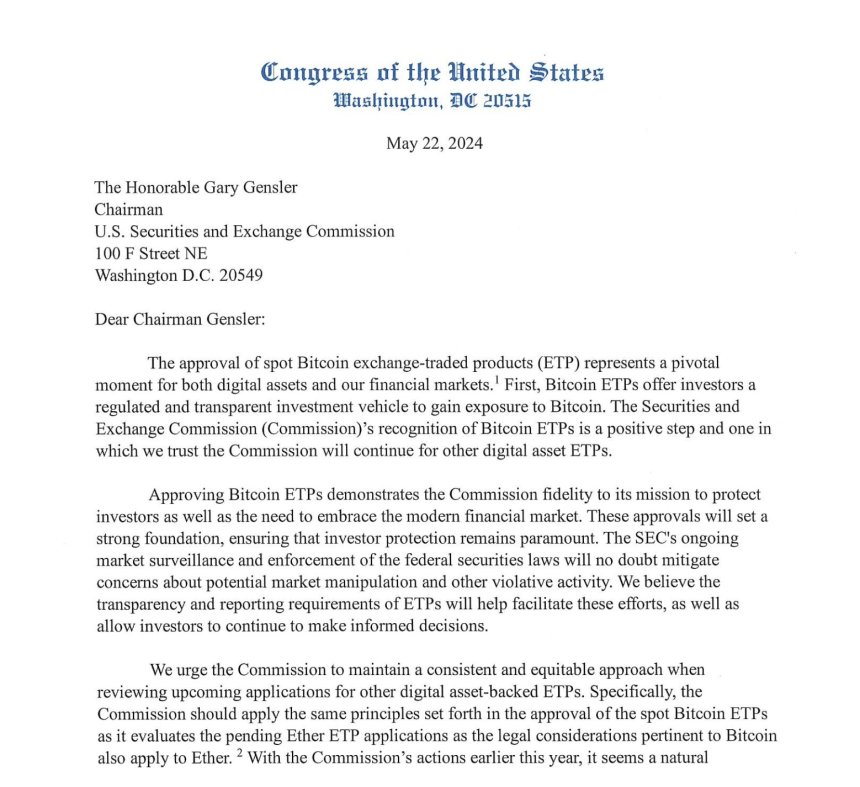

As reported by Eric Balchunas, a bipartisan group of Home lawmakers despatched a letter on Tuesday to the SEC’s Chair asking for the approval of ETH ETFs “and different digital property.”

Based on the letter, the Congress members consider digital asset-backed ETFs supply “traders a regulated and clear funding automobile to realize publicity.” The US lawmakers urged the Fee to “preserve a constant and equitable method when reviewing upcoming functions” for different crypto ETFs.

Are Value Targets Too Low?

Ethereum has carried out remarkablely over the previous few days. ETH has surged 5.6% because the neighborhood awaits the SEC’s resolution.

As identified by a number of market watchers, ETH’s weekly candle is resting ranges not seen for the reason that first half of March. Crypto Yoddha highlighted Ethereum’s historic conduct for the earlier all-time excessive (ATH) runs.

Per the chart, the second-largest crypto asset went by way of a 700-day accumulation section earlier than breaking out and beginning the bullish run. Equally, ETH seemingly ended a 700-day accumulation interval this cycle, which might result in a rally in direction of a brand new ATH, if historical past repeats. The analyst set a goal of $15,300 for this cycle.

Likewise, Crypto Jelle identified that ETH broke out of a multi-month falling wedge sample. Its current efficiency efficiently reclaimed the important thing resistance above the $3,600 mark and is at the moment testing the $3,900 value vary.

The dealer considers that, if that is the present efficiency earlier than the approval of ETH ETFs, his $10,000 goal for this cycle could be “too low.” Nevertheless, he urged traders to “attempt to not get sucked into overtrading.”

He considers the preliminary response to the choice “exhausting to know” regardless of the bullish sentiment. Finally, Jelle suggests the neighborhood to “deal with what ” because the long-term outlook is far clearer.

Associated Studying

On the same be aware, Crypto analyst Mikybull factors out that ETH is repeating the 2020 path that “sparked off Alts season in 2021.” Because of this, the dealer considers that the bull targets for this cycle are $9,000-$11,000.

The SEC’s resolution concerning ETH ETFs might be introduced round 8:30 pm UTC on Could 23.

Featured Picture from Unsplash.com, Chart from TradingView.com