Ethereum is down almost 35% from July highs and roughly 40% from 2024 peaks. Whereas there may be hope amongst holders that the coin will develop, breaking native resistance, the short-term development favors sellers.

From the every day chart, not solely is ETH struggling to realize momentum and push above $2,800, however sellers have been relentless, diffusing any try increased. Because the coin is capped under $2,500 at press time and actively aligning with the promoting strain of late August, Santiment analysts have picked out an fascinating improvement.

Ethereum Register Extra Customers Than Bitcoin

In a put up on X, the sentiment evaluation platform notes that although costs are down at spot charges, the community is curiously resilient, particularly taking a look at consumer development metrics.

Associated Studying: Analyst Says Litecoin Will Outperform Bitcoin And Massive Cap Cryptos With 11,000% Breakout

Within the final three months, the variety of distinctive Ethereum addresses has been rising steadily, outpacing these of Bitcoin. Nevertheless, it nonetheless lags the variety of USDT addresses over the identical interval.

To place within the quantity, as of September 3, Santiment analysts famous that Bitcoin had 54.18 million distinctive wallets, down 0.1% in three months. On the similar interval, Ethereum boasted of greater than 126.96 million addresses, up 3.3%.

The rise within the variety of new customers in Ethereum alerts confidence within the community and even doable rising adoption regardless of difficult market situations. In the meantime, USDT, the fiat-pegged stablecoin, had 5.99 million addresses, up 4% in three months.

Of the three, the speedy development of USDT addresses within the final three months may sign general apprehensiveness amongst merchants. As crypto costs contract, holders select to transform their holdings to USDT, explaining the rise.

One other interpretation of this improvement is that extra new customers are eager to discover crypto. By holding USDT through custodial wallets or by exchanges like Binance, they are going to readily splash on Bitcoin or another prime altcoin every time the time is prepared.

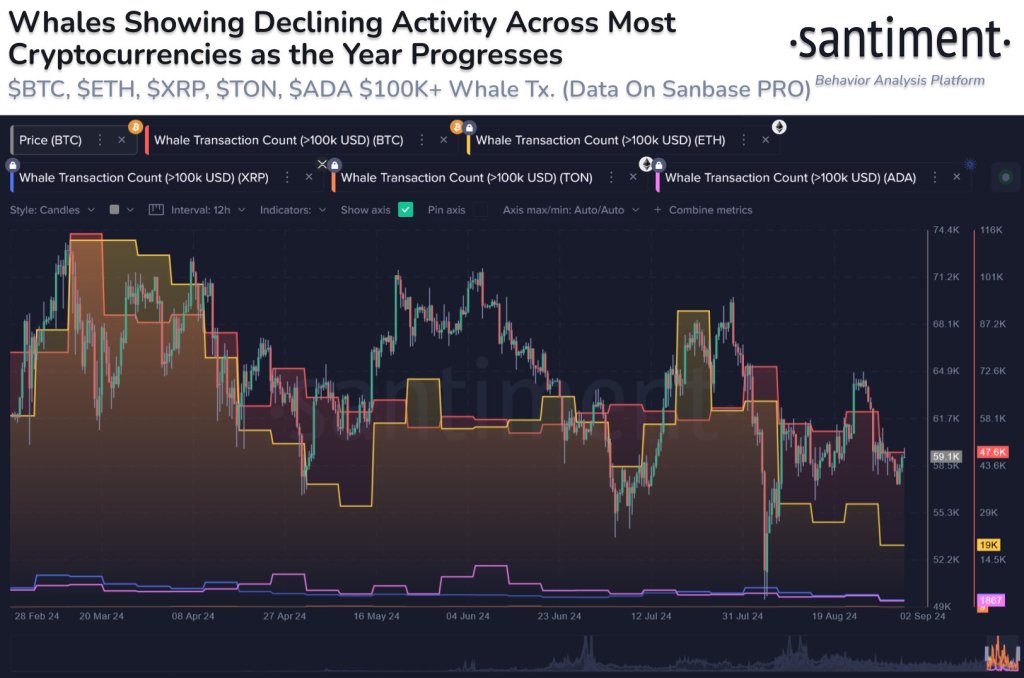

Bitcoin And Ethereum Whale Exercise Declining

Even so, whereas there may be development within the variety of customers, whale exercise, Santiment analysts observe, has been declining. Of notice, the variety of whale transactions has been down since Q1 2024 after costs peaked.

Surging costs, coupled with the approval of spot Bitcoin ETFs, particularly in america, revived curiosity, explaining growth in whale exercise.

Associated Studying

Contemplating the final contraction of costs, Santiment analysts predict whale exercise to drop. This outlook will solely change as soon as there may be volatility spurred by Ethereum or Bitcoin costs ripping above key liquidation ranges within the quick to medium time period.

Characteristic picture from DALLE, chart from TradingView