Ethereum (ETH) stands as a bellwether for the trade’s ebbs and flows. As of press time, Ethereum was buying and selling at $3,174, its worth making an attempt to succeed in the essential $3,000 mark. Nonetheless, beneath the floor of those seemingly steady waters lies a fancy interaction of market forces and investor sentiment.

Supply: CoinMarketCap

Ether’s Difficult Trajectory

Since final week, the decrease timeframes have seen repeated breaches of the $3,000 psychological threshold, and the passion surrounding the altcoin king has considerably waned.

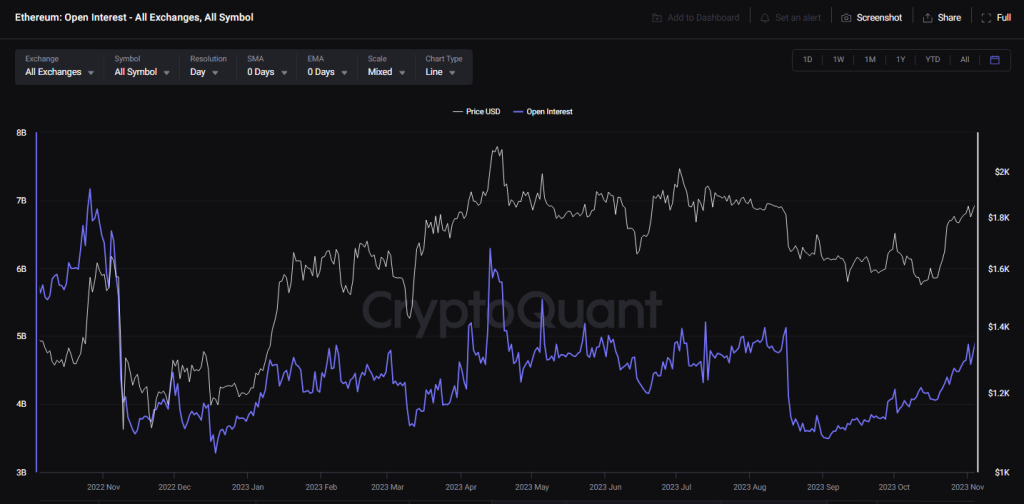

This downward stress is additional underscored by the notable drop in Open Curiosity (OI) behind ETH futures contracts, which plummeted from $10 billion to $7 billion in April alone.

Such a decline suggests a recalibration within the futures market, probably signaling a cooling-off interval for speculative buying and selling exercise.

Supply: CryptoQuant

Navigating Uneven Waters

Nonetheless, amidst the uncertainty, there exists a glimmer of hope for ETH bulls. Historic precedents, such because the mid-February 2021 correction, provide perception into the resilience of Ethereum’s worth.

Following the same dip from an all-time excessive of $1,900 to $1,400, Ethereum skilled a V-shaped reversal, demonstrating the market’s propensity for swift recoveries. This historic context serves as a guiding gentle for buyers navigating the uneven waters of cryptocurrency volatility.

Whole crypto market cap presently at $2.3 trillion. Chart: TradingView

On the social sentiment entrance, Ethereum’s trajectory has been a story of two halves. Whereas sentiment was strongly constructive in February and briefly in mid-March, a destructive sentiment has dominated as costs entered a correction section. Components reminiscent of excessive fuel charges on the Ethereum community have possible contributed to this shift, highlighting the impression of sensible issues on market sentiment.

Ethereum: Elementary Metrics

Analyzing Ethereum’s basic metrics gives additional insights into its present state. Community progress has slowed in latest months, signaling a possible decline in demand. Nonetheless, a more in-depth look reveals a silver lining: the 90-day imply coin age has trended steadily greater since late March, indicating a network-wide accumulation of ETH.

Ether worth motion within the final 24 hours. Supply: CoinMarketCap

As Ethereum continues to navigate these turbulent waters, all eyes are on key resistance ranges. Breaking above the $3,300 barrier may instill confidence amongst merchants and buyers, probably heralding a brand new wave of bullish momentum. Nonetheless, uncertainties loom massive, significantly in gentle of the broader market dynamics and the promoting stress on Bitcoin, Ethereum’s perennial counterpart.

Whereas challenges abound and uncertainties persist, Ethereum’s historic efficiency and basic strengths provide hope for a brighter future. As buyers brace for potential headwinds and alternatives alike, Ethereum stands poised to climate the storm and emerge stronger on the opposite aspect.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site totally at your individual threat.