Based on the most recent Binance Analysis report, the Ethereum (ETH) issuance charge continued to rise in September 2024, elevating considerations in regards to the digital asset’s “ultrasound cash” declare.

Ethereum Issuance Fee Continues To Surge

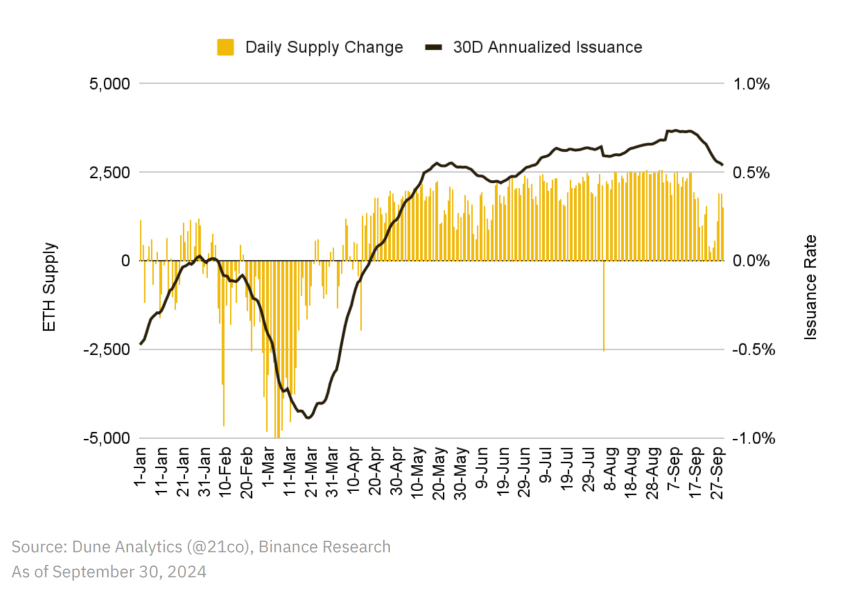

In its October 2024 Month-to-month Market Insights report, Binance Analysis highlighted that the ETH issuance charge continued its ascent in September, shifting away from its beforehand deflationary standing.

Associated Studying

The second largest digital asset by reported market cap had a 30-day annualized inflation charge of roughly 0.74%, a stage not noticed within the final two years. The sharp uptick in ETH provide inflation has questioned its “ultrasound cash” positioning.

Apparently, the time period “ultrasound cash” attracts inspiration from Bitcoin’s (BTC) “sound cash” narrative. Whereas BTC’s provide is capped at 21 million, ETH’s provide can turn into deflationary, theoretically growing shortage and defending it from inflation-driven erosion of buying energy.

Ethereum’s excessive issuance charge could possibly be attributed to a number of elements, together with low mainnet on-chain exercise, resulting in a low transaction charge and, consequently, decrease ETH burn charges.

In 2021, Ethereum core builders carried out EIP-1559, which launched a fee-burning mechanism that aimed to scale back ETH’s circulating provide, thereby creating deflationary strain on the token.

Nevertheless, with declining mainnet exercise, the quantity of ETH being burned is lagging behind the ETH issuance charge, resulting in a internet inflationary development.

Notably, September 2024 skilled one of many lowest ETH burn charges because the extremely anticipated Merge occasion, when Ethereum transitioned from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism.

Ethereum Layer-2 Options To Blame For Low ETH Burn Fee?

The report factors to March 2024 as the start line of Ethereum’s inflationary development, following the implementation of EIP-4844 or the Dencun improve, which lowered transaction prices on layer-2 scaling platforms reminiscent of Optimism (OP), Arbitrum (ARB), Base, and Polygon (MATIC). The report provides:

As L2s cannibalized community exercise all year long – additional impacted by broader market circumstances – transaction charges and, consequently, burned charges on Ethereum declined, with September recording one of many lowest ranges because the Merge. This has prevented ETH from reducing in provide to stay deflationary, resulting in the web constructive each day provide modifications we now see.

Latest traits corroborate the assertion above, as community exercise on layer-2 options grows throughout completely different metrics. As an illustration, a report in July 2024 famous that each day lively addresses and transaction quantity on Polygon had soared considerably.

Associated Studying

Equally, decentralized finance (DeFi) exercise on Arbitrum elevated earlier this yr when decentralized alternate (DEX) Uniswap surpassed $150 billion in whole swap quantity on the community.

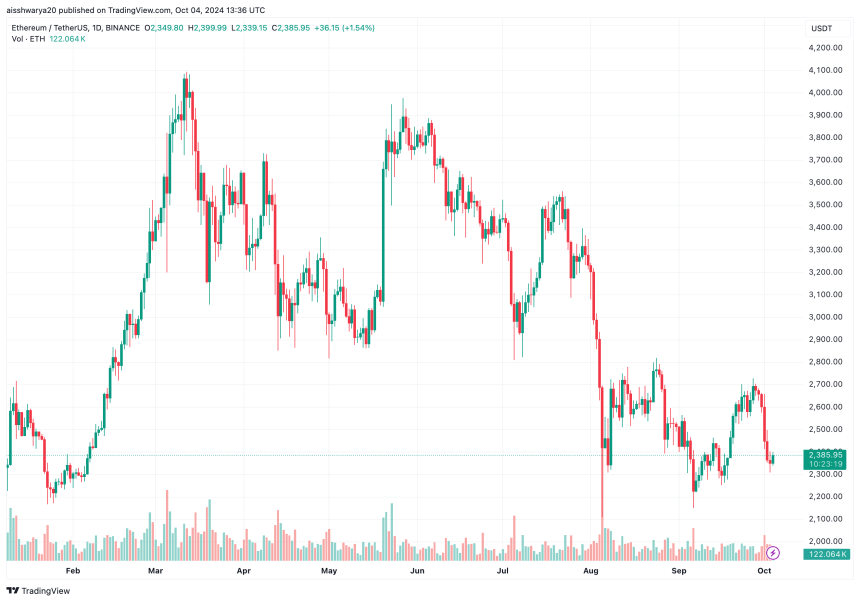

One other report discovered that over 48% of digital belongings bridged from the Ethereum community find yourself on Arbitrum, indicating customers’ excessive belief within the layer-2 community’s strong safety and reliability. ETH trades at $2,385 at press time, up 1.7% prior to now 24 hours.

Featured picture from Unsplash, charts from Binance Analysis and Tradingview.com