The winds of change are blowing by way of the Ethereum ecosystem. Because the long-awaited approval of spot Ether ETFs within the US on Might twenty third, a quiet exodus of Ether has been underway. A large quantity of the world’s second-largest cryptocurrency, or round $3 billion, has vanished from centralized exchanges, marking the bottom stage of Ether reserves in years. This flight of the digital asset has analysts buzzing with the potential for a provide squeeze, doubtlessly propelling Ether to new heights.

Associated Studying

Exodus To Self-Custody: A Bullish Sign?

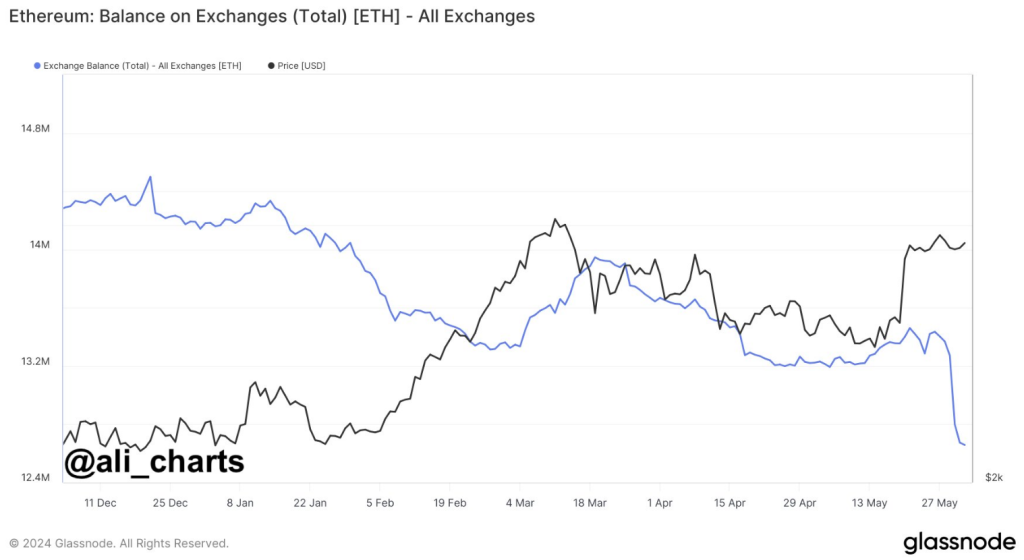

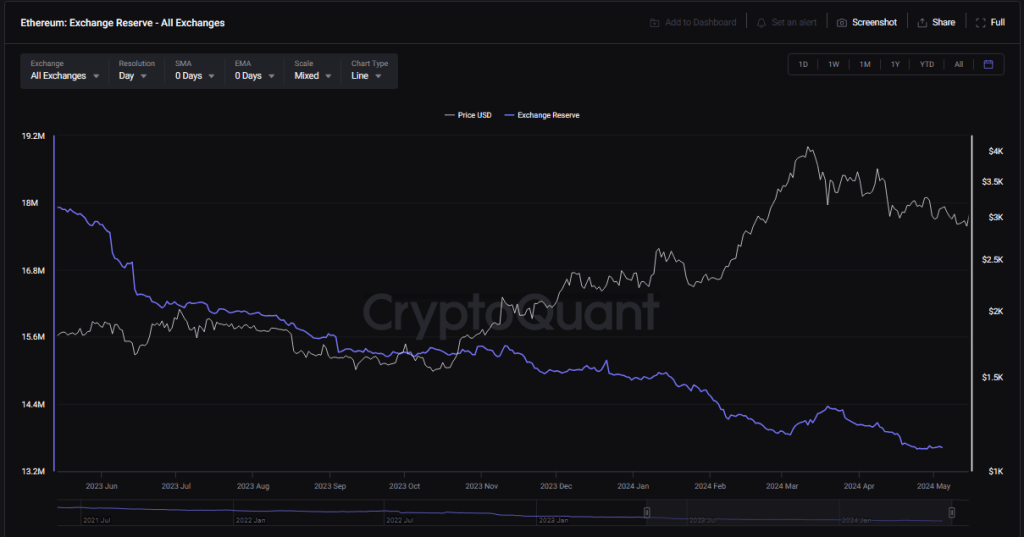

Crypto analyst Ali Martinez reported on X in a current submit that for the reason that US legalized spot Ethereum ETF merchandise, practically 777,000 ETH, or nearly $3 billion, have been faraway from cryptocurrency exchanges. Even when the Ether ETF merchandise haven’t formally begun buying and selling on exchanges but, the continuation of this development may have a big influence on how ETH costs behave over time.

Because the @SECGov accepted spot #Ethereum ETFs, roughly 777,000 $ETH — valued at about $3 billion — have been withdrawn from #crypto exchanges! pic.twitter.com/EzQVC0cw27

— Ali (@ali_charts) June 2, 2024

Historically, excessive reserves on exchanges have indicated a selling-heavy market, with traders readily offloading their holdings. The present state of affairs, nonetheless, paints a distinct image. Analysts recommend this mass exodus signifies a shift in investor sentiment. Many are transferring their Ether to private wallets, a transfer often known as self-custody, indicating a long-term bullish outlook.

The low change reserves recommend traders are treating Ether not simply as a buying and selling asset, however as a possible retailer of worth, says Michael Nadeau, a DeFi report crypto analyst. This shift in mindset, coupled with the potential for elevated demand from ETFs, may create an ideal storm for a worth surge.

The Ethereum community itself can also be contributing to the provision squeeze. Not like Bitcoin miners who face fixed operational prices, Ethereum validators, accountable for securing the community underneath the Proof-of-Stake mannequin, don’t have the identical monetary stress to promote their holdings. This lack of “structural promote stress,” as Nadeau phrases it, additional restricts the available provide of Ether.

Ethereum ETF Launch: A Double-Edged Sword?

The upcoming launch of Ether ETFs in late June provides one other layer of intrigue. The success of spot Bitcoin ETFs in January, which noticed a big worth enhance for Bitcoin, serves as a possible roadmap for Ether. Analysts predict an analogous demand surge, pushing the worth of Ether in the direction of, and even past, its all-time excessive of $4,871 set in November 2021.

Nevertheless, a possible roadblock exists within the type of Grayscale’s Ethereum Belief (ETHE), an enormous funding automobile at present holding a staggering $11 billion price of Ether. If Grayscale decides to comply with go well with with its Bitcoin Belief (GBTC), which skilled over $6 billion in outflows after the launch of spot Bitcoin ETFs, it may dampen the worth enhance.

Associated Studying

Buckle Up For A Bumpy Experience?

Whereas the longer term stays unsure, the present market circumstances current an interesting state of affairs for Ether. The mix of a shrinking provide and the potential inflow of demand from ETFs paints an image of a potential bull run. Nevertheless, the wildcard of Grayscale’s actions and the broader market sentiment inject a dose of warning.

Featured picture from Present Affairs-Adda247, chart from TradingView