Not solely has Ethereum (ETH) seen a powerful rise of almost 100% within the first quarter of 2024 by way of value motion, however the Ethereum blockchain has additionally generated substantial earnings of as much as $369 million throughout this era. This surprising profitability has raised questions on how a blockchain like Ethereum may be worthwhile.

Ethereum Income Potential

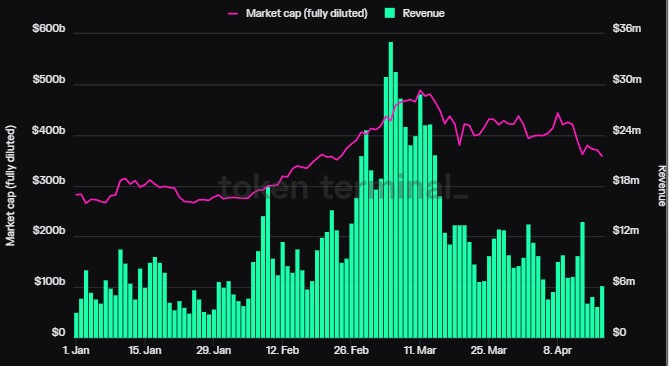

As famous in a latest evaluation by the on-chain knowledge platform Token Termina, the gathering of transaction charges is a crucial facet of Ethereum’s enterprise mannequin.

All community customers are required to pay charges in ETH when interacting with functions on the blockchain, which serves as an vital income for Ethereum.

As soon as transaction charges are paid, a portion of the ETH is burned and completely faraway from circulation. This course of, generally known as “ETH buyback,” advantages current ETH holders, because the discount in provide will increase the shortage and worth of the remaining ETH tokens. Thus, the day by day burning of ETH contributes to the financial advantage of these holding Ethereum.

In distinction to the burning of ETH, Ethereum additionally points new ETH tokens as rewards to the community’s validators for every new block added to the blockchain.

These rewards are just like conventional stock-based compensation and are designed to incentivize validators to safe and preserve the community’s integrity.

Nonetheless, it’s vital to notice that the issuance of latest ETH tokens dilutes the holdings of current ETH holders.

In keeping with Token Terminal, the distinction between the day by day USD worth of the burned ETH (income) and the newly issued ETH (bills) represents the day by day earnings for current ETH holders, primarily the Ethereum blockchain house owners. This calculation permits for the dedication of Ethereum’s profitability on a day-to-day foundation.

Lowered Transaction Prices Drive $3.3 Billion Development

Along with the overhauled income mannequin carried out by the Ethereum blockchain, the launch of the much-anticipated Dencun improve to the Ethereum ecosystem on the finish of the primary quarter of 2024 introduced important adjustments, together with the introduction of a revolutionary knowledge storage system known as blobs.

This improve has lowered congestion on the Ethereum community and considerably lowered transaction prices on Layer 2 networks corresponding to Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base.

Implementing the Dencun improve, alongside the adoption of blobs and Layer 2 networks, has considerably impacted Ethereum’s income.

In keeping with Token Terminal knowledge, the blockchain’s income has witnessed an 18% annualized improve, amounting to a powerful $3.3 billion. These income features may be attributed to lowered transaction prices, making Ethereum a extra engaging platform for customers and builders.

Regardless of the optimistic income development, it’s important to acknowledge the influence of market corrections and dampened investor curiosity within the second quarter of 2024.

Over the previous 30 days, Ethereum’s income has declined by over 52%. This downturn may be attributed to the broader market dynamics and the short-term lower in investor enthusiasm.

Analyzing the info over the previous 30 days, Ethereum’s market cap (totally diluted) has decreased by 15.2% to $358.47 billion. Equally, the circulating market cap has declined by 15.2% to achieve the identical worth.

Moreover, the token buying and selling quantity over the previous 30 days has declined 18.6%, totaling $586.14 billion.

ETH is buying and selling at $3,042, up 0.4% within the final 24 hours. It stays to be seen whether or not these adjustments and the discount in charges can have the identical impact within the second quarter of the 12 months, and the way this, coupled with a possible improve in buying and selling quantity, can push the ETH value to increased ranges.

Featured picture from Shutterstock, chart from TradingView.com