The previous few weeks have been a rollercoaster trip for Ethereum. Buoyed by a waning Bitcoin dominance and an inflow of merchants looking for greener pastures, Ethereum’s value surged in direction of essential resistance ranges close to $2,500.

But, a palpable nervousness lingers within the air, fueled by questions on Ethereum’s long-term scalability and the rising refrain of bearish whispers. Can the second-largest crypto navigate this tightrope stroll and reclaim its DeFi crown, or will it take a tumble from grace?

Ethereum Rises: Progress, Improvements, And Challenges

Beneath the floor of rising value charts lies a fancy story of intertwined strengths and weaknesses. Ethereum’s spectacular 87% year-on-year market cap surge, catapulting it from $140 billion to a hefty $267 billion, paints an image of sturdy development.

The Merge improve, a landmark occasion streamlining Ethereum’s blockchain, and the burgeoning DeFi ecosystem pulsating with progressive functions are key contributors to this ascent.

Nevertheless, lurking beneath this facade is a essential bottleneck: Ethereum’s Layer 1 scalability limitations. The community’s infamous excessive transaction charges and sluggish throughput have develop into thorns within the facet of DeFi growth, irritating each customers and builders craving for a smoother expertise.

As of writing, on this twenty sixth of December, Ethereum’s value hovers round $2,233, portray the day by day and weekly charts purple with a dip of roughly 1.5%, information from Coingecko reveals. This latest descent provides additional intrigue to the advanced dance Ethereum is performing close to the essential $2,500 resistance stage.

This delicate dance between bullish aspiration and bearish stress underscores the delicate equilibrium available in the market. On one hand, the optimism surrounding Ethereum’s future potential continues to attract in merchants.

However, the specter of excessive transaction charges and scalability woes, alongside whispers of a possible bear market, retains promoting stress simmering just under the floor.

Ethereum At $2,300: Bulls’ Battle, Bears’ Threats

For Ethereum bulls, the $2,300 stage is an important battleground. If they will muster sufficient buy-side drive to maintain a climb above this mark, it might pave the best way for a surge in direction of the coveted $2,500 resistance stage. This breakthrough can be a major psychological victory, injecting contemporary confidence into the market and doubtlessly triggering a brand new upward development part.

Nevertheless, the bears should not out for the depend. Their sights are set on breaching the $2,200 assist stage, which might solidify their grip and doubtlessly set off a extra substantial decline. Ought to this situation unfold, the $2,000 mark might come into play, with additional losses doable if promoting stress stays unchecked.

Including to the intrigue is the issue of alternate provide. A latest improve in Ethereum tokens on exchanges signifies extra available ETH for sellers, doubtlessly amplifying downward stress. This highlights the fragile steadiness between market sentiment and technical components in figuring out Ethereum’s future trajectory.

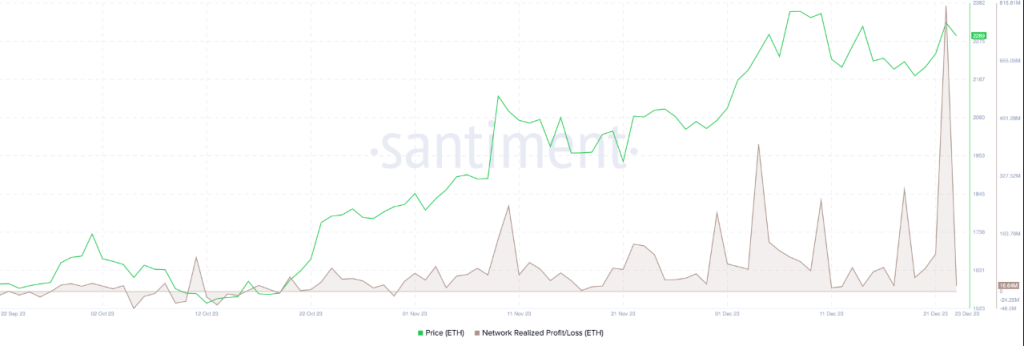

In the meantime, the ETH merchants’ profit-taking is clear within the Community Realized Revenue/Loss between October 31 and December 23. A major quantity of profit-taking might trigger the value of ETH to say no.

Ethereum’s Essential Crossroads Forward

Trying forward, Ethereum’s path hinges on its potential to navigate this advanced panorama. Addressing its scalability points by Layer 2 options and potential future upgrades will likely be essential for sustaining and increasing its DeFi dominance.

Rekindling developer and person confidence by lowering transaction charges and bettering community throughput can also be paramount. Solely by tackling these inside challenges and adapting to the ever-evolving crypto sphere can Ethereum really reclaim its throne because the king of DeFi.

The following few weeks are prone to be pivotal for Ethereum. Will it scale the $2,500 top and cement its place as a frontrunner within the crypto revolution? Or will inside limitations and exterior pressures drive it to face a precipitous drop?

Featured picture from Shutterstock