ETH derivatives quantity means that Ethereum traders have little confidence within the Spot Ethereum ETFs, sparking an enormous rally for the second-largest crypto token by market cap. This growth comes amid the upcoming launch of those funds, that are anticipated to start buying and selling subsequent week.

Ethereum Futures Premium Highlights Little Confidence In ETH’s Value

Based on information from Laevitas, Ethereum’s fixed-month contracts annualized premium presently stands at 11%, suggesting that crypto merchants aren’t bullish sufficient on ETH’s value. Additional information from Laevitas reveals that this indicator has but to maintain ranges above 12% this previous month.

Associated Studying

That is shocking contemplating that the Spot Ethereum ETFs, which might launch subsequent week, are anticipated to spark a value surge for Ethereum. Crypto analysts like Linda have predicted that ETH might rise to as excessive as $4,000 because of the inflows these Spot Ethereum ETFs might witness.

Nevertheless, crypto merchants should not satisfied that Ethereum’s reaching such heights is prone to occur, no less than not quickly sufficient. A believable clarification for this lack of extreme bullishness is that Ethereum’s value might proceed to commerce sideways for some time, because of the $110 million every day outflows that analysis agency Kaiko projected might circulate from Grayscale’s Spot Ethereum ETF.

Furthermore, this appears probably following the ultimate S-1 filings by the Spot Ethereum ETF issuers, which confirmed that Grayscale has the very best charges. The asset supervisor plans to cost a administration payment of two.50%, whereas the very best payment amongst different Spot Ethereum ETF issuers is 0.25%.

Grayscale had carried out one thing comparable with its Spot Bitcoin ETF, setting its administration payment at 1.5%, whereas the opposite Spot Bitcoin ETF issuers had administration charges ranging between 0.19% and 0.39%. That transfer is believed to have been one of many the reason why Grayscale’s Bitcoin ETF witnessed important outflows following the launch of the Spot Bitcoin ETFs.

Making A Case For Ethereum’s Inevitable Value Surge

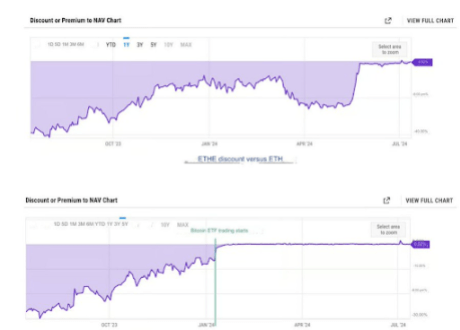

Crypto analyst Leon Waidmann has made a bullish case for ETH’s value and defined why Ethereum traders needs to be extra bullish. He famous that the low cost between Grayscale’s Ethereum Belief (ETHE) and ETH’s value has considerably narrowed because the Spot Ethereum ETFs had been accredited earlier in Could.

Associated Studying

Waidmann acknowledged that this has given ETHE traders ample time to exit their positions with out important reductions in comparison with Grayscale’s Bitcoin Belief (GBTC). Another excuse GBTC is believed to have skilled such outflows was due to traders who had been taking earnings from having invested within the belief at a discounted value to Bitcoin’s spot value.

Nevertheless, not like GBTC and different Spot Bitcoin ETFs, ETHE and different Spot Ethereum ETFs didn’t begin buying and selling instantly after approval. Subsequently, Waidmann believes that whoever supposed to revenue from the low cost between ETHE and ETH’s value will need to have already carried out so prior to now. As such, Grayscale’s ETHE shouldn’t witness the identical quantity of profit-taking as Grayscale’s GBTC did after it started buying and selling.

Featured picture created with Dall.E, chart from Tradingview.com