Fast Take

As Bitcoin’s value has surged roughly 50% because the starting of 2024, knowledge from Glassnode reveals a noteworthy sample in conduct amongst short-term holders (STHs), outlined as buyers holding Bitcoin for lower than 155 days, who are likely to exhibit a sample of worry and greed—shopping for excessive and promoting low.

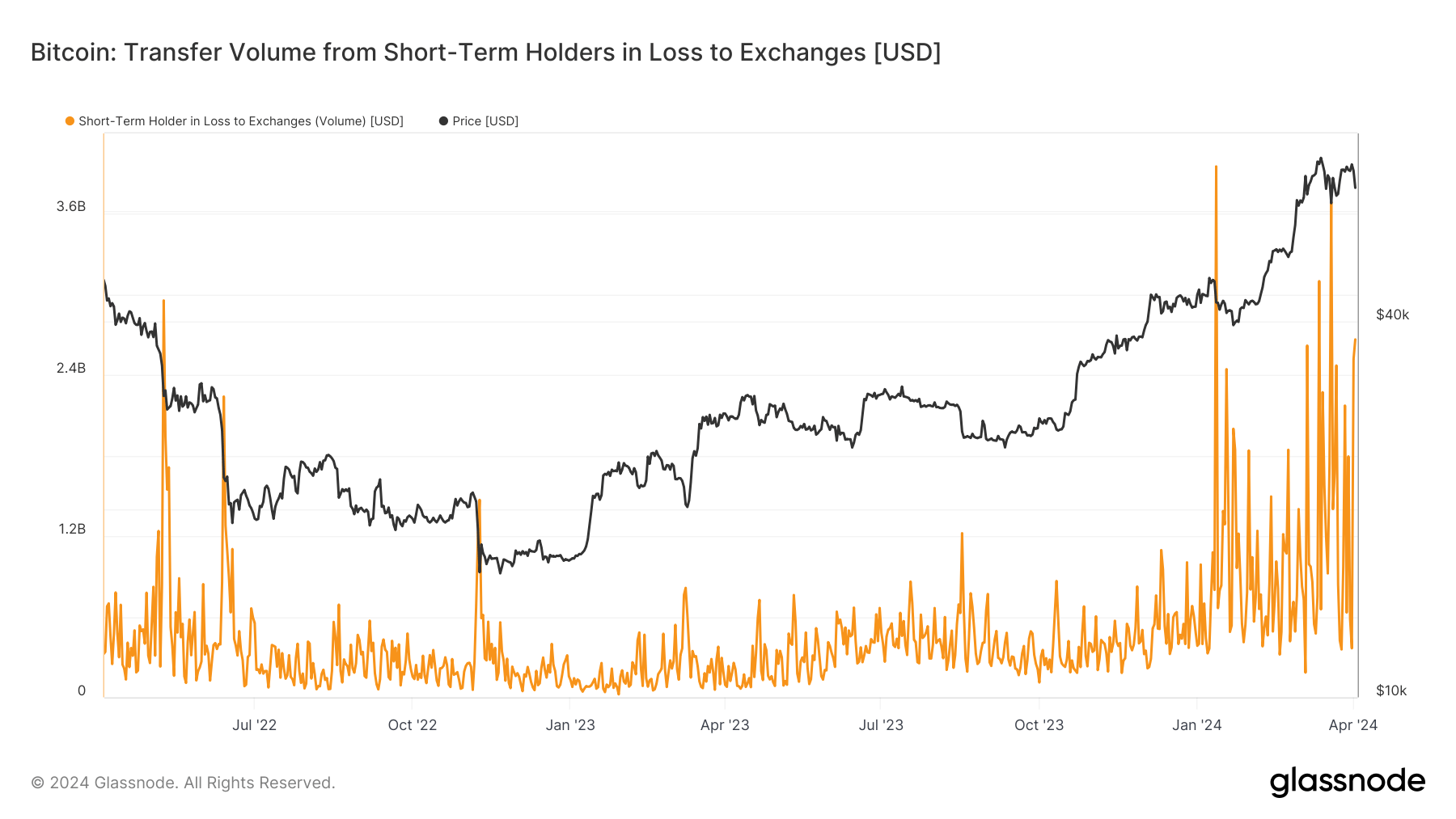

Glassnode knowledge exhibits that throughout the previous two days of April, as Bitcoin skilled a 2.4% dip on Apr. 1, adopted by a 6% decline on Apr. 2, a considerable $5.2 billion, equal to roughly 76k Bitcoin was despatched to exchanges at a loss by STHs.

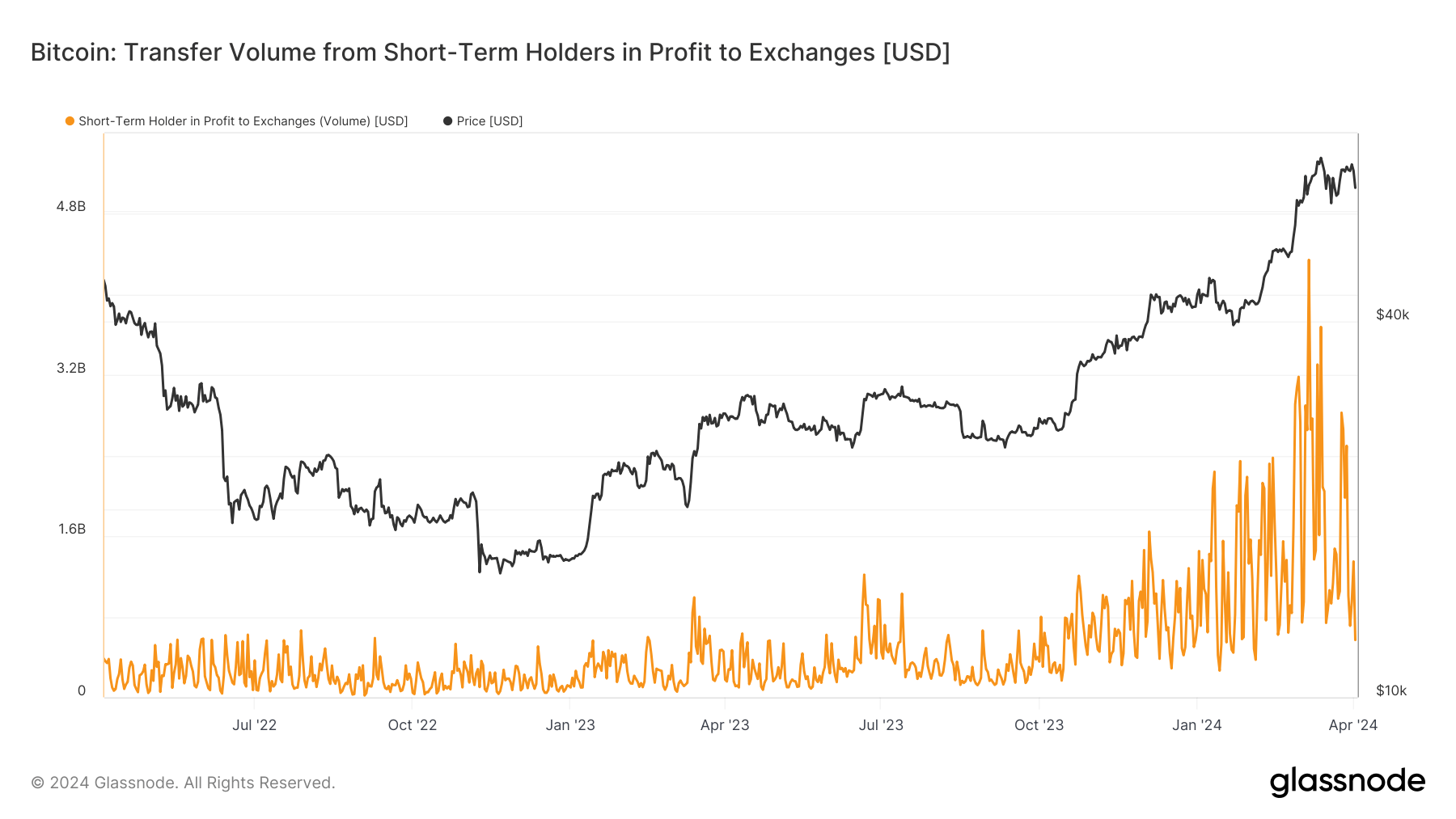

In distinction, solely round $570 million in earnings was despatched to exchanges by this group on Apr. 2—a determine that represents one of many lowest ranges noticed this yr.

This sample displays the emotional conduct generally noticed amongst STHs. Whereas important profit-taking was evident when Bitcoin reached new all-time highs final month, the latest sell-offs at losses point out the worry and capitulation that continuously have an effect on short-term speculators throughout market downturns.

The publish Emotional buying and selling patterns hit short-term Bitcoin holders’ wallets appeared first on CryptoSlate.