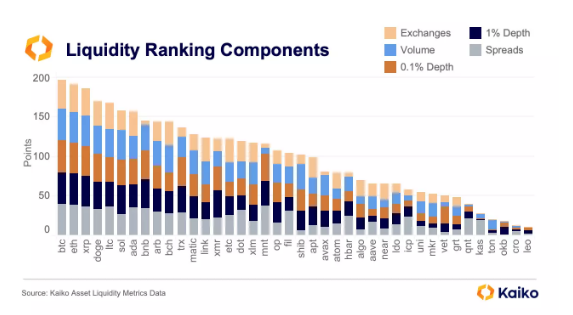

Kaiko, a blockchain analytics platform, carried out an investigation that exposed the complexities of liquidity throughout the largest crypto property, with some decrease market cap property beating greater ones. In keeping with its Q3 liquidity rankings, XRP and Dogecoin (DOGE) managed to beat out Solana and Cardano in liquidity rankings, coming in behind solely Bitcoin and Ethereum. There have been additionally some shock numbers on the rankings, like BNB coming in eighth when it comes to liquidity, and Litecoin additionally outperforming.

Kaiko Evaluation Highlights Liquidity For Crypto Belongings

The huge variety of crypto property has at all times introduced out the thought amongst buyers to rank their valuation on a scale of some kind, with probably the most adopted being the market cap. Nonetheless, based on Kaiko, liquidity, together with different metrics like quantity and market depth is a greater approach to measure a token’s actual worth other than its market cap. This was finest demonstrated by FTX’s token FTT, whose market was bloated to succeed in a peak of almost $10 billion with out having sufficient liquidity on exchanges to again this up.

In keeping with its newest rankings, Bitcoin took up the primary spot in liquidity. This wasn’t shocking, as Bitcoin has at all times held a decent reign over the crypto trade since its inception. Ethereum adopted in second place when it comes to liquidity to reiterate its place because the king of altcoins. Nonetheless, Kaiko’s liquidity rankings began to digress from the market cap on the third place, with BNB underperforming massively to return in at eighth place.

As an alternative, XRP got here in at 4th place, beating out the likes of Solana and Cardano (the Ethereum killers) on exchanges amongst merchants. XRP’s liquidity enhance within the quarter was due to the asset receiving regulatory readability within the US. Dogecoin got here in at fifth place, regardless of being tenth on market cap rankings, to solidify its place because the chief amongst meme cash. Litecoin got here in at fifth place to finish the highest 5, regardless of being 18th in market cap rankings.

Complete crypto market cap at $1.59 trillion on the day by day chart: TradingView.com

However, AVAX’s liquidity rating dropped 11 locations when in comparison with its market cap, whereas TON got here in at thirty seventh place regardless of being ninth by market cap through the quarter. Additionally, ATOM, UNI, APT, TON, SHIB, OKB, LEO, and CRO all fell greater than 5 spots.

What Does Liquidity Say About Dogecoin And Crypto Belongings?

Kaiko’s measure of liquidity included the unfold and the common day by day buying and selling quantity on totally different exchanges. The analytics platform additionally included two totally different market depth ranges; 0.1% for greater frequency merchants and 1% for longer-term holders.

When it comes to buying and selling quantity, BTC got here in first place whereas ETH and XRP adopted swimsuit. Nonetheless, SOL beat DOGE on this metric with round $2 billion within the quarter.

The underside line is that better liquidity typically precedes better success over the long term for cryptocurrencies. This fall 2023 ought to inform a robust story when it comes to crypto liquidity, as most cryptocurrencies registered new yearly highs when it comes to market cap.

Featured picture from Shutterstock

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site completely at your personal danger.