Dogecoin has been a focus within the cryptocurrency world, and a mixture of optimistic and detrimental alerts is setting its future. On one hand, the variety of Dogecoin addresses has been rising. However, the latest technical evaluation provides much less motive for optimism over the brief to medium time period. What should traders make of this twin narrative?

Associated Studying

Dogecoin Rising Adoption: Silver Lining

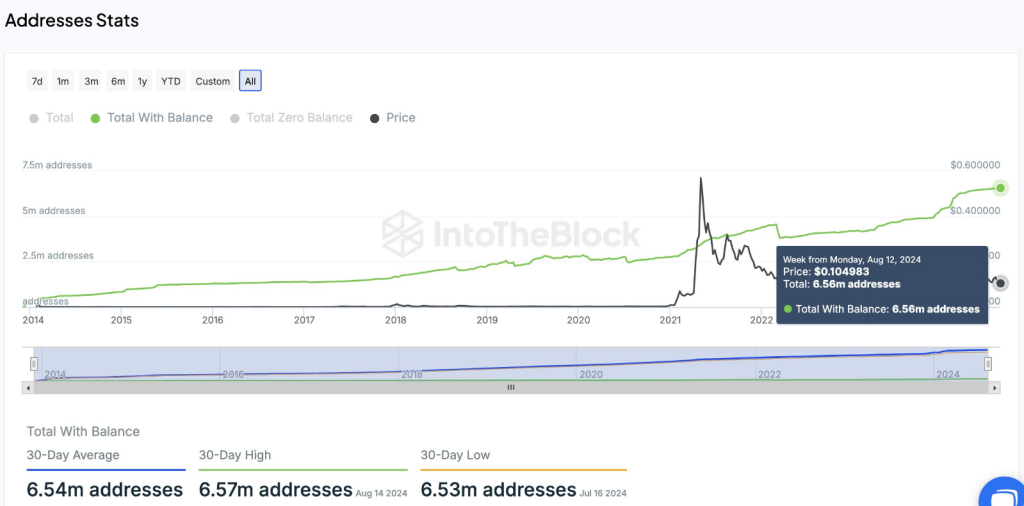

Information from the newest charts on Crypto Every day Commerce Indicators reveal that the variety of Dogecoin addresses with a steadiness has grown to six.56 million, up 20% from eight months in the past. Such an adoption swing signifies that extra persons are holding on to their DOGE for additional good points. This has developed into a robust vote of confidence within the cryptocurrency whereas its value has been unable to realize traction.

#Dogecoin Addresses Hit 6.56M

IntoTheBlock’s addresses metric highlights a continued enhance within the whole variety of Dogecoin addresses with a steadiness. Within the final eight months, addresses within the ecosystem grew 20.1% to six.56 million from 5.43 million. Dogecoin value decline since… pic.twitter.com/A3im2BrcV0— Crypto Every day Commerce Indicators (@cryptodailyTS) August 16, 2024

This optimism, nonetheless, is considerably offset by a number of short-term indicators. In response to IntoTheBlock, the value of Dogecoin has been trending down regardless of the regular enhance in lively addresses. The Worry & Greed Index at present rests at 25, which interprets to “Excessive Worry,” a direct indication that the market is in a state of fear. This typically results in elevated promoting stress, additional miserable costs.

Bearish Quick-Time period Forecast: Ought to You Be Nervous?

Technical evaluation by crypto value prediction platform CoinCodex signifies additional bearish motion within the instant future for Dogecoin. It’s estimated that by September 16, 2024, Dogecoin will drop by 14% to a value goal of $0.087023. That is supported by the truth that over the previous 30 days, Dogecoin has solely spent eight days optimistic, indicative of its downward pattern.

The worth volatility has been excessive at 11% over the past month, indicating excessive swings in costs and uncertainty available in the market. This type of volatility at these ranges, together with such excessive concern available in the market, additional signifies that there could also be extra downward stress on Dogecoin in upcoming weeks. In that case, this is probably not time for one to spend money on DOGE.

Contradictory Indicators: What’s The Actual Story?

The distinction between the rising variety of Dogecoin addresses and a bearish value forecast is relatively puzzling. On one hand, the rising consumer base may very well be seen as an ultra-bullish signal: extra individuals and prospects for additional growth. However, detrimental technical indicators and fearful sentiment of the market forged a shadow.

Associated Studying

A falling wedge that normally has a bullish bias in value motion has dominated Dogecoin lately. Although that is the case, contemplating market situations, such a breakout seems unlikely within the close to future. Within the setting of the resistance at $0.11, analysts are usually not very positive that it shall be reached as a result of present bearish sentiment.

Dogecoin is in a mixed-signal scenario in the mean time. Whereas the adoption continues to extend, the short-term technical evaluation leans bearish. The Worry & Greed Index, coupled with the latest value efficiency and excessive volatility, is all indicating that the market doesn’t favor Dogecoin at this level.

Featured picture from ZyCrypto, chart from TradingView