As reported by Fortune Journal, the cryptocurrency market has been experiencing vital volatility as Bitcoin (BTC) has skilled a pointy decline that has had a domino affect on different cryptocurrencies. The current drop within the worth of Bitcoin, coupled with outflows from Grayscale’s GBTC, has raised considerations amongst traders.

Bitcoin Sees 14% Correction From ATH

Bitcoin suffered a 14% drop since reaching its all-time excessive (ATH) of $73,700 final week, briefly touching $62,483 on Tuesday morning. Nonetheless, it recovered and stabilized round $64,900, slightly below the $65,000 mark.

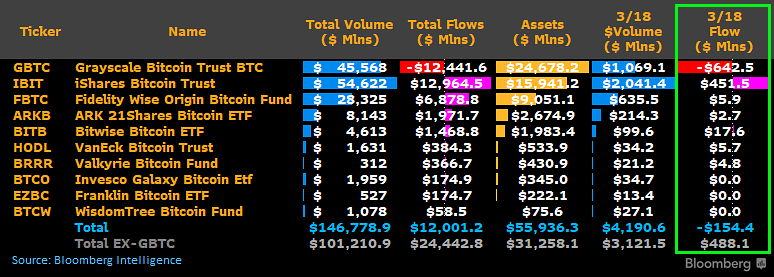

The decline was attributed to report outflows of over $640 million from Grayscale’s Bitcoin Belief (GBTC). As compared, different spot Bitcoin ETFs noticed inflows of lower than $500 million, leading to a internet outflow of $15 million on Monday, in accordance to Bloomberg ETF skilled James Seyffart.

This outflow from GBTC, mixed with the cautious sentiment surrounding the Federal Open Market Committee (FOMC) assembly within the US, has had a big affect on Bitcoin’s efficiency.

As not too long ago reported by NewsBTC, traders exhibited warning forward of the FOMC assembly, intently monitoring the potential adjustments in rates of interest. Current higher-than-expected inflation information, as indicated by the US Client Worth Index (CPI) and Producer Worth Index (PPI), dampened expectations of rate of interest cuts.

In accordance with Fortune, the CME FedWatch Device projected a 99% chance of charges remaining unchanged, additional affecting market sentiment. Per the report, traders have been eager to gauge the Federal Reserve’s stance on financial coverage, contributing to the cautious buying and selling setting.

In the identical context, the Financial institution of Japan raised its key rate of interest from -0.1% to 0% to 0.1% in response to rising shopper costs. This was the primary charge improve in 17 years.

Crypto Futures Merchants Take A Hit

The drop in Bitcoin’s worth had a cascading impact on different cryptocurrencies. Main altcoins like Ethereum (ETH) and Solana (SOL) skilled vital declines of 8.1% and 12.5% over the previous 24 hours, respectively.

Meme cash, together with Floki Inu (FLOKI), Bonk Inu (Bonk), and Dogecoin (DOGE), additionally suffered losses of 34%, 28.5%, and 24.8%, respectively, throughout the previous week.

The decline in cryptocurrency costs resulted in over $440 million price of liquidations for merchants of crypto futures. Merchants who had leveraged positions betting on greater costs confronted vital losses. Most of those liquidations occurred on Binance, totaling $212 million, adopted by OKX at $170 million.

Regardless of its worth correction, BTC retains substantial good points of over 26% and 132% previously thirty days and year-to-date timeframe, respectively.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site completely at your personal danger.