The crypto market is ending the yr on a robust be aware as a document $18 billion price of choices contracts are set to run out.

Choices enable merchants to invest or hedge towards worth actions. A name choice grants the proper to purchase an asset at a selected worth, whereas a put choice supplies the proper to promote beneath related phrases.

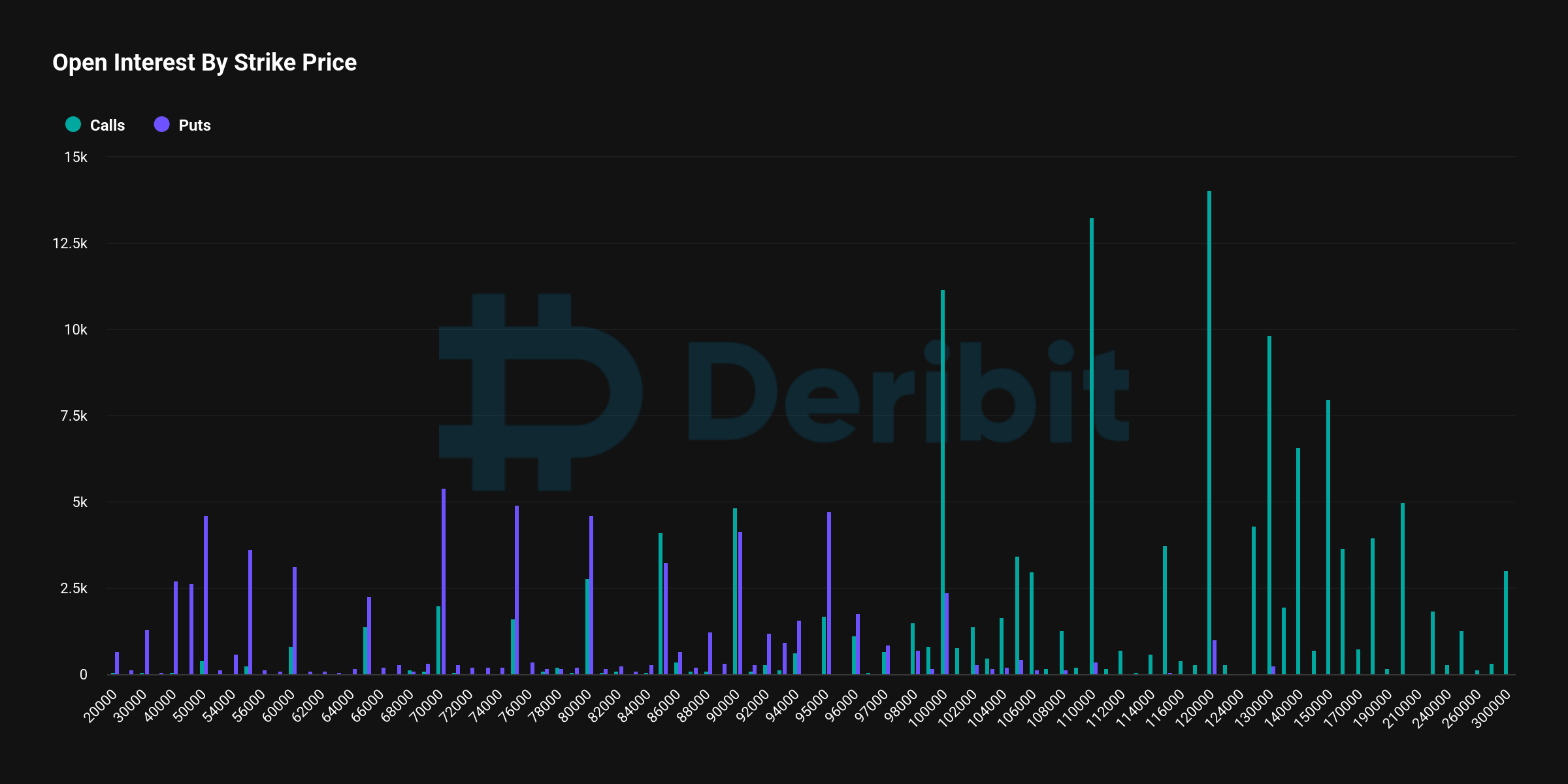

Information from Deribit exhibits that almost 150,000 Bitcoin (BTC) contracts—valued at $14.17 billion—are concerned on this expiry.

These contracts present a Put-Name Ratio of 0.69, that means bullish merchants dominate as they wager on greater costs. The Max Ache stage, the place most consumers face losses and sellers revenue, is $85,000.

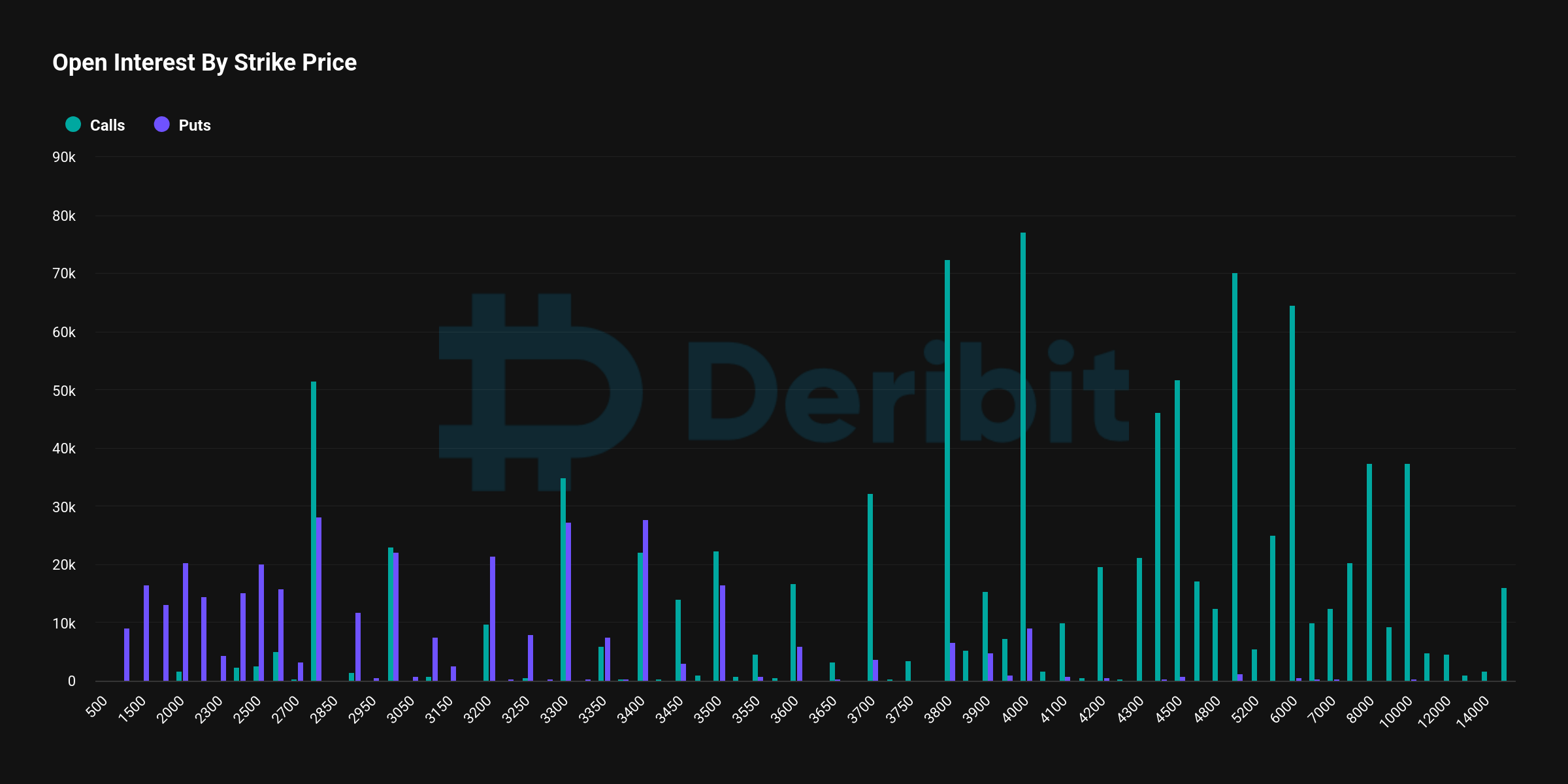

Ethereum (ETH) choices are additionally experiencing important exercise, with 1.12 million contracts expiring. These contracts, carrying a mixed worth of over $3 billion, mirror a bullish market outlook with a Put-Name Ratio of 0.41. The utmost ache worth is $3,000.

Deribit said that this year-end occasion illustrates the bullish yr for crypto markets, however uncertainty stays excessive. The agency famous that fluctuations in volatility measures just like the Deribit Volatility Index (DVOL) and vol-of-vol counsel the potential for sharp worth swings.

It added:

“With the market closely leveraged to the upside, any important draw back transfer may set off a fast snowball impact.”