The Depository Belief and Clearing Company (DTCC) has declared that exchange-traded funds (ETFs) linked to Bitcoin (BTC) or cryptocurrencies haven’t any collateral worth as investments.

In an announcement, the DTCC, which offers clearing and settlement providers to the monetary markets within the US, says digital asset-linked ETFs might be topic to a 100% “haircut.”

“No collateral worth might be given for any ETF or different funding automobile that features Bitcoin or another

cryptocurrency as an underlying funding, therefore might be topic to a 100% haircut.”

In keeping with the announcement, the DTCC’s new modifications might be efficient April 30, 2024, and can presumably have an effect on place values on the corporate’s collateral monitor.

After going into impact, the modifications imply that entities can not use Bitcoin or crypto-linked ETFs as collateral when making use of for credit score or financing by means of the DTCC.

In March, digital belongings supervisor CoinShares mentioned establishments poured a brand new weekly report of $2.9 billion into crypto funding merchandise, largely pushed by the Bitcoin ETFs.

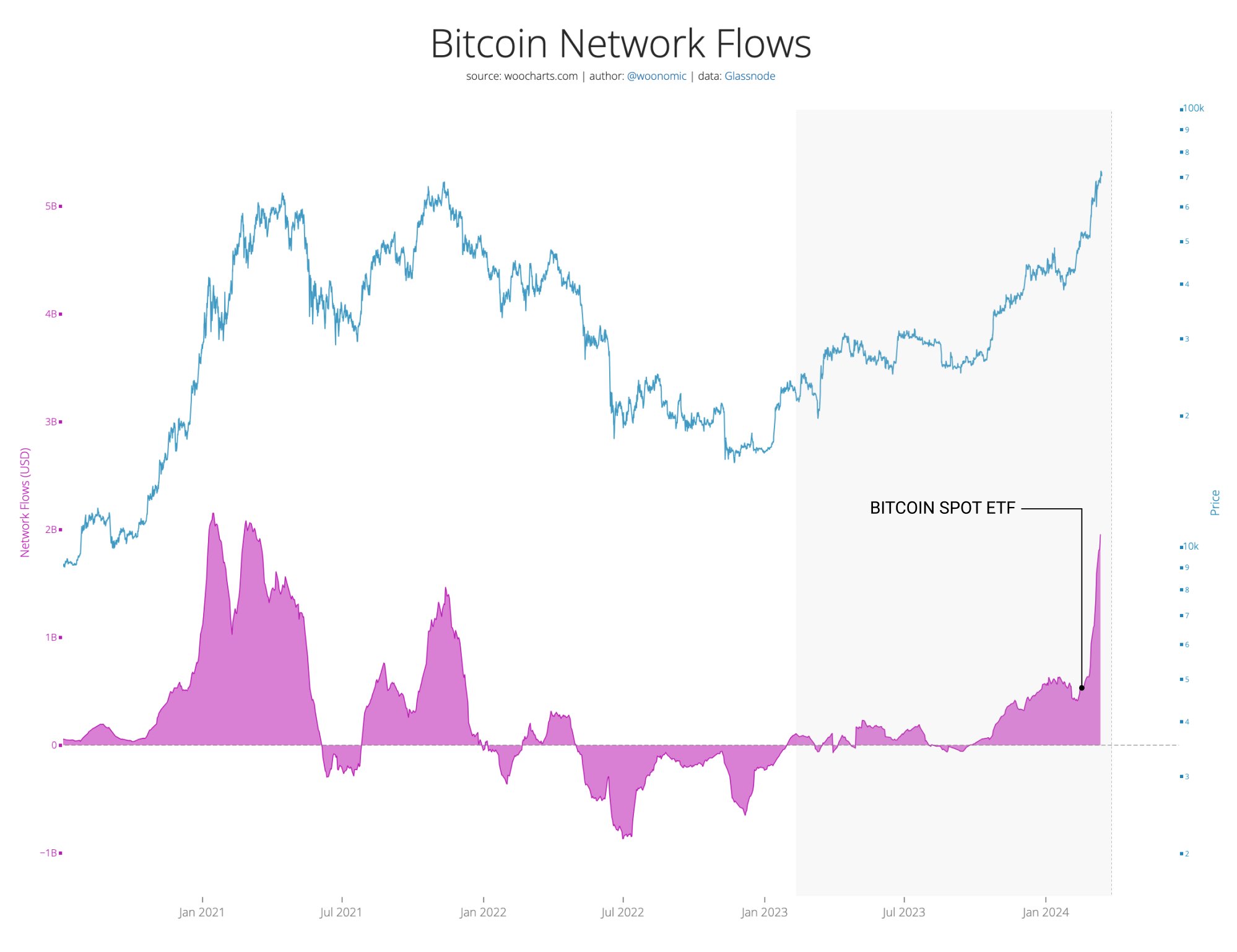

On-chain analyst Willy Woo lately informed his 1 million followers on the social media platform X that each day inflows of capital being saved by the Bitcoin community – largely pushed by the ETFs – lately hit $2 billion per day, equal to the extent of the final full-blown bull market.

“This time it ought to climb a lot greater. Spot ETFs (exchange-traded funds) are opening up the influx pipes markedly.

The inflows are measured on-chain so this consists of all buyers. It’s about 90% correct. Additionally indicative that the ETFs are round 30% of complete flows proper now.

Particularly, you’re taking the each day change in entity-adjusted realized capitalization. Entity-adjusted Actual Cap tallies the worth paid for each BTC once they moved to the present HODLers, it is a measure of the USD saved within the community.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you might incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney