HodlX Visitor Submit Submit Your Submit

What’s DePIN

There’s been a variety of buzz currently about DePINs (decentralized bodily infrastructure networks).

This sector is attracting a variety of consideration as a result of it has a large potential consumer base and a novel solution to increase infrastructure networks from the bottom up with no need a government.

As a report by Messari suggests, DePIN might add $10 trillion to the worldwide GDP (gross home product) within the subsequent decade and $100 trillion the last decade after.

DePINs are seen by some as a game-changer for the way we distribute sources world wide not simply bodily issues however digital ones too.

In addition they maintain promise as a model new solution to construct large-scale infrastructure initiatives.

Put merely, DePINs are the decentralized model of conventional infrastructure and providers we people use.

On the coronary heart of every of those initiatives, there may be an economic system that assure the liveliness of its choices.

This occurs by incentivizing community contributors i.e. suppliers to allocate their capital or unused sources like cupboard space.

We think about a mission within the DePIN sector if it’s a blockchain-based platform that incentivizes individuals to hitch a community and preserve bodily {hardware} or software program providers.

Such providers span throughout an unlimited panorama, together with however not restricted to IoT (web of issues) sensors, storage, climate stations, Wi-Fi, computational energy, power grids, mapping (navigation) and even meals supply.

The final word aim right here is to create a distributed and clear system, boosting the scalability and effectivity of at this time’s infrastructures.

These infrastructures can be found in two main classes.

- {Hardware}-focused or PRNs (bodily useful resource networks) These sources are tied to a selected location. They supply providers in a specific space and infrequently can’t be simply moved elsewhere. Wi-fi, power, and sensors (e.g. climate, mapping, noise air pollution) networks all belong to this department.

- Software program-focused or DRNs (digital useful resource networks) like computing energy, storage, retrieval, knowledge / AI (e.g., wholesale knowledge) and providers marketplaces (e.g., abilities, ride-sharing, meals supply, advert networks), which might be all location-independent and fungible.

How does DePIN profit us with actual world benefits

Traditionally talking, constructing a bodily infrastructure has all the time demanded an enormous quantity of capital and operational bills, making this business dominated by huge tech firms like Amazon and Microsoft.

Now DePIN is right here to disturb the monopoly by leveraging blockchain know-how.

Decentralizing of bodily techniques has notable advantages over the centralized method, similar to the next.

- Greater stage of safety no single level of failure

- Transparency

- Price effectivity

- Scalability

- Monetary rewards for community contributors

How does a DePIN mission really work

DePIN bridges between real-world infrastructure and the blockchain. Think about it like this there’s a bodily gear/useful resource owned by a supplier.

Then a particular software program acts as a intermediary, connecting this gear/useful resource to the blockchain. Lastly, a public ledger like an enormous logbook retains monitor of the whole lot.

Let’s dive deeper into the three elements talked about above.

Bodily gear / useful resource

DePINs depend on bodily infrastructure to be constructed and developed in the actual world.

This infrastructure will be varied issues, like sensors, vehicles, storage hardwares and even photo voltaic panels, sometimes managed by particular person / personal suppliers.

Middleware

This half acts like a translator between the blockchain and the bodily world. It makes use of a particular system, like an oracle, to usher in real-world knowledge.

This knowledge is then examined to determine how a lot customers are contributing and the precise want for the service.

Blockchain structure

DePINs make the most of blockchain know-how’s capabilities. Blockchains operate as tamper-proof registries and ledgers, making them ideally suited for monitoring gadgets and in addition establishing token-based digital economies.

The blockchain performs three necessary roles in DePINs i.e., administration, funds and record-keeping that are mentioned beneath.

- Administration DePINs construct permissionless techniques primarily based on blockchain know-how, that means that anybody can develop into a consumer or a supplier if they’ve important sources / gear.

- Funds Customers pay for providers by blockchain-based techniques, whereas suppliers get rewarded for his or her contributions.

- Document-keeping Each single exercise and transaction within the community is recorded on the blockchain, which is usually obtainable for public viewing.

Final however not least, DePIN networks have a magic wand that helps them overcome the difficulties with constructing a sustainable, useful and actually decentralized bodily infrastructure in the actual world.

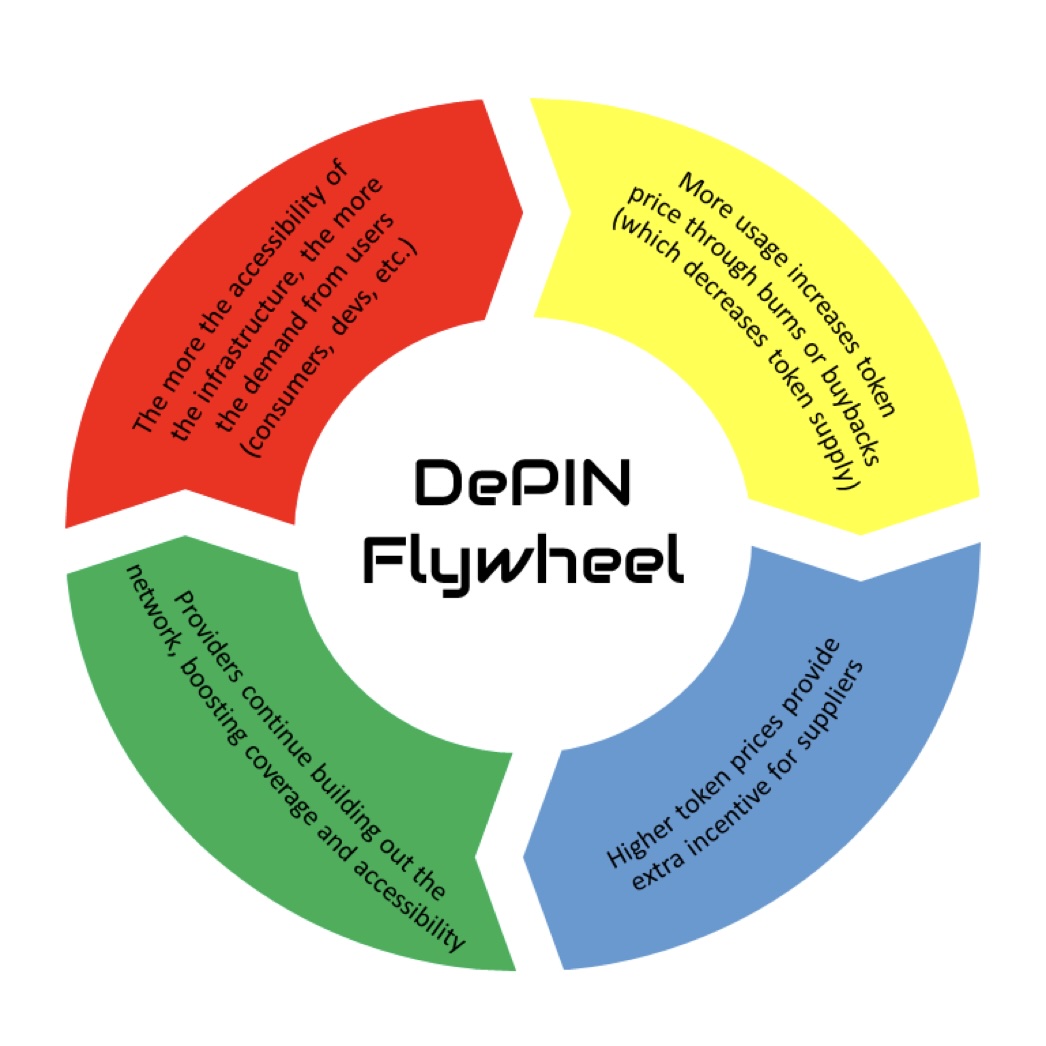

That secret superpower is known as, ‘The DePIN Flywheel.’ The important thing to a profitable DePIN mission is a self-sustaining loop of development.

Tokens act as rewards to draw individuals to hitch the community initially, fixing the problem of discovering preliminary contributors, often known as a ‘chilly begin’ problem.

As extra suppliers be a part of the community, customers who want to use its infrastructure are drawn in.

Since customers sometimes pay for providers with the mission’s native token, this rising demand drives up the value of that token.

Greater token costs then entice much more individuals to contribute to the community, protecting the cycle going. This constructive loop can gasoline the mission’s long-term development.

To raised assure the well being and performance of a decentralized infrastructure, there could also be additionally some penalty mechanisms utilized to the system.

Identical to some rental agreements require a safety deposit, DePIN suppliers usually must pledge collateral.

This acts as a type of insurance coverage to make sure they ship good service. If a supplier fails to satisfy expectations or tries to cheat the system, they face penalties.

This might imply shedding out on rewards they earned, having a portion of their deposit taken away, and even getting faraway from the community solely.

Challenges and dangers

DePINs sound like a game-changer in relation to constructing infrastructure, however there are some huge hurdles to beat earlier than they hit the mainstream.

Regulatory roadblocks

DePINs have the potential to revolutionize industries like telecoms, however these sectors are identified for tight rules.

To profit on a regular basis customers, DePIN initiatives and these regulated industries must work collectively and discover widespread floor.

However no less than for now, DePINs are much less more likely to set off regulatory considerations in comparison with some monetary crypto initiatives, as in DeFi sector.

That is partly evident by the provision of DePIN initiatives on app shops and their partnerships with established firms. This implies DePINs is likely to be a safer area of interest inside the crypto world.

The battle of conventional infrastructure versus DePIN

The large query is how centralized opponents on this area will react to DePINs.

Will they attempt to shut them down, like by lobbying? Will they unfold FUD (concern, uncertainty and doubt) round them? Will they attempt to manipulate the token costs?

Worth volatility

DePIN initiatives might need an excellent thought, however their success hinges on their token’s worth. When the value goes up, it attracts new customers who desire a piece of the rewards.

However when the market takes a downturn and the token worth falls, suppliers may abandon the mission particularly in circumstances that there’s a low market cap and buying and selling quantity.

This could snowball right into a loss of life state of affairs the place the value retains dropping.

This worth fluctuations can even have impacts on the opposite facet i.e., the demand facet. If the token worth shoots up too quick, it’d scare new customers away.

Discovering the proper steadiness isn’t simple. DePIN initiatives want good designs for his or her tokenomics and worth adjustment measures to handle worth swings to maintain issues secure and dealing.

The intrinsic reliability of conventional infrastructure

One problem for DePINs is that they may not be fairly as reliable as centralized infrastructure.

Conventional techniques are like machines with a single management heart. Everybody is aware of who’s accountable for what, and if one thing breaks, they will repair it shortly.

DePINs, however, distribute the accountability amongst quite a few contributors, which may make it trickier and slower to handle and clear up issues.

DePIN isn’t on the radar of the general public

These initiatives disturb the monopoly and may provide safer, broader and even cheaper choices than conventional techniques however they’re flying below the radar for most individuals.

DePINs want to boost consciousness to succeed in a wider viewers and acquire traction.

The long run’s outlook

The probabilities for DePINs are infinite. Think about utilizing them to enhance power grids, communication networks, transportation techniques and even meals supply.

DePINs might even make issues like healthcare and training extra accessible and cheaper. Over the subsequent many years, we additionally count on DePINs to develop even larger, tackling extra vital infrastructure wants.

Assume toll roads, parking garages, anti-pollution tech and provide chain administration.

Nevertheless, realizing this imaginative and prescient requires collaboration amongst stakeholders, regulatory assist and technological improvement to handle present challenges like regulatory considerations, aggressive benefits and worth fluctuations.

That stated, ongoing innovation appears to be the important thing to unlock the complete potential of DePINs.

Mehran Tabrizi has been within the Net 3.0 and crypto area for 3 years throughout which period he has acquired expert-level data in areas like predicting the developments, discovering initiatives which will have a vivid future and analyzing totally different elements of a mission, similar to workforce, tokenomics, improvement, know-how, market, on-chain knowledge and extra.

Observe Us on Twitter Fb Telegram

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet affiliate marketing.