Because the US Securities and Change Fee (SEC) authorized all of the spot Ethereum ETF functions, regardless of elevated regulatory uncertainty surrounding the cryptocurrency, traders have gotten extra optimistic in regards to the potential for ETH’s value to succeed in new heights.

Bullish Sentiment Surrounds Ethereum ETF Approval

DeFiance Capital Founder and CIO Arthur Cheong predicts that ETH might attain an annual excessive of $4,500 earlier than the newly authorized index funds start buying and selling, surpassing its mid-March excessive of $4,096. This projection falls simply wanting ETH’s all-time excessive of $4,878 through the 2021 bull run.

As well as, a survey performed by WuBlockchain within the Chinese language group revealed that 58% of respondents consider that ETH has the potential to rise to $10,000 and even larger on this market cycle.

Associated Studying

The latest regulatory pivot by the SEC in direction of approving Ether ETFs has intensified bets on additional value good points. Within the seven days following the announcement, ETH skilled a 26% surge, marking the most important weekly advance because the 2021 crypto bull market.

This improvement brings hope to speculators, contemplating the success of US spot Bitcoin ETFs, which have amassed $59 billion in property since their record-breaking debut in January.

Nonetheless, spot Ethereum ETFs won’t take part in staking, incomes rewards by pledging tokens to take care of the Ethereum blockchain. This omission might doubtlessly dampen curiosity in these funds compared to holding the tokens instantly.

Though further SEC approvals are required earlier than issuers akin to BlackRock and Constancy Investments can launch their merchandise, the timeline for these releases stays unsure. As of now, ETH is buying and selling round $3,900, with expectations of additional upside potential.

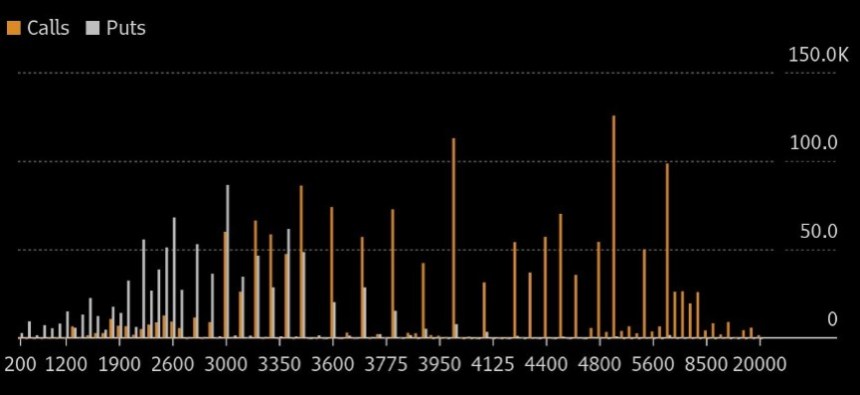

Choices Bets Sign Potential Climb To $5,000

Based on a Bloomberg report, analysts akin to Pepperstone Group Head of Analysis Chris Weston consider that pullbacks in ETH are shopping for alternatives as the danger stays skewed to the upside.

Apparently, as seen within the chart beneath, some merchants are inserting bullish choices bets, with concentrations signaling a possible climb to $5,000 or extra.

Moreover, ETH’s volatility, as indicated by the T3 Ether Volatility Index, is predicted to be higher than that of Bitcoin, highlighting the potential for bigger value swings within the second-largest digital asset.

Associated Studying

Insights from the futures market, notably the extent of open curiosity in Chicago Mercantile Change (CME) Ethereum futures, present proof of institutional demand for regulated publicity to cryptocurrencies.

Whereas open curiosity in CME Ether futures is rising, it stays considerably decrease than that of CME Bitcoin futures. This means comparatively much less institutional publicity to Ether and will doubtlessly influence preliminary inflows into Ether ETFs.

Nonetheless, because the approval of Ethereum ETFs opens up new avenues for funding and hypothesis, the market is carefully watching ETH’s value efficiency, with bullish sentiment and optimistic predictions prevailing amongst traders.

Featured picture from Shutterstock, chart from TradingView.com